Economic Review

RECORD RESULTS

We selected 3 key performance indicators to measure our success in the execution of our ambitious Horizon 2020 growth strategy and our progress towards our longer-term targets and objectives:

Adjusted EBITDA gives a clear indication on earnings and profitability, and is a good proxy for generated operating cashflows (cashflow from operations before change in cash working capital).

As part of our Horizon 2020 strategy we set a 2020 adjusted EBIT target of doubling the 2014 figure or in other words, reaching € 500 million.

We want our investments to create value by generating attractive returns and set a Group ROCE target of 15%+.

Adjusted EBITDA

Millions of Euros

Despite the severe disruption brought by the COVID-19 pandemic in its end-markets, Umicore posted its strongest financial performance ever, boosted by an exceptional PGM price environment. This underscores Umicore’s resilience and the merits of its strategy building on the complementarity of its activities.

After a solid performance in the first half of 2020, with a strong result in Recycling offsetting the impact of the automotive industry downturn on the results of Catalysis and Energy & Surface Technologies, the second half of the year was marked by a strong sequential improvement in the Group’s revenues and earnings driven by continued robust operational performance and buoyant metal prices in Recycling, as well as strong growth in Catalysis.

Adjusted Ebit

Millions of Euros

Umicore’s earnings and profitability reached new highs with full year adjusted EBIT amounting to € 536 million (up 5% year on year) and adjusted EBITDA amounting to € 804 million (up 7% year on year). 2020 ROCE for the Group stood at 12.1% (down from 12.6% in 2019), reflecting a lower ROCE in Catalysis and in Energy & Surface Technologies.

Revenues in Catalysis decreased, albeit less than the global car market, due to Umicore’s strong market position in gasoline technologies for light-duty vehicles, particularly in China and Europe, as well as higher sales of heavy-duty diesel and fuel cells catalysts. Adjusted EBIT declined more than revenues for the full year reflecting the significant impact of the pandemic in the first half of the year.

Return on capital employed

%

Revenues of Energy & Surface Technologies reflected the impact of the pandemic as well as lower sales of cathode materials for high-end portable electronics and energy storage applications. The decline in adjusted EBIT was more pronounced reflecting significant negative operating leverage and the impact of an unfavorable pricing environment for cathode materials due to substantial industry overcapacity in China.

Recycling doubled its adjusted EBIT compared to the previous year, driven by strong growth across business units, reflecting high metal prices, high activity levels despite the COVID-19 crisis and favorable trading conditions.

In 2020, revenues in Catalysis decreased by 7% year on year, amounting to € 1,364 million, against the backdrop of an 18% contraction in the global car market. Umicore’s revenues suffered much less than the global car market, due to the company’s strong market position in gasoline technologies for light-duty vehicles, particularly in China and Europe. Revenues were further supported by higher sales of Umicore’s catalysts for heavy-duty diesel applications and fuel cells catalysts.

ADJUSTED EBITDA

Millions of Euros

Adjusted EBIT in Catalysis amounted to € 154 million, down 17% year on year due to the significant negative operating leverage in the first half of 2020 as a result of the COVID-19 pandemic impact on the automotive industry. In the second half of the year adjusted EBIT increased significantly, both sequentially and compared to the same period in the prior year, boosted by a sharp volume recovery in Automotive Catalysts and savings in manufacturing and SG&A costs. For the full year, adjusted EBITDA was € 234 million, down 11%. ROCE decreased to 9.6% (from 13.6% in 2019) due to the combination of lower returns and a higher capital employed base. Rising PGM prices, particularly in the second half of the year, increased the working capital needs in the business group .

ADJUSTED EBIT

Millions of Euros

The global automotive industry was significantly impacted by the COVID-19 pandemic and declined by 18% for the full year, with a marked contrast between the first and the second half of the year.

In the first half of 2020, car OEMs had to shut down their production plants and close their dealerships in several key regions as a result of government imposed lock-downs. Global car demand started to pick up again in the second half of 2020, albeit with discrepancies between the regions in terms of timing, speed and intensity of the recovery.

After a year-on-year contraction of 35% in the first half, car production in the second half grew by more than 40% sequentially (yet declined by 2% compared to the second half of 2019), with China being the clear driving force behind the global recovery. Other key markets started to pick up later and more gradually and still recorded negative growth for the second half of the year.

