Value chain statements

The value chain and society theme focuses on potential impacts on society that we experience as a company through our activities, products and services. For reporting matters, all entities of the Group are considered.

Securing adequate volumes of raw materials is an essential factor in the ongoing viability of our product and service offering and in achieving our Horizon 2020 growth objectives. The risks and opportunities vary considerably from one business unit to another and for this reason, we have taken a decentralized approach to risk and opportunity management. We have determined to seek a competitive edge in terms of our access to critical raw materials and in our ability to secure these raw materials in an ethical and sustainable manner.

In 2016, each business unit was asked to identify the raw materials that are critical in achieving the Horizon 2020 objectives using a 3-step process. The process consisted of the following elements:

1. Definition of the criteria applicable to the raw materials specific to the business unit’s activity

2. Identification of the raw materials with a high probability of restrictions in supply, considering the selected criteria

3. Calculation of the impact of the supply risk identified on the Horizon 2020 objectives

21 supply criteria, covering various aspects of sustainability, have been offered to the business units as input for the mapping. The criteria can be clustered into the following themes:

EHS or regulatory aspects of the raw materials

Concentration in the market or restrictions in the country of origin

Ethical aspects and potential conflicts with the Code of Conduct linked to the raw materials

Unavailability due to end-of-life of the mineral source

Physical constraints at origin

As supply risks and opportunities can change, the identification of the critical raw materials is a dynamic process. In 2020 all business units updated their mapping. Over the course of Horizon 2020, 11 raw materials have been identified as being critical in achieving the Horizon 2020 objectives. The type of risks spans over the main clusters provided above.

It is particularly important to define actions to mitigate the risk of critical materials supply disruption. Mitigation actions can vary depending on the materials and the position of the business unit in the market. Action plans and dedicated mitigation measures must be in line with the identified risks and opportunities and are therefore updated regularly. The reviewing frequency and process vary from business unit to business unit depending on the specific supply conditions. Mitigation measures beyond responsible sourcing include due diligence actions, ensuring critical raw materials can be supplied from several reliable suppliers, looking for secondary raw materials sources and ensuring the responsible status of the raw materials. More details about the mitigation actions are provided in the next pages for specific critical raw materials.

Business units purchasing 1 of the 4 conflict minerals to manufacture their products, use the Conflict Mineral Reporting Template from the Responsible Minerals Initiative for their due diligence on the purchased raw materials.

On 1 January 2021, the Conflict Minerals Regulation has come into full force across the EU. This law is similar in scope to the US Dodd Frank Act of 2012. The new law aims to help stem the trade in 4 minerals – tin, tantalum, tungsten and gold (also known as 3TG)– that sometimes finance armed conflict, are mined in unacceptable conditions and/or using forced labor. The way Umicore has been managing supply risks in the past years is fully in line with the requirements of this new law.

In addition to existing policies and charters, such as the Umicore Code of Conduct, Human Rights Policy and Sustainable Procurement Charter, Umicore also has a specific policy regarding Responsible global supply chain of minerals from conflict-affected and high-risk areas.

Today, responsible mineral sourcing goes beyond conflict minerals. Umicore pursues responsible sourcing certification wherever appropriate to highlight our best practices and to provide the necessary documentation to the increasing number of customers seeking assurance on our products. The Umicore internal “Metals and Minerals” working group streamlines and optimizes the efforts required for this increasing customer demand through best practices sharing.

The London Bullion Market Association (LBMA) manages the accreditation process for all Good Delivery listed refiners for gold and silver. The Responsible Jewelry Council’s (RJC) Chain of Custody (CoC) Standard is applicable to gold and platinum group metals (platinum, palladium and rhodium).

