Governance statements

Corporate governance

During the financial year 2022, Umicore (also the “Company”) was subject to the Belgian Code on Corporate Governance 2020 (the “CG Code 2020”).

The English, Dutch and French versions of the CG Code 2020 can be found on the website of the Belgian Corporate Governance Committee.

The governance structure of the Company and the policies and procedures of the Umicore Group are described in detail the corporate governance charter of Umicore (the “CG Charter”), which was last amended on 9 June 2022. The CG Charter is available on the Umicore website or may be obtained on request from Umicore’s Group Communications Department.

Umicore has articulated its mission, values and basic organizational philosophy in a document called The Umicore Way. This document spells out how Umicore views its relationship with its customers, shareholders, employees and society. It is supplemented by detailed company codes and policies, the most significant of which is the Code of Conduct.

In terms of organizational philosophy, Umicore believes in decentralization and in entrusting a large degree of autonomy to each of its business units. The business units in turn are accountable for their contribution to the Group’s value creation and for their adherence to Group strategies, policies, standards and sustainable development approach.

In this context, Umicore is convinced that a sound corporate governance structure is a necessary condition to ensure its long-term success. This implies an effective decision-making process based on a clear allocation of responsibilities. Such approach must ensure an optimal balance between a culture of entrepreneurship at the level of the business units and effective steering and oversight processes. The deals in more detail with the responsibilities of the shareholders, the Supervisory Board, the CEO, the Management Board and the specific role of the Audit Committee and of the Nomination & Remuneration Committee. The present statements provide information on governance issues which relate primarily to the financial year 2022.

The Management Board (“directieraad”/“conseil de direction”) is entrusted with all matters not specifically reserved to the Supervisory Board (“raad van toezicht”/“conseil de surveillance”) or the shareholders’ meeting by the Belgian Code of Companies and Associations (the “BCCA”) or Umicore’s articles of association.

The Supervisory Board is responsible for the general policy and the strategy of Umicore, as well as for all actions that the BCCA reserves specifically for the board of directors in a one-tier system. It appoints and dismisses the CEO and the other members of the Management Board and it also supervises the Management Board. The Supervisory Board is assisted in its role by an Audit Committee and a Nomination & Remuneration Committee.

The day-to-day management of Umicore has been delegated to the CEO, who also chairs the Management Board. The Management Board, under the leadership of the CEO, is responsible for proposing the overall strategy of Umicore to the Supervisory Board and for Umicore’s operational management. It also approves the strategies of the individual business units and monitors their implementation. The Management Board is furthermore responsible for screening the various risks and opportunities that Umicore may encounter in the short, medium or longer term (see Risk Management section) and for ensuring that adequate systems are in place to address these. The Management Board is responsible for defining and applying Umicore’s approach to sustainable development.

Umicore is organized in business groups which in turn comprise business units that share common characteristics in terms of products, technologies and end-user markets. In order to provide a Group-wide support structure, Umicore has regional management platforms in China, North America, Japan and South America. Its corporate headquarters are based in Belgium (Brussels). This center provides a number of corporate and support functions in the areas of legal, finance, human resources, tax, internal audit, public and investor relations.

3.1 Issued shares – capital structure

On 31 December 2022 there were 246,400,000 Umicore shares in issue, representing a capital of € 550,000,000.

The following shareholders have declared a participation of 3% or more (the below mentioned participations are those as mentioned in the transparency declarations of the resp. shareholders):

Gérald Frère, Ségolène Gallienne, Stichting Administratiekantoor Frère-Bourgeois, The Desmarais Family Residuary Trust, Groupe Bruxelles Lambert SA/NV, Arthur Capital S.à r.l.: 39,363,737 shares (15.98%). Baillie Gifford & Co and Baillie Gifford Overseas Ltd.: 24,420,971 shares (9.91%). Norges Bank: 13,054,028 shares (5.30%). BlackRock Inc.: 12,463,608 shares (5.06%). APG Asset Management: 6,728,778 shares (3.00%)

Also on 31 December 2022, Umicore owned 6,199,341 of its own shares representing 2.52% of its capital. Information concerning the shareholders’ authorization for Umicore to purchase and/or sell its own shares and the status of such buy-backs and divestments can be consulted in the CG Charter and on Umicore’s website.

During the year, 198,050 own shares were used in the context of the exercise of employee stock options and 60,145 shares were used for share grants, of which 10,334 to the members of the Supervisory Board and 49,811 to the Management Board members. 43,459 own shares were used following a partial conversion into shares of the variable compensation of the former CEO and some members of the Management Board.

3.2 Dividend policy and payment

In 2022, Umicore paid a gross dividend of € 0.80 per share relating to the financial year 2021. This was an increase by € 0.05 compared with the gross dividend paid in 2021 in respect of the financial year 2020.

In July 2022, the Supervisory Board decided to pay a gross interim dividend of € 0.25 per share, which was paid on 23 August 2022.

3.3 Shareholders’ meetings in 2022

The annual shareholders’ meeting took place on 28 April 2022. A special and an extraordinary shareholders’ meeting were also held on the same day. The shareholders’ meeting took place physically but could also be viewed via a live (or differed) webcast.

On the occasion of the annual shareholders’ meeting, the shareholders approved the resolutions regarding the annual accounts, the appropriation of the results and the discharges to the Supervisory Board members and to the statutory auditor regarding their respective 2021 mandates. At the same meeting, the shareholders appointed Ms Alison Henwood as new, independent member of the Supervisory Board for a period of three years, effective 1 September 2022. Furthermore, the mandates of Françoise Chombar as independent member of the Supervisory Board, and of Laurent Raets, as member of the Supervisory Board, were renewed, also for three years. The annual shareholders’ meeting also approved a new remuneration policy, as well as the remuneration report and the remuneration of the Supervisory Board for 2022. Details of the fees paid to the members of the Supervisory Board in 2022 are disclosed in the remuneration report.

The special shareholders’ meeting approved a contractual change of control clause in accordance with article 7:151 of the BCCA.