Return on Capital employed (ROCE)

%

Against this extremely challenging backdrop, revenues and adjusted EBIT for Automotive Catalysts were only moderately below the level of the previous year as the business unit demonstrated tremendous resilience. It benefited disproportionately from the sharp market recovery in the second half of the year and outperformed the car market both in volumes and revenues, due to its strong position in the Chinese and European light-duty gasoline markets. In addition to the positive operating leverage created by the strong sales recovery, earnings were supported by cost savings resulting from recent footprint adjustments and operational excellence initiatives in manufacturing and SG&A.

In China, where car production for the full year was down 5%, Umicore’s revenues were well up, reflecting Umicore’s exposure to the growing penetration of direct injection gasoline platforms which require particulate filters under China 6 emission norms.

In Europe, Umicore’s sales volumes and revenues were down less than the car market due to the company’s strong market position in gasoline catalyst technologies.

In North America, sales performance was slightly lower than the market as a result of an unfavorable customer mix, while volumes in South America outperformed a heavily contracting car market.

Umicore’s revenues in Japan and Korea evolved in line with the overall market. In South-East Asia, volumes and revenues substantially outperformed the market, driven by market share gains in India as Umicore qualified for new platforms compliant with Bharat 6 regulation.

The sharp economic contraction and the lower industrial production induced by COVID-19 also had a significant and a more prolonged impact on the heavy-duty diesel market segment in 2020 except in China. Despite this challenging context, Umicore grew volumes and revenues in this market segment, due mainly to strong demand in the second half of the year for its China V technologies and a favorable customer mix.

Umicore’s stationary catalyst activity was substantially impacted by the disruptions caused by COVID-19, in particular in its power, chemicals and oil refining end-markets where several large projects were postponed.

Revenues and earnings for Precious Metals Chemistry declined compared to the previous year, despite stronger demand for Umicore’s fuel cells catalysts in Korea. The business unit was hit in the first half of the year by the severe downturn in the automotive industry and the related impact on demand for its inorganic chemicals. Demand for Umicore’s homogeneous catalysts used in pharmaceutical and fine chemical applications remained stable.

Against a backdrop of accelerating demand for Umicore’s state-of-the-art catalysts for proton exchange membrane (PEM) fuel cells and to enable this activity to pursue its growth strategy, Umicore decided to house it in a new business unit Fuel Cells & Stationary Catalysts within the Catalysis business group. As of 1 January 2021, this business unit combines both Umicore’s fuel cell catalyst activities, previously included in the business unit Precious Metals Chemistry, and Umicore’s stationary catalyst activities, previously part of the Automotive Catalysts business unit. This change has no reporting impact on the Catalysis business group level. The new business unit will build on a strong portfolio of technologies to grow globally both in PEM fuel cells and stationary catalysis.

To learn more, see our story aboutUmicore fuel cell catalysts.

In 2020, revenues in Energy & Surface Technologies amounted to € 1,045 million, down 15% compared to 2019, driven by the negative impact of the pandemic on several end-markets and reflecting much lower sales of cathode materials for high-end portable electronics and energy storage applications. After a severe contraction of the global EV market in the first half, Umicore’s sales volumes of cathode materials for EVs grew in the second half of the year, both sequentially and year on year. The integration of the cobalt refining and cathode precursor activities acquired in Finland at the end of 2019 also helped mitigate the decline in the business group’s full year revenues.

ADJUSTED EBITDA

Millions of Euros

As expected and in line with guidance, adjusted EBIT amounted to € 75 million, 59% below the 2019 levels. The underutilized capacity in Umicore’s Chinese greenfield cathode material plant, in combination with higher fixed costs related to recent and ongoing expansions, resulted in a significant negative operating leverage. In addition, the unfavorable pricing environment in China, due to the substantial excess capacity in that region, severely weighed on margins. Adjusted EBITDA was € 186 million, down 31% year on year. 2020 ROCE further reflected the higher investments in Rechargeable Battery Materials and was 3.4% (versus 9.1% in 2019) .

Revenues and volumes in Rechargeable Battery Materials were down compared to 2019 as higher sales of NMC cathode materials used to power EVs were more than offset by lower sales of high energy LCO cathode materials for high-end portable electronics and reduced demand for NMC cathode materials used in energy storage applications.

