Investing in Umicore

Creating value as an established circular materials technology partner

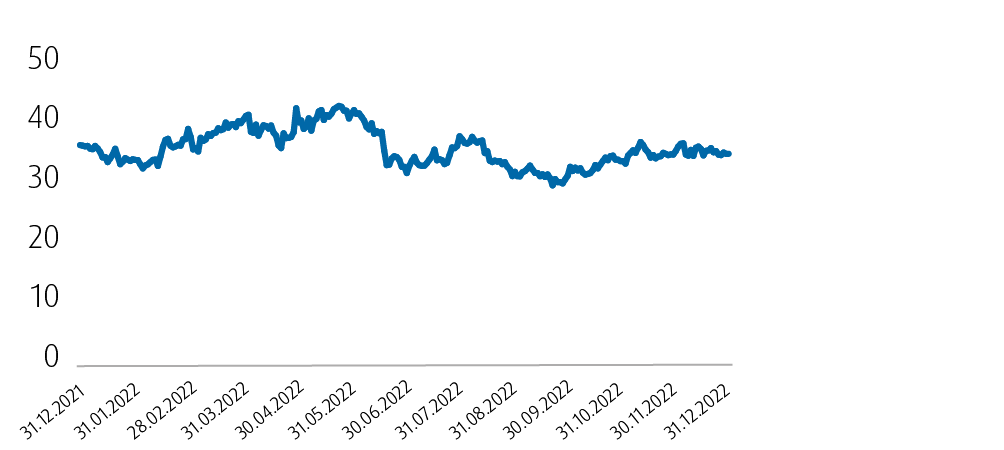

SHAREPRICE & DENOMINATOR

€ 2.47 BASIC ADJUSTED EARNINGS PER SHARE

| 2022 | |

| Total shares issued as at 31 December | 246,400,000 |

| of which treasury shares | 6,199,341 |

| of which shares outstanding | 240,200,659 |

| Weighted average number of outstanding shares | 240,340,705 |

| Potential dilution due to stock option plans | 345,226 |

Investing in Umicore is an investment in a net beneficiary of a changing world. Driven by and embracing powerful megatrends, Umicore is set to deliver fast, profitable growth with uninterrupted value creation to 2030 and beyond as we embark on the next strategic chapter as a circular materials technology company.

Investing in Umicore is also an investment in a sustainability champion. Sustainability is in our DNA, it’s part of our history and our future. The Let’s Go for Zero sustainability ambitions are translated into the following three focus areas: zero inequality, zero harm and zero greenhouse gases. These are, combined with todays’ megatrends, all key drivers for our sustainable growth path.

Building on the successful achievement of the Horizon 2020 strategy, Umicore is scaling up and unveiled the 2030 RISE strategy at the Capital Markets Day held on 22 June 2022 in London.

The financial ambition is to create sustainable value by balancing growth, returns and cashflow throughout the plan. In concrete terms this means Umicore aims to:

- More than double revenues compared with 2021.

- Achieve profitable growth with EBITDA-margin above 20%.

- Create sustainable value, above cost of capital, targeting 15% ROCE.

- Carry out phased investments of approximately € 5 billion between 2022-2026, with Battery Recycling and Rechargeable Battery Materials accounting for the bulk, subject to value creative agreements.

- Generate attractive free cashflow at Umicore Group level in the second half of the decade.

Acceleration of profitable growth supported by megatrends

Umicore’s ambition to RISE is driven by the following three powerful megatrends, but particularly the rapidly accelerating mobility transformation.

- Mobility transformation: The global mobility transformation is accelerating and the shift to cleaner mobility is expected to grow threefold by 2030. Through our complementary portfolio and presence in all drivetrain technologies, Umicore is uniquely positioned to capture this growth opportunity and to guide our automotive customers through their transformation journey.

- Growing need for advanced metal materials: Advanced materials are key enablers for faster, more scalable, more efficient, and more sustainable solutions that tackle the challenges of society today and tomorrow. Umicore develops the next generation of sustainable advanced materials ensuring that they are used again and again through its recycling technologies.