Finally, the extraordinary shareholders’ meeting renewed the authorization conferred to the Company and its direct subsidiaries to acquire Umicore shares as well as the authorization granted to the Supervisory Board to increase the Company’s capital (i.e. the authorized capital). These renewed authorizations are valid until respectively 30 June 2026 and 9 May 2027.

4.1 Composition

The Supervisory Board, whose members are appointed by the shareholders’ meeting resolving by a simple majority of votes without any attendance requirement, is composed of at least six members. The members’ term of office may not exceed four years. In practice, Supervisory Board members are elected for a (renewable) period of three years. A member of the Supervisory Board cannot at the same time be member of the Management Board.

Members of the Supervisory Board can be dismissed at any time following a resolution of a shareholders’ meeting, deciding by a simple majority of the votes cast. There are no attendance requirements for the dismissal of Supervisory Board members. The BCCA provides for the possibility for the Supervisory Board to appoint members of the Supervisory Board in the event of a vacancy. The next general meeting must decide on the definitive appointment of the above member of the Supervisory Board. The new member completes the term of office of his or her predecessor.

On 31 December 2022, the Supervisory Board was composed of 10 members. On the same date, seven Supervisory Board members were independent in accordance with the criteria laid down in article 3.5 of the CG Code 2020.

In terms of gender and cultural diversity, the Supervisory Board counted four women and seven different nationalities among its 10 members on 31 December 2022. Diversity also arises from the Supervisory Board members’ educational backgrounds which include engineering, law, economics, finance, earth sciences and applied languages. The Supervisory Board’s cumulative industry experience is broad, covering automotive, electronics, chemicals, metals, energy, finance and scientific/educational sectors. It also includes people experienced in the public and private sector and members with experience in the different regions in which Umicore is active. Collectively, the Supervisory Board possesses strong experience of managing industrial operations and counts seven active or former CEOs in its ranks. The Supervisory Board also has collective experience in disciplines that are specifically relevant to Umicore’s non-financial goals such as environmental, social and sustainability governance (ESG), health and safety, talent attraction and retention and supply chain sustainability.

The composition of the Supervisory Board underwent the following changes in 2022:

- Alison Henwood was appointed independent member of the Supervisory Board for a period of three years, with effective date 1 September 2022, at the annual shareholders’ meeting held on 28 April 2022.

- Furthermore, the mandates of Françoise Chombar, as independent member of the Supervisory Board, and of Laurent Raets, as Supervisory Board member, were renewed for three years on 28 April 2022.

4.2 Meetings and topics

The Supervisory Board held eight regular meetings in 2022. One of these meetings was held by means of a videoconference. On one occasion, the Supervisory Board also took decisions by unanimous written consent. One of the meetings took place in the context of a two-day strategy workshop.

The matters reviewed by the Supervisory Board in 2022 included the following:

- Group and strategy governance including Umicore’s 2030 RISE Strategy,

- capital markets day 2022 storyline and content,

- financial performance of the Umicore Group,

- approval of the annual and half-year financial statements,

- adoption of the statutory and consolidated annual accounts and approval of the statutory and consolidated annual reports (including the remuneration report),

- new remuneration policy,

- approval of the agenda of an ordinary, a special and an extraordinary shareholders’ meeting and calling of these meetings,

- environmental, social and sustainability governance (ESG) related topics, including but not limited to climate action, risk and resilience, water and biodiversity, diversity, transparency and disclosures and more;

- safety,

- business risk assessment,

- investment and divestment projects,

- Audit Committee reports,

- HR strategy,

- funding,

- business and technology reviews and market updates,

- joint venture and partnership projects and updates,

- annual performance review of the CEO and the other members of the Management Board,

- nomination and remuneration matters,

- interim dividend distribution.

The Supervisory Board attended the inauguration of Europe’s first gigafactory for battery materials on Umicore’s site in Nysa (Poland). Furthermore, the Supervisory Board visited the Volkswagen site in Salzgitter (Germany) on the occasion of the joint venture agreement entered into between Umicore and PowerCo.

4.3 Performance review of the Supervisory Board and its committees

The Supervisory Board undertakes at least every three years an evaluation of its own performance and its interaction with the CEO and the Management Board, as well as its size, composition, functioning and that of the board committees.

The last performance review took place in 2020 and included a preliminary feedback round and an in-depth discussion during a Supervisory Board meeting held in July 2020.

4.4 Audit Committee

The Audit Committee’s composition and the qualifications of its members are fully in line with the requirements of article 7:99 of the BCCA and of the CG Code 2020.

On 31 December 2022, the Audit Committee was composed of four members of the Supervisory Board, three of them being independent. It is chaired by Ines Kolmsee.

The composition of the Audit Committee underwent one change in 2022: Alison Henwood was appointed member of the Audit Committee effective 1 September 2022.

All the members of the Audit Committee have extensive experience in accounting and audit matters as demonstrated by their curriculum.

The committee met four times in 2022. Apart from the review of the 2021 full year and the 2022 half year accounts, the Audit Committee reviewed reports and discussed matters related to internal audit, financial reporting, internal controls, ESG and other audit-related matters. The 2023 internal audit plan was validated. The committee met with the Group’s auditor and reviewed and approved provided non-audit services. Members of the Audit Committee also discussed ad hoc matters with senior management.

4.5 Nomination & Remuneration Committee

The composition of the Nomination & Remuneration Committee is fully in line with the requirements of article 7:100 of the BCCA and of the CG Code 2020.

On 31 December 2022, the Nomination & Remuneration Committee was composed of five members, all members of the Supervisory Board, three of them being independent. The committee is chaired by the chairman of the Supervisory Board.

The composition of the Nomination & Remuneration Committee remained unchanged in 2022.

Seven Nomination & Remuneration Committee meetings were held in 2022, including three videoconference calls. During the same period the committee discussed the remuneration policy for the Supervisory Board members, the Supervisory Board committee members and Management Board members, and the rules of the stock grant and option plans offered in 2022. The committee also discussed the succession planning at the level of the Supervisory Board and the Management Board.