ADJUSTED EBIT

Millions of Euros

The global EV market was profoundly affected by the COVID-19 pandemic in the first half of the year and rebounded in the second half of the year, primarily driven by strong EV growth in Europe and, later in the year and to a lesser extent, by increasing EV sales in China. For the full year 2020, EV sales grew 50% to 3.4 million vehicles. This translated in an addressable market for cathode materials producers of some 137 GWh, or a 17% year-on-year growth.

For the full year, Umicore’s sales volumes of cathode materials going into EVs grew less than battery demand in GWh as the cathode materials industry, including Umicore, could not immediately benefit from the rebound in battery demand in the second half of the year because of the existence of excess inventories in the supply chain. These excess inventories were largely depleted by year-end. Excluding this inventory effect, Umicore’s sales volumes grew broadly in line with EV battery demand. As anticipated, Umicore’s sales volumes for EVs grew in the second half of the year, both sequentially and year on year.

RETURN ON CAPITAL EMPLOYED (ROCE)

%

In China, battery demand for EVs remained bleak until the summer and turned positive in the second half of the year, albeit compared to a depressed second half in 2019. After years of strong year-on-year growth, culminating with a more than doubling of demand in 2018 and leading to massive capacity additions in the battery materials value chain, demand for cathode materials for EVs has lagged the anticipated growth in 2019 and 2020. This slowdown has resulted in significant excess capacity and pressure on the pricing environment. Umicore is not immune to this effect and its performance in the region was also impacted by underutilized capacity in its Chinese greenfield cathode materials plant.

In Europe, battery demand for EVs recorded strong momentum throughout 2020, in particular in the second half of the year, and doubled compared to 2019. This growth was driven by new models launched by car OEMs to comply with the more stringent CO2 directive which kicked in in 2020, local incentives for EV buyers in several countries as part of their recovery plans and more environmentally-friendly choices by consumers when purchasing a new car. Umicore sales of cathode materials in the region grew in line with the market trend. Umicore is currently using its capacity in Korea to serve that growth, until its new greenfield plant in Nysa, Poland will start commercial production. The Nysa plant will be the first industrial cathode materials production plant in Europe and its construction is progressing well with commissioning expected towards the end of the first half of 2021. Once production lines will have gone through customers’ qualifications, initial commercial production volumes are expected in the fourth quarter of 2021, with the full ramp-up of volumes taking place in 2022.

While having production capacities in three different locations (Korea, China and Europe) involves higher capital investments and operating costs than for most competitors, Umicore is convinced that having a presence in multiple key markets will prove a strong competitive differentiator over time as battery and car OEMs will increasingly require electric car components to be produced locally to minimize their CO2 footprint.

The push towards electric mobility is stronger than ever, driven by regulatory initiatives to protect air quality and reduce greenhouse gas emissions in several regions. Europe recently reconfirmed its ambition to achieve zero-emission mobility and remains committed to increasingly more stringent CO2 emission targets. The EU ambitions and commitments to a cleaner future imply rapid growth in GWh of battery demand in the coming years. In China, the Ministry of Industry and Information Technology announced an extension of the NEV subsidy plan from 2020 until end 2022. It also confirmed its long-term commitment to achieve a target penetration rate of 20% NEVs in 2025 and 50% by 2035. Although it will take a while before the current excess capacity in China is fully utilized, these targets will boost electrification in the coming years.

Revenues for Cobalt & Specialty Materials were below the level of the previous year, reflecting the severe impact of COVID-19 on the activity levels in most of the business unit’s end-markets.

Although demand for cobalt and nickel chemicals and activity levels in the distribution activities gradually recovered in the second half of the year, this could not compensate for the volume losses incurred in the first half of 2020. Order levels for tool materials declined substantially year on year, impacted by reduced activity levels in the construction and industrial manufacturing sectors throughout the year. The reduced demand levels for cobalt and nickel chemicals also resulted in lower throughput and contribution from the refining and recycling activities. Revenues from carboxylates remained stable compared to the previous year.

As part of the ongoing assessment of its global production footprint, Umicore announced in September its decision to consolidate the cobalt refining and transformation activities in Kokkola, Finland and Nashville, US in order to achieve synergies and strengthen the unit’s competitive position. The transfer of the activities is on track and is anticipated to be finalized by mid-2023. Earlier in the year, the business unit closed its cobalt, nickel and rhenium refining and recycling plant in Wickliffe, Ohio.

Revenues for Electroplating were slightly higher compared to the previous year reflecting primarily higher demand for advanced precious metal-based electrolytes used in portable electronics. This more than offset the impact of lower demand for precious and base metal compounds as a result of the COVID-related slowdown in the jewelry and industrial end-markets.