- Circularity for critical metals: We see value where others see waste. Against a background of a rapidly growing conviction that the future economy will be even more of a circular economy, also considering the growing electrification of mobility, Umicore enables full circularity for critical metals and integrates circularity in its everyday business.

Synergetic, coherent and competitive portfolio

Umicore has a unique value proposition for automotive customers that are impacted by the clean mobility transformation. We are a reliable partner that provides clean mobility solutions for all existing types of automotive platform drivetrains (e.g. emission control catalysts to clean exhaust gases from gasoline and diesel internal combustion engines in light-duty and heavy-duty vehicles; rechargeable battery materials required to power plug-in hybrid and full-electric vehicles; and catalysts for fuel cell-powered vehicles). By offering the full spectrum of automotive drivetrain technologies, Umicore is uniquely positioned to support its automotive customers in their complete journey from internal combustion engine towards electrification, ultimately, becoming a partner for the whole mobility transformation.

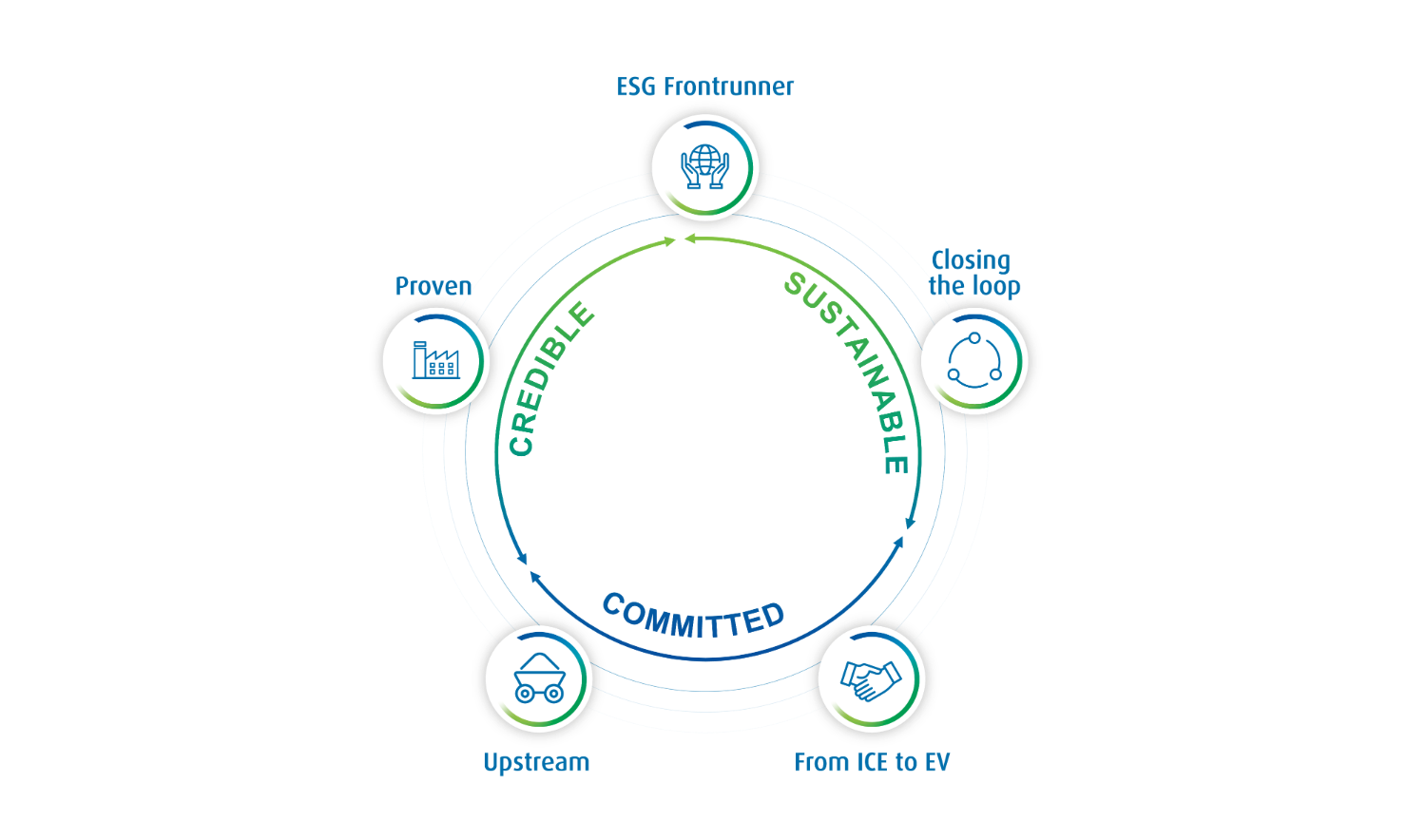

Umicore’s accumulated assets and abilities precisely address what automotive original equipment manufacturers need in their energy transition:

- in-depth upstream expertise in metal sourcing, trading and transformation;

- proven industrial-scale high-quality production of automotive catalysts and rechargeable battery materials for decades;

- ESG frontrunner in decarbonization and sustainable sourcing; and, last but certainly not least,

- by truly closing the loop as a technology leader in metal recycling.

Umicore’s complementary and synergetic portfolio enables value creation based on solid foundations. All three business groups and 11 business units are individually strong but together unlock solid commercial, operational and financial synergies across transversal themes, making them interdependent. In-depth, shared know-how in metal science, chemistry, metallurgy, sustainability and circularity is the common tread. In addition, with different positions in their lifecycle, the business groups combined represent a strong value creating model.

- Scale-up | investments to capture future profitable growth: based on the mobility transformation, Umicore will invest in battery materials, battery recycling and fuel cells to capture long-term value creation.