The Responsible Minerals Initiative is used by many customers to streamline the process to guarantee conflict-free products in complex supply chains. A typical example is the automotive industry, where a structure has been created to assure that all individual elements of a car can be certified as not containing conflict minerals sourced from non-certified origins. This procedure is not a ban on those materials (tin, tantalum, tungsten and gold), but a process to create transparency in the supply chain to ensure conflict-free minerals can be sourced. Other industries, such as the electronics industry, implement the same or similar processes

LBMA Gold | LBMA Silver | RJC Chain of Custody | RMI-Conformant Cobalt Refiners | RMI-Conformant Gold smelters and refiners | |

|---|---|---|---|---|---|

Bangkok | X | X | |||

Hoboken | X | X | X | ||

Kokkola | X | ||||

Olen | X | ||||

Pforzheim | X | X | X | X | |

Vienna | X | X |

Both the RJC Chain of Custody and LBMA Good Delivery accreditations qualify the accredited sites for listing in the Responsible Minerals Initiative conformant smelters and refiners.

For more information, please visit:

Umicore uses cobalt in materials for rechargeable batteries, tools, catalysts and several other applications. The Sustainable Procurement Framework for Cobalt covers Umicore’s cobalt purchases worldwide. The Framework is aligned with the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas. Umicore obtained, for the sixth year in a row, third party assurance from PwC that its cobalt purchases in 2020 are carried out in line with the conditions set out in the framework. The share of cobalt from recycled origin was also reviewed by PwC as part of the assurance process and was 4.1% for 2020. The figure is reported in the compliance report.

A dedicated cobalt sourcing committee, referred to as the Approval Committee, is responsible for the principles and guidelines in the framework and has overall control and decision-making power. The Approval Committee includes a member of the Umicore Executive Committee and the senior management of Sustainability and Supply.

In May 2019, Umicore Olen was approved as the first Responsible Minerals Initiative-conformant cobalt refinery worldwide. Umicore’s newly acquired Kokkola’s cobalt operations were the second recognized refinery. The refineries must undergo a yearly certification process. Given the COVID-19 context in 2020, the audit had to be postponed but both sites remain on the list of RMI compliant refiners. The audit will take place as soon as the situation allows for it. As mentioned above the audit related to Sustainable Procurement Framework for Cobalt, which is aligned with OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, has taken place. This audit covers the cobalt supply for Olen and Kokkola.

In 2020, Umicore performed the follow up of the mitigation actions defined as a result of the third-party audit that was performed in 2019 at one of its cobalt suppliers. No new third party audit could be conducted in 2020 due to the COVID-19 pandemic. We did a follow up with our suppliers in DRC on the measures that were put in place to guarantee safe working conditions with respect to COVID-19 pandemic control.

Umicore supported the development of the Cobalt Industry Responsible Assessment Framework (CIRAF) within the Cobalt Institute. The CIRAF is a management framework for risk assessment and mitigation aiming at ensuring responsible cobalt production and sourcing. As part of the CIRAF, risks regarding own operations and supply chain must be analyzed. Following the recommendations of the framework, Umicore performed a risk analysis of its 8 cobalt-related operations considering the risks identified by the CIRAF and the results of our own materiality analysis and of our internal Business Risk Assessment. The material risks for our operations are (1) Air-water-soil pollution & energy efficiency; (2) OHS and working conditions; (3) Conflict & financial crime; (4) Human rights abuses. Umicore has policies and measures in place covering these risk areas (see Management Approach). Key performance indicators are reported yearly (see Environmental and Social statements). With respect to “supply chain”, Umicore’s approach is aligned with the level 3 requirements of the CIRAF, moving from level 2 in 2019 as all the risks, including biodiversity and resettlement risks, are now covered.

The compliance report for 2020, including the CIRAF report, is available online.

Umicore continued its engagement with the Global Battery Alliance and supported the transition to an independent entity. Via its engagement in the Cobalt Action Partnership, Umicore supports a coordinated approach for local interventions in mining communities in the Democratic Republic of Congo.

Umicore participated in the Battery Passport project of the Global Battery Alliance, which aims to deliver a digital sustainability record for batteries. Together with many stakeholders of the battery value chain, Umicore supported the development of KPIs to represent the sustainability of the battery supply chain (including environment and human rights).

In 2018 Umicore implemented, besides its continued engagement in sustainable cobalt sourcing, due diligence in the supply of the other raw materials for batteries, i.e. nickel, manganese and lithium. The approach is directly inspired by the experience with cobalt and follows the basic steps of the Sustainable Procurement Framework for Cobalt. Specific mitigation actions have been defined for these metals depending on the identified risk.