As of 1 January 2021, the business unit Electroplating has been renamed Metal Deposition Solutions. In addition to the activities previously included in Electroplating, the new business unit also includes the thin film products business, which was previously part of the Electro-Optic Materials business unit and which manufactures evaporation materials and sputtering targets for the microelectronic and optical industries, with activities in Liechtenstein and Taiwan. The purpose of this transfer is to bring together businesses serving similar applications and customers in electronics and semiconductors.

Revenues for Electro-Optic Materials decreased compared to the previous year. This was mainly due to lower demand for high purity chemicals used in optical fibers as a result of a delay in 5G-deployment. Revenues increased both for substrates and for infrared optics, following the successful launch of innovative new products and services.

The Recycling business group delivered a record performance in 2020, posting an increase in revenues of 23% to € 836 million and nearly doubling its adjusted EBIT to € 362 million. This stellar performance was driven by strong growth across all business units, reflecting high metal prices, high activity levels despite the COVID-19 crisis and favorable trading conditions. Adjusted EBITDA amounted to € 425 million, an increase of 70% compared to 2019. These record earnings drove ROCE up to 72% (versus 39.3% in 2019).

ADJUSTED EBITDA

Millions of Euros

Revenues for Precious Metals Refining increased significantly year on year and adjusted EBIT more than doubled, reflecting primarily higher received metal prices, particularly for platinum group metals, and to a lesser extent a supportive supply environment and higher processed volumes.

The performance of the business unit was boosted by a favorable metal price environment. Average received metal prices were well above the level of the previous year for most precious and platinum group metals, in particular rhodium. In a context of tight supply and growing demand from the car industry as a result of increasingly more stringent emission norms, the rhodium price surged from the high levels already reached at the end of 2019. The business unit also benefited, to a more moderate extent, from the price increases of gold, platinum and palladium as it previously hedged a significant portion of its exposure to these metals.

ADJUSTED EBIT

Millions of Euros

The overall supply of industrial by-products remained favorable over the period, despite the temporary shutdowns of certain mining activities in response to COVID-19. Also the supply of end-of-life materials remained strong and the Hoboken plant benefited from an ample inflow of highly complex spent automotive catalysts.

The business unit continued to leverage its unique recycling technology to efficiently treat such highly complex materials. Processed volumes in 2020 were higher compared to 2019 as a result of the process improvements which were introduced in 2019 and which required a longer than usual shutdown during that year. The higher processed volumes, in combination with the valuable mix, further supported the performance of the Hoboken plant.

RETURN ON CAPITAL EMPLOYED (ROCE)

%

As part of its endeavors to continuously drive improvement in the robustness of the Hoboken operations and the overall safety performance of the plant, a multi-year investment program has been launched with a priority on fire prevention and emergency planning. In parallel, Umicore continues with the execution of the investment program aimed at further reducing emissions.

Revenues for Jewelry & Industrial Metals increased compared to the previous year. The impact of lower demand from the jewelry and industrial sectors was offset by a substantial increase in orders for precious metal based investment products as well as strong demand for platinum engineered materials. The revenues and margins of the business unit were further supported by a higher contribution from the refining and recycling activities, which benefited from robust demand as well as a favorable metal price environment, in particular for gold.

The earnings contribution from Precious Metals Management substantially increased compared to 2019 as the business unit benefited from high metal prices and exceptionally high metal price volatility which resulted in favorable trading conditions. In addition, demand for gold and silver investment bars was strong.

Financial result and taxation

Net financial charges totaled € 104 million, up from € 83 million in the same period last year due to higher net interest charges resulting from a higher average financial debt as well as fees and costs linked to the issuance of new debt instruments. These higher charges were partly offset by lower forex costs and lower discounting costs related to provisions. The adjusted tax charge for the period amounted to € 103 million, stable compared with the same period last year despite substantial changes in the underlying regional result distribution. Both the adjusted taxable base for the group and effective group tax rate were stable year on year. The latter reached 24,2%, compared to 24,7% last year. Taking into account the tax effects on EBIT adjustments, the net tax charge amounted to € 59 million. The total tax paid in cash over the period amounted to € 79 million, which is lower than last year.