- Free cashflow generation | strong internal free cashflow generation in Automotive Catalysts and Precious Metals Refining: The Automotive Catalyst Business Unit is ideally positioned to capture an unprecedented market value peak, maximizing business value and delivering approximately € 3 billion free cashflow between 2022-2030 by focusing on process efficiency and operational agility. The Precious Metals Refining Business Unit will leverage its leadership in sustainable, complex, low-carbon recycling to generate strong free cashflows, even at normalized precious metals prices. These cashflows can be re-invested in Umicore’s growth businesses.

- Cultivate | developing with a focus on ROCE and diversification: the business units that are champions in their respective markets have very strong returns, value creation and ROCE. In addition, they enable the diversification towards a broader industrial base.

Materials for a better life, sustainability at the core of the corporate purpose

Sustainability is truly engrained in who we are and how we behave. When it comes to sustainability, we see it as our mission to be an industry leader. Over the past decades, Umicore has established a strong track record in ethical supply, eco-efficiency and wellbeing at work. More fundamentally, we have sharpened our strategic focus on those activities that are providing solutions to some of the most pressing societal challenges globally, such as the need for cleaner mobility, the need for a circular economy and the need to address climate change with speed and decisiveness. Sustainability at Umicore is not only about minimizing the impact of our industrial operations, it is first and foremost about having a positive impact on society.

Building on the achievements of the past years and striving to continuously raise the bar, Umicore introduced in 2021 the next chapter in its sustainability ambitions with Let’s Go for Zero. By introducing bold targets to achieve net-zero Scopes 1 and 2 greenhouse gas emissions (GHGs) by 2035, zero inequality and zero harm, we stretch our sustainability ambitions even further. And we are convinced that this is the right thing to do for society and our stakeholders.

In the framework of the 2030 RISE Strategy, Umicore introduced an ambitious target for its Scope 3 GHGs to drive decarbonization in the value chain. In November 2022, the Science Based Target initiative (SBTi) validated Umicore’s intermediate GHGs reduction targets for 2030 as science-based and aligned with the United Nations’ Paris Agreement.

These bold Let’s go for Zero sustainability ambitions, particularly when it comes to decarbonization, provide significant value to our customers and allow Umicore to distinguish itself within its industry, turning our sustainability profile into a greater competitive advantage.

By embedding these ambitions, Umicore’s 2030 RISE Strategy builds on our corporate purpose to produce Materials for a better life through businesses that will help shape a healthy planet and society, while delivering sustainable value to the stakeholders.