5.1 Composition

The Management Board is composed of at least four members. It is chaired by the CEO. All members of the Management Board, including the CEO, are appointed by the Supervisory Board upon recommendation of the Nomination & Remuneration Committee.

The composition of the Management Board underwent the following changes in 2022:

- Filip Platteeuw, former Chief Financial Officer, resigned as member of the Management Board effective 1 October 2022,

- Wannes Peferoen was appointed Chief Financial Officer and member of the Management Board effective 1 October 2022.

- On 31 December 2022 the Management Board was composed of seven members, including the CEO.

5.2 Performance review

The Management Board regularly reviews and assesses its own performance. The valuation is also discussed at the Nomination & Remuneration Committee and presented to the Supervisory Board.

The last performance reviews of the CEO and the other members of the Management Board took place on 15 February 2022.

6.1 Restrictions on transferring securities

Umicore’s articles of association do not impose any restriction on the transfer of shares or other securities.

The Company is furthermore not aware of any restrictions imposed by law except in the context of the market abuse legislation and of the lock-up requirements imposed on some share grants by the BCCA.

The options on Umicore shares as granted to the CEO, to the members of the Management Board and to designated Umicore employees in execution of various Umicore incentive programs may not be transferred inter vivos.

6.2 Holders of securities with special control rights

There are no such holders.

6.3 Voting right restrictions

Umicore’s articles of association do not contain any restriction on the exercise of voting rights by shareholders, providing the shareholders concerned are admitted to the shareholders’ meeting and their rights are not suspended. The admission rules to shareholders’ meetings are articulated in article 20 of the articles of association. Pursuant to article 7 of the articles of association, if a share is the subject of concurrent rights, the rights attached to these shares are suspended until one person is designated as owner vis-à-vis the Company.

To the Supervisory Board’s best knowledge, none of the voting rights attached to the shares issued by the Company were suspended by law on 31 December 2022, save for the 6,199,341 shares held by the Company itself on that date (article 7:217 §1 of the BCCA).

6.4 Employee stock plans where the control rights are not exercised directly by the employees

Umicore has not issued any such employee stock plans.

6.5 Shareholders’ agreements

To the Supervisory Board’s best knowledge, there are no shareholders’ agreements which may result in restrictions on the transfer of securities and/or the exercise of voting rights.

6.6 Amendments to the articles of association

Save for capital increases decided by the Supervisory Board within the limits of the authorized capital, only an extraordinary shareholders’ meeting is authorized to amend Umicore’s articles of association. A shareholders’ meeting may only deliberate on amendments to the articles of association – including capital increases or reductions, mergers, de-mergers and a winding-up – if at least 50% of the subscribed capital is represented. If the above attendance quorum is not reached, a new extraordinary shareholders’ meeting must be convened, which will deliberate regardless of the portion of the capital represented. As a general rule, amendments to the articles of association are only adopted if approved by 75% of the votes cast. The BCCA provides for more stringent majority requirements in specific instances, such as the modification of the corporate object or the company form.

The Company’s articles of association were amended once in 2022, following the renewal of the authorized capital approved by the extraordinary shareholders’ meeting held on 28 April 2022.

6.7 Authorised capital – buy-back of shares

The Company’s capital may be increased following a decision of the Supervisory Board within the limits of the so-called “authorized capital”. The authorization must be granted by an extraordinary shareholders’ meeting; it is limited in time and amount and is subject to specific justification and purpose requirements.

The extraordinary shareholders’ meeting held on 28 April 2022 (resolutions published on 10 May 2022) renewed the authorization granted to the Supervisory Board to increase the Company’s share capital. The Supervisory Board is authorized to increase the capital in one or more times by a maximum amount of € 55,000,000. The authorization will lapse on 9 May 2027 but it can be renewed.

Up until 31 December 2022, the Supervisory Board has not made use of this renewed authorization.

Following a resolution of the extraordinary shareholders’ meeting held on 28 April 2022, the Company is authorized to acquire own shares on a regulated market within a limit of 10% of the subscribed capital, at a price per share comprised between € 4 and € 120 and until 30 June 2026 (included). The same authorization was also granted to the Company’s direct subsidiaries. The Company acquired 1,300,000 own shares in 2022 in implementation of the above and the previous authorization.

6.8 Agreements between the Company and its directors or employees providing for compensation if they resign, or are made redundant without valid reason, or if their employment ceases because of a take-over-bid

For a closed group of employees an individual agreement has been put in place, applicable in the event of a dismissal within 12 months after a change of control over the Company. As far as the members of the Management Board are concerned, reference is made to the remuneration report and policy.

During 2022, no conflicts of interests or decisions/transactions as defined under articles 7:115 through 7:117 BCA were discerned at the level of the Supervisory Board or the Management Board.

At the annual shareholders’ meeting held on 29 April 2021, EY Bedrijfsrevisoren BV / EY Réviseurs d’Entreprises SRL was appointed statutory auditor for a renewable period of three years. The statutory auditor is represented by Marnix Van Dooren & C° BV/SRL, itself represented by Marnix Van Dooren, and Eef Naessens BV/SRL, itself represented by Eef Naessens for the exercise of this mandate.

The Umicore policy detailing the independence criteria for the statutory auditor may be requested from Umicore.

Umicore operates a Code of Conduct for all its employees, representatives and supervisory or Management Board members. This Code of Conduct is fundamental to the task of creating and maintaining a relation of trust and professionalism with its main stakeholders namely its employees, commercial partners, shareholders, government authorities and the public.

The main purpose of Umicore’s Code of Conduct is to ensure that all persons acting on behalf of Umicore carry out their activities in an ethical way and in accordance with the laws and regulations and with the standards Umicore sets through its present and future policies, guidelines and rules. The Code of Conduct contains a specific section on complaints and expressions of concern by employees and “whistleblower” protection.1

The Code of Conduct is published in Appendix 6 to the CG Charter.

Umicore’s policy related to market abuse including insider trading is spelled out in the Umicore Dealing Code, which can be found under Appendix 7 to the CG Charter.

During the financial year 2022, the Company has complied with all the provisions of the CG Code 2020 .