Cashflows

Cashflow generated from operations, including changes in net working capital, amounted to € 603 million, compared to € 549 million last year. After deduction of € 436 million of capital expenditures and capitalized development expenses, this corresponds to a free cash flow from operations over the period of € 167 million, compared to a cash drain of - € 39 million in 2019, demonstrating the resilience of the Group’s cash flows in a challenging market context. Adjusted EBITDA was € 804 million compared to € 753 million last year, corresponding to an adjusted EBITDA margin for the Group of 24.6%, up versus 22.1% in 2019 driven by the strong performance in Recycling. Net working capital for the Group increased by € 104 million since the end of 2019. Working capital needs increased in Catalysis and, to a lesser extent, in Recycling due to strong year-on-year price increases in precious metals, PGM’s in particular. Energy & Surface Technologies reported a decrease in working capital needs year on year due to subdued sales volumes and metal prices. Capital expenditures totaled € 403 million, compared with € 553 million last year. This reduction reflects the decision taken shortly after the start of the COVID-19 outbreak to postpone selected investment projects with the exception of safety and license to operate investments, awaiting more clarity on market outlook. Taking into account the continued investment in Rechargeable Battery Materials’ greenfield plant in Poland, Energy & Surface Technologies accounted for close to two thirds of the Group’s capex. Spending for this strategic project will continue into 2021. Capitalized development expenses amounted to € 32 million compared to € 35 million last year. The net cash outflow related to the exercise of options and the purchase of treasury shares to cover option plans and share grants was € 27 million, slightly lower than in the previous year.

Financial debt

Net financial debt at 31 December 2020 stood at € 1,414 million, slightly down from € 1,443 million at the end of 2019. This corresponded to 1.76x adjusted EBITDA which is lower than the ratio of 1.92x at the end of 2019. In the first half of the year, Umicore further diversified its sources of funding by completing a € 500 million convertible bond offering due in 2025 and by concluding a € 125 million 8-year loan with the European Investment Bank. Prior to that, in response to the COVID-19 outbreak, Umicore had already increased its undrawn committed bank lines, ensuring itself of ample liquidity to pursue its strategy. Group shareholders’ equity was € 2.557 million at the end of the year, including the value of the convertible bond’s conversion rights, corresponding to a net gearing ratio (net debt / net debt + equity) of 35,0% (35.2% at the end of 2019).

EBIT adjustments

Adjustments had a negative impact of € 237 million on EBIT in 2020 of which € 72 million were already recognized in the first half. Of this total, € 112 million were related to Energy & Surface Technologies. The latter including € 56 million charges linked to the restructuring initiatives in Cobalt & Specialty Materials, a resulting € 34 million impairment charge linked to the rightsizing of permanently tied up cobalt inventories in that same business unit as well as a € 15 million impairment in Rechargeable Battery Materials due to a site reconfiguration in Korea. Catalysis accounted for € 57 million charges of which € 55 million were already recognized in the first half, linked mainly to the consolidation of the North American automotive catalyst production and some impairments including selected capitalized development costs and license agreements. In Recycling, a charge of € 51 million was accounted for, comprising a € 50 million provision to cover costs related to the intention to buy houses closest to the Hoboken plant and create a green zone. These costs comprise an estimated purchase value of the houses (based on third party appraisal) to be demolished as well as an estimate of demolition and landscaping costs. Concertation with the city council and residents is ongoing and might result in adjustments to this cost estimate. Finally, EBIT adjustments also include € 14 million charges linked to restructuring, property, plant and equipment and goodwill impairments in Element Six Abrasives, a JV in which Umicore has a 40% stake. Of the total adjustments, € 147 million have a non-cash nature. Restructuring-related charges account for € 128 million of the total, environmental items for € 56 million and selected asset impairments for € 45 million. After tax, the adjustments to net group earnings over the period correspond to - € 192 million.

Metal hedging

Over the course of 2020 and early 2021, Umicore entered into additional forward contracts, thereby securing a substantial portion of its structural future price exposure to certain precious metals and providing increased earnings visibility. For 2021 and 2022, approximately two thirds of the expected gold and palladium exposure and somewhat less than half of the expected silver exposure have been locked-in. In addition, close to one third of the expected platinum exposure for 2021 has been hedged. In spite of the absence of a liquid futures market, Umicore entered in recent months into forward contracts locking in a minority of its expected 2022 and 2023 rhodium exposure.