In 2020, Umicore continued to ensure that operations with a production of gold are certified as conflict-free. Umicore operations in Hoboken, and Pforzheim are certified as conflict-free smelters for gold by the London Bullion Market Association (LBMA). The LBMA also provides certification for responsible silver and the sites of Hoboken, Pforzheim and Bangkok are accredited refiners by the LBMA. The Jewelry & Industrial Metals operations in Pforzheim, Vienna and Bangkok are certified as part of the Responsible Jewelry Council’s (RJC) Chain of Custody program for gold.

Since 2020, the LBMA audit for compliance against the Responsible Platinum and Palladium Guidance is mandatory for the London Platinum and Palladium Market (LPPM) accredited producers of platinum and palladium plates and ingots. As there is currently no official due diligence certification scheme for platinum and palladium sponge, UPMR went for these precious metals for a voluntary audit based on the requirements of the LBMA responsible sourcing program. The Jewelry & Industrial Metals operations in Pforzheim, Vienna and Bangkok are certified as part of the Responsible Jewelry Council’s (RJC) Chain of Custody program for recycled platinum, palladium and/or rhodium.

While the metal-bearing raw materials are purchased directly by the business units (direct procurement, see note V2 for specific sustainable supply related actions), Umicore’s worldwide purchasing and transportation teams take care of the energy and other goods and services which are referred to as indirect procurement. In 2020, though indirect procurement spend remained stable compared to the previous year, it was down to roughly 5% of the total spend. Half of indirect procurement spend is handled by the Procurement & Transportation teams in Belgium and Germany.

The indicators presented are based on 2020 data from our Procurement & Transportation teams in Belgium and Germany and Poland. EcoVadis, a well-known collaborative platform providing Supplier Sustainability Ratings, is also used by the local procurement team in Brazil.

Since 2017, a quick scan based on criteria such as size, geographical location and type of product or service provided is systematically used for the assessment of new suppliers. This tool determines the need for an EcoVadis assessment. This tool was first implemented by the teams in Belgium and Germany, and in 2020 it was also used by the team in Poland. In 2020, 484 quick scans have been initiated. The goal is to further roll-out to more teams worldwide in the future.

Sustainability performance of specific suppliers is assessed by EcoVadis.

101 assessment scores were made available to the teams in 2020, including the requests from the Procurement & Transportation teams in Brazil. A total of 417 scores have been received since the start of our collaboration with EcoVadis. This represents the number of unique suppliers that have been assessed and does not consider the regular re-assessment of a supplier.

82% of the assessed suppliers in 2020 reached a score of 45 or higher, suppliers “engaged in CSR” (Corporate Social Responsibility). None of the scores received in 2020 indicates a “high risk”.

Suppliers' score in Ecovadis assessment | |

|---|---|

1-24: high sustainability risk | 0% |

25-44: some basic steps made on sustainability issues | 18% |

45-64: appropriate sustainability management system | 52% |

65-84: advanced practices on sustainability | 30% |

85-100: outstanding sustainability management systems | 0% |

SUPPLIERS’ SCORE IN ECOVADIS ASSESSMENT

%

SUPPLIERS’ SCORE IN ECOVADIS ASSESSMENT

Group | |

|---|---|

Environmental | 58.9 |

Labor and Human Rights | 58.8 |

Fair business practices | 52.0 |

Suppliers | 50.1 |

Overall | 56.6 |

The overall score is a weighted average of the 4 theme scores.

More information on Umicore’s relationship with suppliers can be found in the Stakeholder Engagement and in the Value Chain and Society performance review.

The Umicore Group was re-evaluated by EcoVadis and was awarded its first Platinum Medal in Corporate Social Responsibility (CSR), with a score of 73/100. This result includes our company among the top 1% performers evaluated by EcoVadis.

To see Umicore's EcoVadis CSR scorecard, see: ECOVADIS-SCORECARD-2020.PDF

The 2020 rating is an improvement on Umicore’s previous Gold rating (top 5% of peers), demonstrating Umicore’s continued commitment and efforts for an improved performance in all four sustainability themes (environment, labor and human rights, ethics and sustainability procurement). Umicore has been assessed by EcoVadis since 2013.