Umicore’s remuneration policy (the “Policy”) outlines the remuneration principles for the members of Umicore’s Supervisory Board and Management Board.

In 2021, Umicore undertook a detailed review of the Policy to ensure the Group’s remuneration structure and rewards remain fair, responsible with a clear link to sustainable long-term value creation and in line with current international remuneration trends. The review also took into account the feedback received from our international shareholder base.

The Policy provides targets and remuneration with an increased focus on sustainable, profitable growth, combining financial and sustainability performance in full alignment with our sustainability ambitions.

The Policy, effective as of 1 January 2022 was approved at Umicore’s annual shareholders’ meeting on 28 April 2022 with 71.43% of the votes cast (disregarding the abstention votes, as provided under Belgian company law). The Policy contributes further to Umicore’s efforts to increase disclosure and is available on Umicore’s website.

REMUNERATION OF THE SUPERVISORY BOARD MEMBERS

The remuneration structure of the members of the Supervisory Board is in accordance with the Policy. The annual fixed fee and the attendance fee for the members of the Supervisory Board was increased in 2022. In addition, an annual fixed fee was introduced for the Chair and the members of the Nomination and Remuneration Committee. Other fees remained unchanged.

Supervisory Board

- Chair: annual fixed fee: € 60,000 + € 5,000 per meeting attended + 2,000 Umicore shares + company car

- Member: annual fixed fee: € 30,000 (versus € 27,000 in 2021) + € 3,000 per meeting attended (versus € 2,500 in 2021) + € 1,000 per meeting attended in person (for foreign-based members) + 1,000 Umicore shares

Audit Committee

- Chair: annual fixed fee: € 10,000 + € 5,000 per meeting attended + € 1,000 per meeting attended in person (for foreign-based Chair)

- Member: annual fixed fee: € 5,000 + € 3,000 per meeting attended + € 1,000 per meeting attended in person (for foreign-based members)

Nomination and Remuneration Committee

- Chair: annual fixed fee: € 10,000 (new versus 2021) + € 5,000 per meeting attended

- Member: annual fixed fee: € 5,000 (new versus 2021) + € 3,000 per meeting attended + € 1,000 per meeting attended in person (for foreign-based members)

2022 Remuneration overview of the Supervisory Board members

All components of the remuneration of the Supervisory Board members for the reported year are detailed in the table below.

| in (€) | ||||||||

| Name Mandate | Start date | End date | Fixed Fee | Shares 1 | Attendance Fee | Number of meetings attended Online/In person | Other (Car) | Total |

| Leysen T. | 223,817 | |||||||

| Chairman of the supervisory board | 19-11-2008 | 60,000 | 76,440 | 40,000 | 1 / 7 | 2,377 | ||

| Chairman of the nomination & remuneration comittee | 19-11-2008 | 10,000 | 35,000 | 3 / 4 | ||||

| Armero M. | 125,220 | |||||||

| Member of the supervisory board | 30-4-2020 | 30,000 | 38,220 | 31,000 | 1 / 7 | |||

| Member of the nomination & remuneration committee | 9-12-2020 | 5,000 | 21,000 | 3 / 4 | ||||

| Behrendt B. | 99,220 | |||||||

| Member of the supervisory board | 29-4-2021 | 30,000 | 38,220 | 31,000 | 1 / 7 | |||

| Chombar F. | 115,220 | |||||||

| Member of the supervisory board | 26-4-2016 | 30,000 | 38,220 | 24,000 | 1 / 7 | |||

| Member of the nomination & remuneration committee | 26-4-2018 | 5,000 | 18,000 | 3 / 3 | ||||

| Debackere K. | 135,220 | |||||||

| Member of the supervisory board | 26-4-2018 | 30,000 | 38,220 | 24,000 | 1 / 7 | |||

| Member of the audit committee | 26-4-2018 | 5,000 | 12,000 | 0 / 4 | ||||

| Member of the nomination & remuneration committee | 9-12-2020 | 5,000 | 21,000 | 3 / 4 | ||||

| Garrett M. | 121,220 | |||||||

| Member of the supervisory board | 28-4-2015 | 30,000 | 38,220 | 30,000 | 2 / 6 | |||

| Member of the nomination & remuneration committee | 25-4-2017 | 5,000 | 18,000 | 2 / 4 | ||||

| Henwood A. | 33,304 | |||||||

| Member of the supervisory board | 1-9-2023 | 10,027 | 10,605 | 8,000 | 0 / 2 | |||

| Member of the audit committee | 1-9-2023 | 1,671 | 3,000 | 0 / 1 | ||||

| Kolmsee I. | 128,220 | |||||||

| Member of the supervisory board | 26-4-2011 | 30,000 | 38,220 | 30,000 | 2 / 6 | |||

| Chairman of the audit committee | 28-4-2015 | 10,000 | 20,000 | 1 / 3 | ||||

| Meurice E. | 94,220 | |||||||

| Member of the supervisory board | 28-5-2015 | 30,000 | 38,220 | 26,000 | 2 / 5 | |||

| Raets L. | 109,220 | |||||||

| Member of the supervisory board | 25-4-2019 | 30,000 | 38,220 | 24,000 | 2 / 6 | |||

| Member of the audit committee | 25-4-2019 | 5,000 | 12,000 | 1 / 3 |

REMUNERATION OF THE CEO AND OTHER MANAGEMENT BOARD MEMBERS

The value of the CEO’s and other Management Board members’ remuneration was reviewed by the Supervisory Board on 15 February 2022. This review was carried out on the basis of recommendations from the Nomination and Remuneration Committee following a comparison survey with BEL20 and European peer companies.

In line with the Policy, remuneration of the CEO and other Management Board members included the following components in 2022: fixed remuneration, variable compensation, share-based compensation, pension plans and other benefits.

Remuneration of the CEO

Mathias Miedreich began his mandate as CEO on 1 October 2021. His annual fixed remuneration was set at € 1,000,000 and remained unchanged in 2022.