EARNINGS PER SHARE

DENOMINATOR ELEMENTS

2020 | |

Total shares issued as at 31 December | 246,400,000 |

of which treasury shares | 5,733,685 |

of which shares outstanding | 240,666,315 |

Weighted average number of outstanding shares | 240,589,550 |

Potential dilution due to stock option plans | 1,183,525 |

Adjusted weighted average number of outstanding shares | 241,773,075 |

Investing in Umicore is an investment in producing materials for a better life – our mission – and supporting our growth strategy. We have a healthy capital structure with funding headroom to execute our growth strategy while remaining within the equivalent of an investment grade credit status territory.

THE UMICORE SHARE

Umicore shares are listed on the Euronext stock exchange.

The total number of outstanding and fully paid-up shares, and the number of voting rights, are 246,400,000. During 2020, no new shares were created as a result of the exercise of stock options with linked subscriptions rights. During the year Umicore used 1,024,435 of its treasury shares in the context of the exercise of stock options and 66,430 of its treasure shares for shares granted. In the course of 2020, Umicore bought back 1,200,000 own shares. On 31 December 2020, Umicore owned 5,733,685 of its own shares representing 2.33% of the total number of shares issued as of that date.

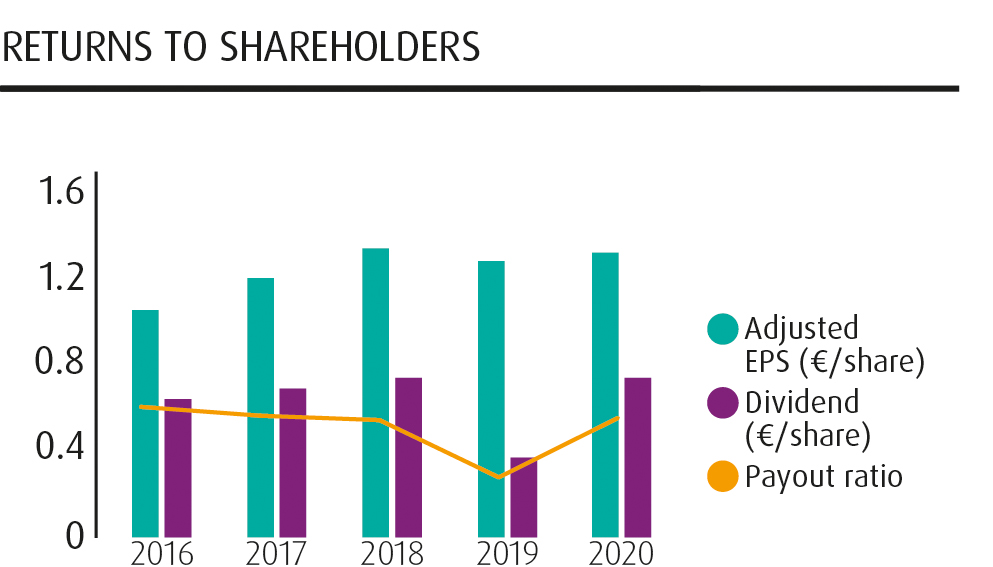

SHAREHOLDER RETURNS

Umicore aims to create value for its shareholders. There is no fixed pay-out ratio.

Umicore’s Supervisory Board will propose a gross annual dividend of € 0.75 per share for the full year 2020. This compares to a full dividend of € 0.375 per share paid out for the financial year 2019. Taking into account the interim dividend of € 0.25 per share paid out on 25 August 2020 and subject to shareholder approval, a gross amount of € 0.50 per share will be paid out on 5 May 2021.

The Supervisory Board has decided that starting in 2021, the interim dividend will be a fixed amount of € 0.25 per share. The dividend policy of a stable to growing dividend remains unchanged.

Over the course of its Horizon 2020 strategy, Umicore delivered strong and sustainable shareholder returns through growth of its intrinsic value and dividend distribution.

Over the 2015-2020 period, Umicore substantially outperformed the Stoxx Europe 600 Chemicals index with a share price performance of 140.2% versus 60.6% for the index. The corresponding annualized share price performance amounts to 15.7% per year over the 5-year period.