Maintaining a competitive lead through innovation

As a circular materials technology company, innovation is at the core of our success. We are a technology leader in key activity fields, combining our rich expertise in the field of metal-based chemistry, science and complex metallurgy. Umicore has a strong track record of, and commitment to, innovation to maintain a competitive lead. Spending on R&D represented 7.6% of revenues in 2022 (compared with 6% in 2021).

In line with our RISE 2030 strategy, the focus of our innovation efforts lies in developing process and product technologies that address the key global societal challenges of clean mobility and resource scarcity. In 2022, we made progress on our short- and long-term technology and innovation roadmap, to unlock transformational growth and meet the goals of our strategic journey. The significant step-up in R&D spending in 2022 reflects primarily the increased spending in Rechargeable Battery Materials related to next generation design-to-performance and design-to-cost product and process technologies as well as ongoing customer qualifications. We also increased our R&D expenditures in battery recycling and advanced technology development related to decarbonization and emission reduction programs to meet our ambitious sustainability programs. The importance of our R&D efforts is reflected in the 15 R&D centers globally and the 72 new patents registered in 2022, an increase of almost 5% from 2021.

Over 75% of Group capital expenditure to be spent between 2022-2026 will be dedicated to battery materials, battery recycling, and fuel cells, all focused on secular growth opportunities, with rechargeable battery materials and battery recycling solutions being the most significant growth projects.

Healthy capital structure

Our focus is on maintaining a strong balance sheet and remaining equivalent to an investment grade credit status across our growth plan. Our synergetic and complementary portfolio of activities offers diversified funding opportunities. Firstly, the strong internal free cash flow generation in Automotive Catalysts and Precious Metals Refining can be re-invested in the growth businesses. Secondly, there is an increasing appetite in the market to fund sustainable ESG projects. Sustainable funding instruments are being favored in Umicore’s financing mix of which the sustainability-linked private placement of debt for an amount of € 591 million is an example. For the first time, the funding costs of the placement are tied to our sustainability performance. We also strongly believe in co-funding through joint ventures or other strategic partnerships, a third funding lever. In addition, we have the possibility to look into grants and incentive mechanisms when available. Finally, as a listed company, we have the option to seek capital market funding in different forms, conditional upon the fact that it presents the right opportunity, from both a business and return perspective.

Umicore shares

Umicore shares are listed on the Euronext Brussels stock exchange.

The total number of outstanding and fully paid-up shares, and the number of voting rights, are 246,400,000. During the year, Umicore used 198,050 of its treasury shares in the context of the exercise of stock options, 43,459 for bonus conversions and 60,145 for shares granted. In the course of 2022, Umicore bought back 1,300,000 of its own shares. On December 31st 2022, Umicore owned 6,199,341 of its own shares representing 2.52% of the total number of shares issued as of that date.

Evidenced by the significant and historical volatility of the VIX index in 2022, the stock markets were overall affected by strong cautions about rising interest rates, inflation and geopolitical tensions.

Umicore share price started the year at € 35.66 and peaked at € 42.16 on May 27th, conclusion of the strong performance of the Umicore share against the market over the first half of 2022. While the performance during the first half of 2022 was driven by the announcement – in February – of Umicore’s 2021 all-time record results and strong Q1 guidance for 2022, markets reacted cautiously, in an overall volatile market, to the 2030 RISE Strategy, unveiled at our 2022 Capital Markets Day.

The Umicore share price evolved slightly above the market over the second half of 2022, overall following the volatile market trend. The share price reached its lowest level at € 29.15 on September 23rd, before a gradual recovery, further boosted by the announcement of the joint venture with PowerCo; the MoU to construct a manufacturing facility for CAM and pCAM in Canada; and the inauguration of the Europe’s first battery materials Gigafactory in Nysa. Share price closed 2022 at € 34.32.

Over the year, Umicore substantially outperformed the main indexes (Bel-20, Euro Stoxx Chemicals, Euro Stoxx 50) with a share price performance stabilizing at 96.0% (Base 100) versus 85.9%, 88.2% and 88.3% for the respective indexes.

Shareholder returns

Umicore aims to create value for its shareholders. There is no fixed pay-out ratio and the dividend policy supports a stable to growing dividend.

Umicore’s Supervisory Board will propose a gross annual dividend of € 0.80 per share for the full year 2022. This compares to a full dividend of € 0.80 per share paid out for the financial year 2021.