Mathias Miedreich participates in the short- and long-term variable remuneration programs as of the year of reference – 2022. The annual variable remuneration target (100% value) for performance in 2022 was set at € 600,000 and can vary between 0-125% depending on the Group and individual performance.

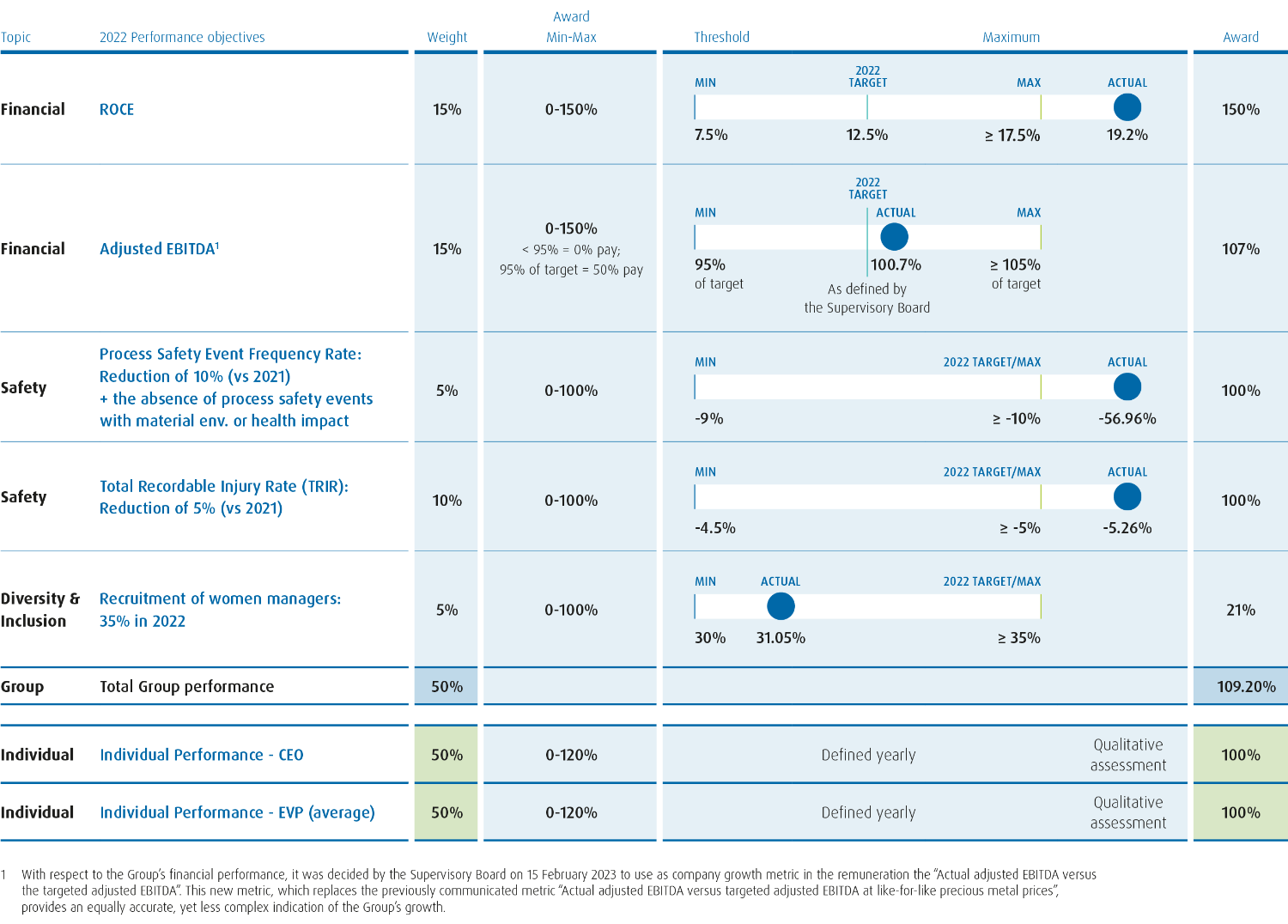

The year 2022 marked a successful start of Umicore’s 2030 RISE Strategy, with very solid financial results and the achievement of important milestones in Umicore’s “Let’s Go for Zero” ambitions. This strong performance resulted in an award outcome of 109.2% for Group performance (50% weight) and 100% for individual performance (50% weight), hence a total award level of 104.6%. The CEO’s actual gross annual variable compensation for the year of reference amounts to € 627,600. See Table 13.2 for more details on the 2022 performance award level.

In line with the Policy, a Performance Share Unit Plan (the PSU Plan) was introduced in 2022. The PSU Plan rewards strategic achievements driving long-term sustainable performance over a period of three years (2022-24). Under this PSU Plan, Mathias Miedreich received 17,529 PSUs, for vesting per 1 March 2025, provided the vesting conditions are met and subject to the achievement of the PSU performance objectives set in 2022 (as published in the 2021 remuneration report).

As part of the annual Umicore Incentive Stock Option Plan, 93,313 stock options were granted for 2022. On 15 February 2023, The Supervisory Board also decided to grant 2,000 Umicore shares for services rendered in the reported year. These shares are subject to a three-year lock-up.

As part of the compensation package, the Group also paid for the tuition fees (secondary school) in Belgium in 2022.

All components of the remuneration earned by Mathias Miedreich for the reported year are detailed in the Table 13.3.

Remuneration of other Management Board members

On proposal of the Nomination and Remuneration Committee and in line with the Policy, the Supervisory Board decided on 15 February 2022 to reduce, as of the year of reference 2022, the number of unconditional share awards, redistributing them over increased variable remuneration and a fixed annual fee. A pay mix with a higher portion of variable remuneration reinforces the link between reward and sustainable performance. Fixed remuneration for each other Management Board member was set at € 550,000 as of 1 January 2022.

The 2022 annual variable remuneration target (100% value) amounts to € 325,000, which can vary between 0-125% depending on Group and individual performance. See Table 13.2 for more details on the 2022 performance award level and Table 13.3 for the actual pay-outs.