Primary raw materials: are materials that have a direct relation to their first lifetime hereby excluding streams of by-products

Secondary raw materials: are by-products of primary material streams

End-of-life materials: are materials that have ended at least a first life cycle and will be re-processed through recycling leading to a second, third… life of the substance

Incoming materials are regarded as primary by default if their origin is unknown. The collected data are expressed in terms of total tonnage of incoming material.

RESOURCE EFFICIENCY

%

In 2020, 64% of the materials were from end-of-life or secondary origin while 36% were of primary origin, respectively, compared to 60% and 40% in 2019. This ratio results from the combined effect of the COVID-19 on the global automotive industry and higher processed volumes in Recycling.

Our primary focus in terms of sustainable products and services is to leverage activities that provide solutions to the megatrends of clean mobility and resource scarcity. For more information, please refer to Value chain and society.

We developed an indicator to underline our focus on clean mobility and recycling.

REVENUES FROM CLEAN MOBILITY AND RECYCLING

%

Business units continue to develop specific solutions for sustainability aspects of our products and their applications in close relationship with customers. Typical subjects dealt with in such developments are the reduction of risks related to the use of products, reduction of the hazard of products or a higher material efficiency in the delivery or the use of our products.

Worldwide, Umicore ensures regulatory compliance for the products it puts on the market. Changes to existing product related legislation as well as the introduction of new legislation, might impact our business. In terms of the REACH legislation and the newly proposed concepts such as the Chemical Strategy on Sustainability in the EU, Umicore closely monitors all changes in the regulation, in interpretation as well as guidance documents that might affect its REACH implementation strategy. Umicore is actively involved in industry association working groups to ensure a consistent approach is followed and the metal specifics are understood by the regulators and the companies.

Umicore actively supports the engagement of the metals sector with ECHA in the Metals/inorganics sectorial approach (MISA).

Umicore engaged with the cobalt industry in managing the EU cobalt metal harmonized classification and continues to be engaged in the Annex XV proposal on the restriction of 5 cobalt salts. This process has no final outcome yet and continues into 2021.

In 2020, we submitted 27 additional substances for registration under REACH due to new business developments.

As part of regular maintenance, we updated 76 REACH dossiers among others to change the tonnage band, to reply to ECHA requests and to include new information.

In Korea, Umicore is actively involved in preparation for the first Korea REACH registration deadline end of 2021 including Lead Registrant roles. Umicore has submitted 2 registrations in Korea in 2020 for priority chemical substances.

Umicore prepared for arising international regulations like for Turkey and Russia by submitting pre-registrations/notifications. Umicore is also preparing for compliance with UK-REACH.

The indicators presented are based on data from fully consolidated companies. The historical numbers (2016 and before) were not restated.