Taking into account the interim dividend of € 0.25 per share paid out on August 23rd 2022 and subject to shareholder approval, a gross amount of € 0.55 per share will be paid out on May 4th 2023.

INDEXES & RATINGS

| Index membership (selection) at December 31st 2022 | |

| Bloomberg | Bloomberg Belgium Large & Mid Cap Price Return Index Bloomberg Electric Vehicles ESG Screened Net Return Index Bloomberg Electric Vehicles Price Return Index Bloomberg Goldman Sachs Global Clean Energy Index Price Return |

| Euronext | BEL20 Euronext100 |

| MSCI | MSCI AC Europe IMI MSCI ACWI IMI with USA Gross Dividends Index MSCI EAFE ESG Leaders Index MSCI EMU ESG Leaders Price Return USD MSCI EMU SRI S-Series PAB 5% Capped Index MSCI Europe ESG Leaders Index MSCI Europe SRI S-Series PAB 5% Capped Index MSCI World Custom ESG Climate Series A Net in EUR MSCI WORLD ESG SEL IMPACT ex FOSSIL FUEL |

| STOXX | STOXX Europe 600 ex UK Net Return EUR STOXX Sustainability Price Index EUR |

In addition, Umicore is a member of the Financial Times Stock Exchange (FTSE) FTSE4Good Index Series, a series of ethical investment indices designed to measure the performance of companies demonstrating specific ESG practices and minimizing ESG risks. Umicore is also a member of the FTSE World Europe Index.

| ESG ratings 2022 (snapshot) | |

| CSR Hub | 91 |

| Ecovadis | 75 |

| ISS ESG | B- |

| MSCI | AAA |

| Refinitiv | 75 |

| SUSTAINALYTICS | 29.7 |

The Standard Ethics (SE) indexes measure Sustainability and Corporate Governance in accordance with OECD, EU and UN voluntary guidelines. Umicore is rated EE+ (very strong) and is a member of:

- SE European Best in Class Index (30 European listed companies with the highest Standard Ethics Rating)

- SE Belgian Index

- SE European 100 index

Engagement with shareholders and investors

Umicore has a high free float with a broad base of international shareholders which at the end of 2022 were primarily situated in Europe and North America. The overview of shareholders holding voting rights equal to 3% or more, as well as analyst research and consensus information can be found on our website under share information.

Umicore is covered by various financial analysts, who provide their own independent research analyses and earnings estimates in respect of the company. Some 20 brokerage firms actively cover Umicore at the end of 2022, reflecting strong and global interest from the financial market in its equity story and growth opportunities.

Umicore strives to provide timely and accurate information on its strategy, performance and prospects to its shareholders. Leveraging on 2021’s debuts (the launch of Umicore’s Let’s go for Zero ambitions, increased disclosure in the 2021 Full year results, etc.), 2022 saw the reinforcement of Umicore’s increased transparency and disclosure. The 2022 Capital Markets Day, during which the 2030 RISE strategy was presented, was a key highlight of the year. The full Management Board presented to a total of 48 physical participants and 743 participants following online. The Management Board took the opportunity to present the strategic roadmap for Umicore’s next development phase, building on our proven ability to embrace megatrends, our strong market positions, technology leadership and organizational excellence, and which will allow us to accelerate sustainable and profitable growth to be a net beneficiary of the changing world.

In addition to the 2022 Capital Markets Day, the further integration of EU taxonomy in its reporting and the SBTi validation of Umicore’s near-term 2030 targets to reduce its Scopes 1, 2 and 3 are testament of the increased transparency and disclosure in Umicore’s reporting.

Umicore’s Management, including the newly appointed CFO, Wannes Peferoen, and the Investor Relations team were in contact with investors and shareholders on a regular basis during virtual and in-person roadshows in North America, Europe and Asia, as well as through investor conferences, webcasts or conference calls (among others, the earnings calls and the call to announce the Joint Venture with PowerCo), and the Annual General Meeting of shareholders. In addition to what is mentioned above, the investor and shareholder contacts focus on a broad range of topics covering both strategy and financial, Environmental, Social and Governance (ESG) performance.