Other Management Board members also participate in the PSU Plan. Under this Plan, they each received 9,495 PSUs, for vesting per 1 March 2025, provided the vesting conditions are met and subject to achieving the 2022 PSU performance targets (see 2021 remuneration report). Wannes Peferoen, who started his mandate as CFO of the Group on 1 October 2022, received 2,697 PSUs pro rata for the months in service in 2022.

As part of the annual Umicore Incentive Stock Option Plan 30,000 stock options per Management Board member were offered for 2022.

The Supervisory Board decided on 15 February 2023 to grant 2,000 Umicore shares per person for services rendered in the reported year (pro rata for Wannes Peferoen and Filip Platteeuw). These shares are subject to a three-year lock-up.

All components of the remuneration earned by the other Management Board members for the reported year are detailed in Table 13.3.

Group and individual performance 2022

The 2022 Group performance results related to the 2022 annual variable remuneration plan, are outlined in Table 13.2. This Table also shows results for individual performance in 2022.

13.2 Annual variable remuneration plan 2022 – Outcome

| in (€) | |||||||||||

| Name Position | Mandate Start date End date | Fixed Compensation 1 | Short-term Variable 2 | Long-term Variable 3 | Shares 4 | Stock Options 5 | Pension Plans 6 | Other 7 | Total | Ratio fixed 8 | Ratio variable 9 |

| Grynberg M. | 19/11/2008 | 0 | 0 | 486,500 | 0 | 0 | 8,805 | 0 | 495,305 | 2% | 98% |

| CEO | 31/10/2021 | ||||||||||

| Miedreich M. | 1/10/2021 | 1,000,000 | 627,600 | 0 | 65,380 | 600,003 | 208,800 | 55,732 | 2,557,515 | 75% | 25% |

| CEO | |||||||||||

| Csoma S. | 01/11/2012 | 0 | 0 | 264,100 | 0 | 0 | 3,968 | 0 | 268,068 | 1% | 99% |

| EVP | 31/03/2021 | ||||||||||

| Daufenbach D. | 6/12/2021 | 550,000 | 339,950 | 0 | 65,380 | 192,900 | 114,840 | 13,662 | 1,276,732 | 73% | 27% |

| EVP | |||||||||||

| Goffaux D. | 01/07/2010 | 550,000 | 315,575 | 264,100 | 65,380 | 192,900 | 134,161 | 38,828 | 1,560,945 | 63% | 37% |

| EVP | |||||||||||

| Kiessling R. | 01/02/2019 | 550,000 | 364,325 | 264,100 | 63,371 | 192,900 | 114,840 | 85,775 | 1,635,311 | 62% | 38% |

| EVP | |||||||||||

| Nolens G. | 01/07/2015 | 550,000 | 339,950 | 264,100 | 65,380 | 192,900 | 144,193 | 20,874 | 1,577,396 | 62% | 38% |

| EVP | |||||||||||

| Peferoen W. | 01/10/2022 | 137,500 | 84,988 | 0 | 16,345 | 0 | 28,710 | 3,946 | 271,489 | 69% | 31% |

| CFO | |||||||||||

| Platteeuw F. | 01/11/2012 | 412,500 | 218,400 | 264,100 | 49,035 | 192,900 | 105,930 | 24,420 | 1,267,285 | 62% | 38% |

| CFO | 30/09/2022 | ||||||||||

| Sap B. | 01/3/2021 | 550,000 | 372,450 | 0 | 65,380 | 192,900 | 114,840 | 13,818 | 1,309,388 | 72% | 28% |

| EVP | |||||||||||

| Steegen A. | 01/10/2018 | 0 | 0 | 264,100 | 0 | 0 | 0 | 0 | 264,100 | 0% | 100% |

| EVP | 30/09/2021 | ||||||||||

COMPARATIVE INFORMATION ON REMUNERATION CHANGES - PAY RATIO

Table 13.4 provides an overview on the annual remuneration changes for the CEO; other Management Board members (in aggregate); mandates within the Supervisory Board and the Committees; the average employee remuneration on a full-time equivalent basis; and Company performance. Incomplete years of remuneration due to a start or end of mandate in the course of the reference year, have been adjusted to an annual base. The number of shares in Table 13.4 represents for all years the numbers of shares taking into account the share split of 16 October 2017.

Average employee remuneration relates to Umicore (Belgium), in accordance with applicable legal provisions.

| Annual Change | RFY 2018 vs RFY 2017 | RFY 2019 vs RFY 2018 | RFY 2020 vs RFY 2019 | RFY 2021 vs RFY 2020 | RFY 2022 vs RFY 2021 | Information regarding RFY | |

| Remuneration management board | |||||||

| Position | Type of remuneration | ||||||

| CEO (Mathias Miedreich) Mandate as of 01/10/2021 | Fixed | 2.9% | 0.0% | 2.9% | 0.0% | 38.9% | |

| Variable | -24.8% | -5.6% | 37.9% | 57.7% | -22.3% | ||

| Number of shares | 0.0% | -3.8% | 0.0% | 0.0% | -80.0% | ||

| Number of options | 0.0% | -6.7% | 0.0% | -31.4% | -2.8% | ||

| Pension + other | 1.1% | 8.2% | 13.0% | 6.7% | -7.8% | ||

| Members of the management board (excl. CEO) | Fixed | 3.3% | 0.4% | 4.5% | 0.0% | 25.0% | |

| Variable | -28.0% | 18.3% | 10.6% | 58.2% | 45.2% | ||

| Number of shares | 0.0% | -5.4% | 0.0% | -0.9% | -71.2% | ||

| Number of options | 0.0% | -14.3% | 5.6% | 0.0% | 0.0% | ||

| Pension + other | -2.3% | 1.9% | 13.8% | -6.1% | 3.3% | ||

| Remuneration supervisory board | Type of remuneration | ||||||

| Chairman supervisory board | Fixed | 50.0% | 0.0% | 0.0% | 0.0% | 0.0% | |

| Attendance fee/meeting | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||

| Number of shares | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||

| Chairman nomination & remuneration committee | Fixed | - | - | - | - | + 10,000 € | Introduction of 10,000 € fixed fee |

