Economic statements

Key figures

2016 | 2017 | 2018 | 2019 | 2020 | ||

|---|---|---|---|---|---|---|

Total turnover | 11,086 | 12,277 | 13,717 | 17,485 | 20,710 | |

Total revenues (excluding metal) | 2,667 | 2,916 | 3,271 | 3,361 | 3,239 | |

Adjusted EBITDA | F9 | 527 | 599 | 720 | 753 | 804 |

Adjusted EBIT | F9 | 351 | 410 | 514 | 509 | 536 |

of which associates | F9 | 18 | 30 | 5 | 11 | 8 |

EBIT adjustments | F9 | (110) | (46) | (14) | (30) | (237) |

Total EBIT | F9 | 232 | 343 | 500 | 479 | 299 |

Adjusted EBIT margin | 12.5 | 13.1 | 15.5 | 14.8 | 16.3 | |

Return on Capital Employed (ROCE) (in %) | F31 | 14.6 | 15.1 | 15.4 | 12.6 | 12.1 |

Effective adjusted tax rate (in %) | F13 | 25 | 25.7 | 24.4 | 24.7 | 24.2 |

Adjusted net profit, Group share | F9 | 233 | 267 | 326 | 312 | 322 |

Net profit, Group share | F9 | 131 | 212 | 317 | 288 | 131 |

R&D expenditure | F9 | 156 | 175 | 196 | 211 | 223 |

Capital expenditure | F34 | 287 | 365 | 478 | 553 | 403 |

Net Cash flow before financing | F34 | 141.9 | (381) | (604) | (271) | 99 |

Total assets, end of period | 4,146 | 5,116 | 6,053 | 7,023 | 8,341 | |

Group shareholders' equity, end of period | F24 | 1,790 | 1,803 | 2,609 | 2,593 | 2,557 |

Consolidated net financial debt, end of period | 296 | 840 | 861 | 1,443 | 1,414 | |

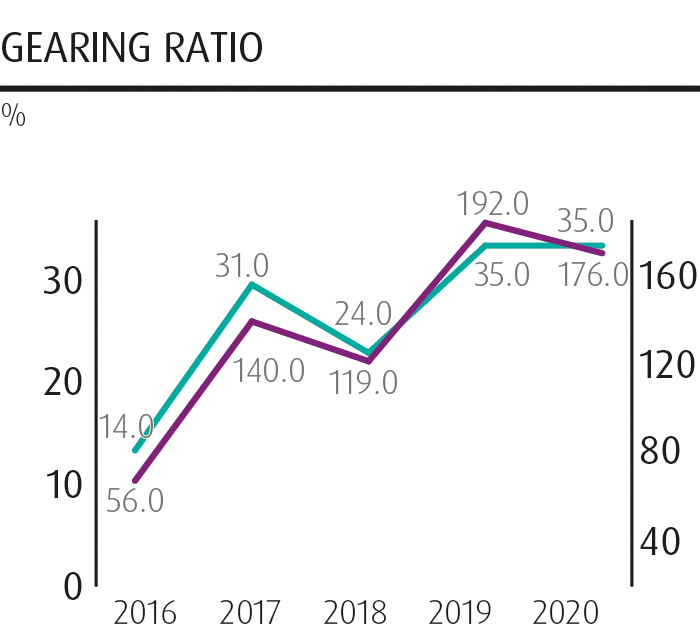

Gearing ratio, end of period | 13.8 | 31.1 | 24.4 | 35.2 | 35.0 | |

Net debt / LTM adjusted EBITDA | 0.56x | 1.40x | 1.19x | 1.92x | 1.76x | |

Capital employed, end of period | 2397 | 3,003 | 3,802 | 4,442 | 4,457 | |

Capital employed, average | 2399 | 2710 | 3,344 | 4,048 | 4,451 |

Revenues (excluding metal)

Millions of Euros

Adjusted Ebitda

Millions of Euros

Basic adjusted EPS

Euros

Gross Dividend

Euros

Adjusted Ebit

Millions of Euros

r&d expenditure

Millions of Euros

CApital expenditure

Millions of Euros

Net debt / LTM adjusted EBITDA

Millions of Euros

Return on capital employed (ROCE)

%

Effective Adjusted Tax Rate

%

KEY FIGURES

2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

Total turnover | 2,779 | 3,091 | 3,311 | 4,539 | 5,917 |

Total revenues (excluding metal) | 1,163 | 1,253 | 1,360 | 1,460 | 1,364 |

Adjusted EBITDA | 203 | 224 | 237 | 264 | 234 |

Adjusted EBIT | 152 | 165 | 168 | 185 | 154 |

of which associates | 9.2 | 0.4 | 0 | 0 | 0 |

Total EBIT | 126 | 161 | 162 | 185 | 96 |

Adjusted EBIT margin | 12.3 | 13.2 | 12.4 | 12.7 | 11.3 |

R&D expenditure | 102 | 120 | 135 | 147 | 139 |

Capital expenditure | 46 | 45 | 79 | 104 | 64 |

Capital employed, end of period | 911 | 1,150 | 1,265 | 1,537 | 1,727 |

Capital employed, average | 918 | 1,014 | 1,200 | 1,358 | 1,596 |

Return on Capital Employed (ROCE) (in %) | 16.6 | 16.3 | 14 | 13.6 | 9.6 |

Workforce, end of period (fully consolidated) | 2,464 | 2,952 | 3,070 | 3,190 | 3,073 |

Workforce, end of period (associates) | 177 | - | - | - | - |

Revenues (excluding metal)