GROUP DATA

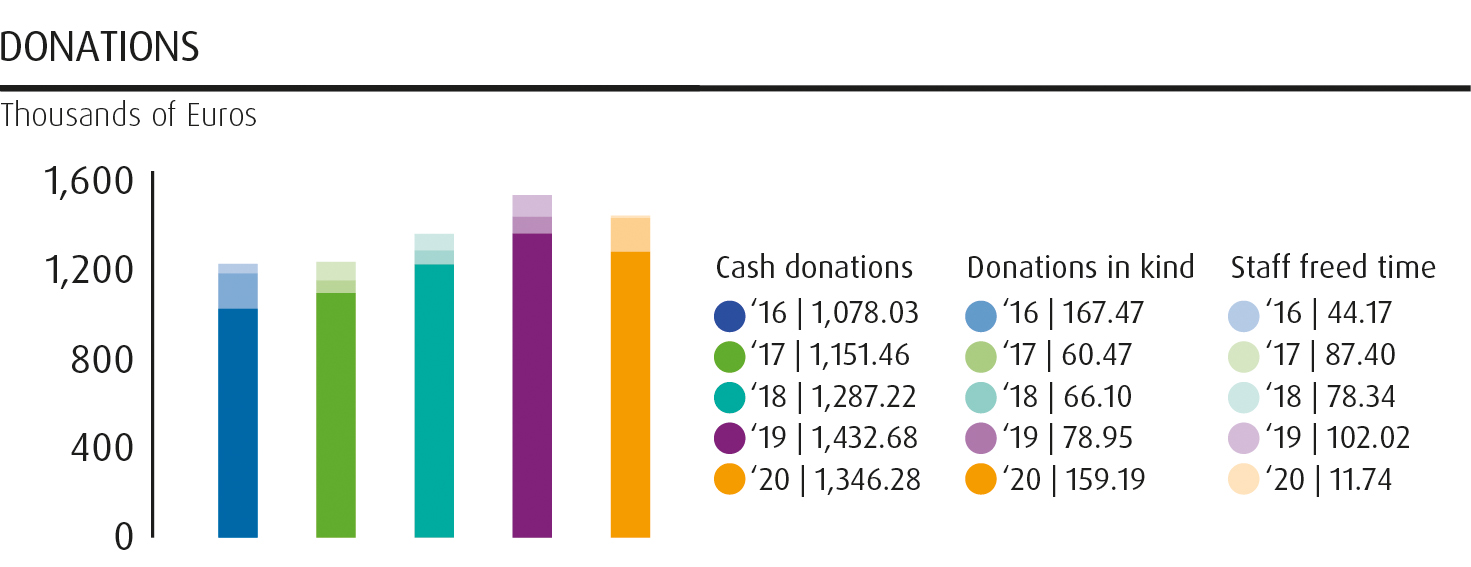

unit | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|

Cash donations | € thousand | 1,078.03 | 1,151.46 | 1,287.22 | 1432.68 | 1346.28 |

Donations in kind | € thousand | 167.47 | 60.47 | 66.10 | 78.95 | 159.19 |

Staff freed time | € thousand | 44.17 | 87.40 | 78.34 | 102.02 | 11.74 |

Total donations | € thousand | 1,289.68 | 1,299.34 | 1,431.66 | 1613.65 | 1517.21 |

Donations are subdivided into cash donations, donations in kind and staff time.

Each business unit is expected to allocate an annual budget that provides sufficient donations and sponsorship support to each site’s community engagement program. By way of guidance, this budget should equal to an amount corresponding to one third of 1% of the business unit’s average annual consolidated adjusted EBIT (i.e. excluding associates) for the 3 previous years. Most of the donations from the business units go to charity events close to their sites, in support of the local community.

At Group level, the budget is set at the discretion of the CEO and the donations are coordinated and managed by a Group Donations Committee reporting to the CEO. Group donations focus on projects with an international scope with priority given to initiatives that have a clear link with sustainable development and with an educational component.

REGIONAL DATA

unit | Europe | North America | South America | Asia-Pacific | Africa | Umicore Group | |

|---|---|---|---|---|---|---|---|

Total donations | € thousand | 1,215.05 | 86.34 | 92.19 | 87.50 | 36.13 | 1,517.21 |

BUSINESS GROUP DATA

unit | Catalysis | Energy & Surface Technologies | Recycling | Corporate | Umicore Group | |

|---|---|---|---|---|---|---|

Total donations | € thousand | 202.57 | 244.81 | 297.27 | 772.56 | 1,517.21 |

In 2020, the Group donations included a substantial contribution to the Fund for the Prevention of Child Labour in Mining Communities – A Global Battery Alliance Collaboration. Other Group donations in 2020 included donations to UNICEF educational projects in Madagascar and in India, projects coordinated by Entrepreneurs for Entrepreneurs in Mali, Ecuador and Bolivia and support for student sustainable mobility projects.

In 2020, Umicore contributed a total of € 1.5 million in donations. This was slightly below the level of donations in 2019, due to a reduced level of local community fundraising activities in the context of the COVID-19 pandemic. This was also the case for the decrease in staff freed time with citizens being asked to stay at home. Donations in kind, however, increased, as Umicore donated ventilator machines to hospitals and supported hospitals, care homes and home nurses with surgical masks and cleaning material in their fight against COVID-19, as well as food baskets for local communities.

Belgium

Belgium Germany

Germany Worldwide

Worldwide