| Attendance fee/meeting | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||

| Number of shares | - | - | - | - | - | ||

| Chairman audit committee | Fixed | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | |

| Attendance fee/meeting | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||

| Number of shares | - | - | - | - | - | ||

| Member supervisory board | Fixed | 0.0% | 0.0% | 0.0% | 0.0% | 11.1% | |

| Attendance fee/meeting | 0.0% | 0.0% | 0.0% | 0.0% | 20.0% | ||

| Number of shares | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||

| Member audit committee | Fixed | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | |

| Attendance fee/meeting | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||

| Number of shares | - | - | - | - | - | ||

| Member nomination & remuneration committee | Fixed | - | - | - | - | + 5,000 € | Introduction of 5,000 € fixed fee |

| Attendance fee/meeting | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | ||

| Number of shares | - | - | - | - | - | ||

| Average employee remuneration on a full time equivalent basis | |||||||

| % change versus previous year | 3.6% | 3.7% | 2.7% | 7.5% | 5.6% | ||

| Company's Performance | 2018 | 2019 | 2020 | 2021 | 2022 | ||

| ROCE | 15.4% | 12.6% | 12.1% | 22.2% | 19.2% | ||

| EBIT M€ | 514 | 509 | 536 | 971 | 865 | ||

| % ROCE change versus previous year | 2.0% | -18.2% | -4.0% | 83.5% | -13.5% | ||

| % EBIT change versus previous year | 25.4% | -1.0% | 5.4% | 81.1% | -11.0% | ||

The pay ratio 2022 between the highest and lowest pay level at Umicore (Belgium) was equal to 49.

SHARE BASED PLANS AND TRANSACTIONS 2022

Management Board PSU Plans

As of performance year 2022, a Performance Share Unit Plan (PSU Plan) was introduced, replacing the deferred cash variable program that was in place until performance year 2021. Under this PSU Plan, PSUs are granted conditionally to the members of the Management Board. The PSUs vest after three years, depending on the achievement of pre-set performance goals and provided continued service on the date of vesting. The objectives are defined by the Supervisory Board upon proposal of the Nomination and Remuneration Committee and include measurable financial and sustainability targets. (See 2021 remuneration report for the 2022 PSU performance targets).

Table 13.5 provides an overview of the number of PSUs granted for performance in 2022 and the main provisions of the PSU Plan. The number of PSUs granted conditionally was determined by dividing the target PSU grant value by the Umicore share price on Euronext Brussels, being equivalent to either the closing share price on the day before the grant date or the average closing price of the last 30 calendar days before the grant date, whichever is lowest.

| Name Position | Number of PSUs received in 2022 | Comment | |

| Miedreich M., CEO | 17,529 | ||

| Daufenbach F., EVP | 9,495 | ||

| Goffaux D., EVP | 9,495 | ||

| Kiessling R., EVP | 9,495 | ||

| Nolens G., EVP | 9,495 | ||

| Peferoen W., CFO | 2,697 | ||

| Platteeuw F., CFO | 9,495 | ||

| Sap B., EVP | 9,495 | ||

| Main provisions of the outstanding PSU plans | |||

| PSU Plan | Grant Date | Vesting Date | Performance window Start End |

| 2022 | 01/03/2022 | 01/03/2025 | 01/01/2022 - 31/12/2024 |

| 2022 (Peferoen W.) | 01/10/2022 | 01/03/2025 | 01/01/2022 - 31/12/2024 |

Vesting PSUs is subject to:

(1) a continued mandate as Management Board member, to the extent applicable under the PSU Plan. This condition is not applicable for members of the Management Board appointed before 1 April 2021 (unless in the event of termination for serious cause); and

(2) achievement of PSU performance objectives as defined by the Supervisory Board (see 2021 remuneration report).

If and when vesting takes place, the vesting of the PSUs is proportionate to the total weighted achieved award percentage, which can vary between 0-125%, pro rata of the number of months served by a Management Board member in the related performance year.

Management Board share option transactions in 2022

Table 13.6 provides an overview of the number of stock options granted for the services rendered in 2022 in the mandate of each member of the Management Board, the number of stock options exercised and expired in the course of the reported year, as well as the main provisions of the outstanding stock option plans.

Contrary to other countries, under Belgian Law, taxes on stock options are due at the time they are granted. Therefore and in alignment with other Belgian companies, the Umicore Incentive Stock Option Plans do not include performance conditions.

Details of all options exercised, and other share-related transactions can be found on the Financial Services and Markets Authority (FSMA) website.

| Transactions in the reported year 2022 | |||||

| Name Position | Options Granted | Options Exercised | Options Expired | ||

| Miedreich M. | ISOP 2022 | 93,313 | 0 | ||

| CEO | |||||

| Daufenbach F. | ISOP 2022 | 30,000 | 0 | ||

| EVP | |||||

| Goffaux D. | ISOP 2022 | 30,000 | 0 | ||

| EVP | |||||

| Kiessling R. | ISOP 2022 | 30,000 | 0 | ||

| EVP | |||||

| Nolens G. | ISOP 2022 | 30,000 | 0 | ||

| EVP | |||||

| Platteeuw F. | ISOP 2022 | 30,000 | ISOP 2016 | 30,000 | 0 |

| CFO | |||||

| Sap B. | ISOP 2022 | 30,000 | 0 | ||

| EVP | |||||

| Main provisions of the outstanding stock option plans | |||||

| ISOP Plan | Grant Date | Exercise Price * | Exercise window Start End | ||

| 2022 | 16/02/2022 | 33.220 | 16/02/2025 - 15/02/2029 | ||

| 2021 | 11/02/2021 | 47.080 | 11/02/2024 - 10/02/2028 | ||

| 2020 | 10/02/2020 | 42.050 | 10/02/2023 - 09/02/2027 | ||

| 2019 | 11/02/2019 | 34.080 | 01/03/2022 - 10/02/2026 | ||

| 2018 | 09/02/2018 | 40.900 | 01/03/2021 - 08/02/2025 | ||

| 2017 | 13/02/2017 | 25.500 | 01/03/2020 - 12/02/2024 | ||

| 2016 | 05/02/2016 | 16.632 | 01/03/2019 - 04/02/2023 | ||

* Exercise prices take into account the share split of 16 October 2017.