Millions of Euros

ADJUSTED EBITDA

Millions of Euros

Adjusted EBIT

Millions of Euros

R&D Expenditure

Millions of Euros

Capital expenditure

Millions of Euros

Return on capital employed (roce)

%

Key figures

2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

Total turnover | 1,469 | 2,392 | 3,650 | 2,938 | 2,811 |

Total revenues (excluding metal) | 610 | 894 | 1,289 | 1,225 | 1,045 |

Adjusted EBITDA | 132 | 198 | 323 | 271 | 186 |

Adjusted EBIT | 82 | 141 | 257 | 183 | 75 |

of which associates | 1.0 | 10.5 | 0.9 | 5 | 5 |

Total EBIT | 74 | 110 | 251 | 154 | (36.2) |

Adjusted EBIT margin | 13.2 | 14.6 | 19.8 | 14.5 | 6.7 |

R&D expenditure | 20 | 30 | 39 | 46 | 58 |

Capital expenditure | 144 | 225 | 316 | 348 | 252 |

Capital employed, end of period | 752 | 1,206 | 1,769 | 2,324 | 2,133 |

Capital employed, average | 695 | 978 | 1,469 | 2,014 | 2,209 |

Return on Capital Employed (ROCE) (in %) | 11.7 | 14.4 | 17.5 | 9.1 | 3.4 |

Workforce, end of period (fully consolidated) | 2,357 | 2,716 | 3,447 | 3,997 | 3,761 |

Workforce, end of period (associates) | 847 | 917 | 782 | 751 | 727 |

Revenues (excluding metal)

Millions of Euros

Adjusted EBITDa

Millions of Euros

Adjusted EBIT

Millions of Euros

R&d expenditure

Millions of Euros

Capital Expenditure

Millions of Euros

Return on Capital employed (ROCE)

%

Key figures

2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

Total turnover | 6,886 | 7,327 | 7,625 | 11,320 | 13,904 |

Total revenues (excluding metal) | 641 | 650 | 626 | 681 | 836 |

Adjusted EBITDA | 187 | 189 | 195 | 250 | 425 |

Adjusted EBIT | 125 | 128 | 135 | 188 | 362 |

Total EBIT | 115 | 121 | 126 | 190 | 311 |

Adjusted EBIT margin | 19.5 | 19.7 | 21.5 | 27.6 | 43.3 |

R&D expenditure | 23 | 19 | 15 | 8 | 10 |

Capital expenditure | 72 | 79 | 68 | 82 | 72 |

Capital employed, end of period | 498 | 474 | 546 | 405 | 447 |

Capital employed, average | 474 | 495 | 483 | 479 | 502 |

Return on Capital Employed (ROCE) (in %) | 26.3 | 25.8 | 27.9 | 39.3 | 72 |

Workforce, end of period (fully consolidated) | 3,170 | 3,092 | 2,832 | 2,849 | 2,769 |

Revenues (Excluding metal)

Millions of Euros

Adjusted EBITDa

Millions of Euros

Adjusted EBIT

Millions of Euros

R&d expenditure

Millions of Euros

Capital expenditure

Millions of Euros

Return on capital employed (ROCE)

%

The most significant portion of Umicore’s total income was used to secure the metal component of raw materials (the cost of which is passed on to the customer). After subtracting other raw materials costs, energy-related costs and depreciation, the remaining economic benefits available for distribution stood at € 1.13 billion.

The biggest portion (€ 798 million) was distributed to employees. The bulk of employee benefits was in the form of salaries, with the balance going to national insurance contributions, pensions and other benefits.

Net interest to creditors totaled € 57 million, while taxes to the governments and authorities in the places where we operate, totaled € 79 million. The earnings attributed to minority shareholders were € 4.8 million.

Subject to approval by shareholders at the AGM in April 2021, Umicore’s Supervisory Board will propose a gross annual dividend of € 0.75 per share for the full year 2020. This compares to a full dividend of € 0.375 per share paid out for the financial year 2019. Taking into account the interim dividend of € 0.25 per share paid out on 25 August 2020 and subject to shareholder approval, a gross amount of € 0.50 per share will be paid out on 5 May 2021. This is in line with Umicore’s policy of paying a steady or gradually-increasing dividend.

In 2020, Umicore charitable donations amounted to € 1.5 million.

DISTRIBUTION OF ECONOMIC BENEFITS

unit | 2020 | |

|---|---|---|

Economic value distributed (including contibution from associates) | MILLIONS OF EUROS | 20,785.4 |

Raw materials cost (excluding water, gas & electricity) | MILLIONS OF EUROS | 18,719.6 |

Water, gas & electricity cost | MILLIONS OF EUROS | 99.7 |

Depreciation & impairments | MILLIONS OF EUROS | 362.5 |

Other costs (net) | MILLIONS OF EUROS | 532.8 |

Direct economic value generated | MILLIONS OF EUROS | 1,131.9 |

Total taxes | MILLIONS OF EUROS | 78.5 |

Creditors | MILLIONS OF EUROS | 57.9 |

Minority Shareholders | MILLIONS OF EUROS | 4.8 |

Shareholders (dividends only) | MILLIONS OF EUROS | 60.2 |

Retained by the company | MILLIONS OF EUROS | 130.5 |

Charitable donations | MILLIONS OF EUROS | 1.5 |

Employee compensation & benefits | MILLIONS OF EUROS | 798.5 |

Belgium

Belgium Germany

Germany Worldwide

Worldwide