INDEXES & RATINGS | |

|---|---|

EURONEXT | BEL20; Euronext 100 |

ECPI | EMU Ethical Equity; Euro ESG Equity; World ESG Equity |

FTSE RUSSELL | FTSE4GOOD; FTSE Environmental Opportunities 100 |

ISS OEKOM | PRIME ESG Rating |

MSCI | ACWI Sustainable Impact Index, ACWI Low Carbon Target, Belgium IMI Index, EMU ESG Enhanced Focus Index, Global Pollution Prevention Index, World ESG Leaders Index, AAA ESG Rating (Leader) |

SOLACTIVE | Solactive Europe Corporate Social Responsibility Index |

STOXX | STOXX Europe 600; STOXX Europe Mid 200 |

SUSTAINALYTICS | 29.1 (Low Risk) |

VIGEO EIRIS | Benelux 20; Eurozone 120 |

For more, visit: UMICORE.COM/INVESTORS

Around the world, the way energy is managed is changing, moving away from fossil fuels and towards more sustainable energy solutions, including for cleaner mobility. Umicore provides clean-tech solutions for all vehicle types including cathode materials used in lithium-ion batteries for electromobility and electro-catalysts for fuel cell vehicles.

A fuel cell is like a battery in that it generates electricity from an electrochemical reaction, and is built with an anode and a cathode. However, fuel cells do not run down or need recharging. The main difference between a battery and fuel cell is that a battery stores energy, while a fuel cell generates energy. A fuel cell takes an energy source (the “fuel”), such as hydrogen, and an oxidizing agent, oxygen from air, and through its reaction converts it into electricity. In doing so, as long as air and fuel are supplied, a fuel cell can run indefinitely. The assembly of fuel cell components is referred to as a stack, which is the power generation unit of a fuel cell system.

Typically batteries and fuel cells can be found working together, where a battery will store the electricity generated by a fuel cell and the total energy output will be the combined output from the two energy sources.

At Umicore, our tailor made Proton Exchange Membrane (PEM) fuel cell catalyst provide superior performance to accelerate the development of fuel cells, boasting longer ranges, shorter refueling times and higher energy density.

In the move towards cleaner mobility, and with the technology maturity now demonstrated, fuel cell drivetrains are gaining momentum in the trend towards electrified vehicles. Since 2019, Umicore has recorded strong growth in the demand of fuel cell catalysts used in the transportation segment. To support the rapid growth of our automotive customers we have created a new and promising business unit for fuel cell and stationary catalysts and are ready to ramp up our production.

With 30 years of experience developing PEM fuel cell catalysts, covering both anode and cathode electrode applications, Umicore’s competitive products are key components of commercial stack platforms found on the road today. We are present in most of the development platforms of the biggest OEMs, and our R&D centers and industrial production activities both in Germany and South Korea are well placed to globally serve our automotive customers.

We expanded our production capacity in Korea, close to Umicore’s technology development center near Seoul, to support the growth of Hyundai Motors Group and we will also support our other automotive customers allowing further expansion to cover future growing demand.

Umicore’s fuel cell material solutions are also applicable to water electrolysis, the cleanest production of low-carbon hydrogen. Looking ahead, we share the vision that clean hydrogen has a key role to play in decarbonizing the energy, mobility and industry systems. Scaling up of hydrogen technologies is direly needed to achieve competitiveness across many applications and reach its full deployment potential by 2050. Hydrogen technologies are therefore crucial to climate change mitigation while delivering on economic value creation and generating massive job opportunities.

Umicore also closes the loop for fuel cells, recycling end-of-life and production waste in our Precious Metals Refining operations, a world market leader in eco-efficient recycling of complex waste streams containing precious and other non-ferrous metals. At Umicore, after recovering precious metals, we are able to convert these scarce metals back into advanced materials for new fuel cell technology.

Today, fuel cell vehicles are already circulating on roads all over the globe though in limited numbers. Market deployment of fuel cell vehicles will intensify provided that a refueling infrastructure is sufficiently developed. Electric buses and energy-intensive heavy-duty applications such as trucks will strongly rely on fuel cell technology. On the road to 2050, fuel cell electric vehicles will dominate long range and medium-high duty applications.

Fuel cells have a clear role to play in the engine and energy mix providing one of the various technologies required towards zero emissions. They provide the best of both worlds by combining the environmental advantages of battery drivetrains with the driving range and refueling time of internal combustion engines. Therefore, as a complementary technology, Umicore’s fuel cell catalysts are part of our unique technology portfolio offering the full spectrum of clean mobility materials.

For Umicore products and services, visit: UMICORE.COM/INDUSTRIES

Belgium

Belgium Germany

Germany Worldwide

Worldwide