Management Board share grant in 2022

Table 13.7 provides an overview of shares granted in 2022 for services rendered in 2021 during a Management Board member’s mandate. Shares were granted on 16 February 2022 and were valued at the fair market value of € 33.22 per share, equivalent to either the closing share price on the day before the delivery date or the average closing share price of the last 30 calendar days before delivery date, whichever is the lowest. For German and Korean tax purposes, shares were valued respectively at € 33.54 and € 35.50. Shares are subject to a three-year lock-up until 15 February 2025.

As per the Policy, within five years from the date of appointment, the CEO is required to set aside a minimum of 30,000 Umicore shares, which he must retain throughout his tenure. This requirement also applies to other Management Board members in respect of a minimum of 15,000 shares.

On 31 December 2022, G. Nolens, D. Goffaux and R. Kiessling reached this minimum shareholder requirement. M. Miedreich, F. Daufenbach, B. Sap and W. Peferoen, are still within the five-year time-frame to build up the required minimum.

Management Board members held collectively a total of 202,831 shares on 31 December 2022.

| Name Position | Number of shares received in 2022 for YR 2021 | Comment |

| Grynberg M., CEO | 8,334 | |

| Miedreich M., CEO | 500 | |

| Csoma S., EVP | 1,750 | |

| Daufenbach F., EVP | 143 | |

| Goffaux D., EVP | 7,000 | |

| Kiessling R., EVP | 7,000 | |

| Nolens G., EVP | 7,000 | |

| Platteeuw F., CFO | 7,000 | |

| Sap B., EVP | 5,834 | |

| Steegen A., EVP | 5,250 |

Supervisory Board share grant in 2022

Table 13.8 provides an overview of shares granted in 2022 to Supervisory Board members for services rendered in 2022. Shares were granted on 12 May 2022 (on 1 September 2022 for Alison Henwood) and were valued at the fair market value of the share at € 38.22 (at € 31.75 for Alison Henwood), equivalent either to the closing share price on the day before the delivery date or the average closing price of the last 30 calendar days before delivery date, whichever is lowest. Shares must be held until at least one year after the member leaves the Supervisory Board and until at least three years after the delivery date.

Supervisory Board members held collectively a total of 909,707 shares on 31 December 2022.

| Name Mandate in the Supervisory Board | Number of shares received in 2022 | Comment |

| Leysen T. | 2,000 | |

| Chairman | ||

| Armero M. | 1,000 | |

| Member | ||

| Behrendt B. | 1,000 | |

| Member | ||

| Chombar F. | 1,000 | |

| Member | ||

| Debackere K. | 1,000 | |

| Member | ||

| Garrett M. | 1,000 | |

| Member | ||

| Henwood A. | 334 | Pro rata the services in 2022 |

| Member | as of 01/09/2022 | |

| Kolmsee I. | 1,000 | |

| Member | ||

| Meurice E. | 1,000 | |

| Member | ||

| Raets L. | 1,000 | |

| Member |

APPROVAL OF THE 2021 REMUNERATION REPORT AND IMPLEMENTATION OF NEW REMUNERATION POLICY AS OF JANUARY 2022

The 2021 remuneration report received 63.51% of shareholder votes (disregarding the abstention votes, as provided under Belgian Company Law), compared with 81.49% of the previous year. The 2021 remuneration report was still based on the previous remuneration policy, which was applicable until performance year 2021.

The 2022 remuneration report shows next to revised financial targets also sustainability/ESG targets in alignment with Umicore’s “Let’s Go for Zero” ambitions embedded within the Umicore 2030 RISE Strategy to enhance sustainable long-term value creation. Umicore will continue to include stretched and achievable targets, disclosing these targets upfront. (See Table 13.9 for the 2023 performance objectives).

| Annual Variable compensation plan (1y performance) | Weight | 2023 Target Award % | Treshold Award % | Maximum Award % |

| ROCE | 15% | 12.5% 100% award | 7.5% 0% award | ≥17.5% 150% award |

| Adjusted EBITDA | 15% | Defined by the Supervisory Board1 | 95% 50% award (Below 95%, 0% award) | ≥105% 150% award |

| Process Safety Event Frequency Rate | 5% | Reduction of 10% by 2023 versus 2022 + the absence of process safety events with material environmental or health impact | 0% (same as 2022 level) 0% award | ≥10% 100% award |

| Total Recordable Injury Rate (TRIR) | 10% | Reduction of 10.5% by 2023 versus 2021 | Reduction of 7.37% 0% award | ≥10.5% 100% award |

| Recruitment of women managers | 5% | 35% recruited | 30% recruited 0% award | ≥35% recruited 100% award |

| Individual performance | 50% | Defined yearly | 0% award | 120% award |

| Performance Share Unit Plan (3y performance) | Weight | 2023 Target Award % | Treshold Award % | Maximum Award % |

| ROCE | 25% | 12.5% 100% award | 7.5% 0% award | ≥17.5% 150% award |

| Total Shareholder Return (TSR) | 25% | Ranked in top 50% of 12 peers | Sixth place 25% award (Ranked outside the Top 50%, 0% award) | First place 150% award |

| GHG emissions | 25% | Scope 1+2: Reduction of 20% by 2025 versus 2019 | Reduction of 12% 0% award | ≥20% 100% award |

| Diffuse emissions | 6.25% | Reduction of 36.36% lead by 2025 versus 2021 | Reduction of 28.57% 0% award | ≥36.36% 100% award |

| Diffuse emissions | 6.25% | Reduction of 57.89 % arsenic by 2025 versus 2021 | Reduction of 53.68% 0% award | ≥57.89% 100% award |

| Diversity of thought index | 12.5% | Increase of 16.5% by 2025 versus 2021 | Increase of 13% 0% award | ≥16.5% 100% award |