Financial

%

Millions of Euros

%

Millions of Euros

Resilient business performance in a volatile market

Umicore posted a strong performance in 2022 in a context of severe market disruptions, cost inflation and a volatile precious metal price environment. Group revenues1 for the full year amounted to € 4.2 billion, up 10% compared with the previous year, driven by a strong operational performance, higher volumes and prices. Adjusted EBITDA amounted to € 1,151 million, a decrease of 8% compared with the record level achieved in 2021, reflecting increased spending for innovation and growth preparation, cost inflation2 and less favorable precious metal price levels3. Operational free cash flow remained strong at € 344 million, despite higher working capital requirements mainly driven by a record level lithium price, as well as higher capital expenditures. Net financial debt slightly increased to € 1.1 billion, resulting in a leverage ratio of 0.96x LTM adjusted EBITDA.

Revenues and earnings in Catalysis reached record levels. Automotive Catalysts outperformed the global car market, driven by a favorable platform and customer mix in light-duty applications as well as market share gains. Operational excellence and the ability to pass-through cost inflation resulted in record adjusted EBITDA of € 419 million.

Revenues and earnings in Energy & Surface Technologies increased substantially, achieving adjusted EBITDA of € 290 million. Cobalt & Specialty Materials benefited from an exceptionally strong demand and a supportive cobalt and nickel price environment in the first half of the year, before an expected normalization in the second half. The increased performance of Rechargeable Battery Materials included a favorable exposure to the increase of the lithium price. As anticipated and previously announced, sales volumes of cathode active materials remained subdued

Recycling delivered another excellent operational performance with revenues in line with the level achieved in 2021. The Precious Metals Refining Business Unit benefited from solid volumes and an overall supportive supply environment. A slightly lower contribution of the trading activity in Precious Metals Management was offset by higher revenues in the Jewelry & Industrial Metals Business Unit. Adjusted EBITDA amounted to € 532 million, below the level of 2021 due to cost inflation and less favorable precious metal price levels compared to 2021.

“The year 2022 marks a successful start for our “2030 RISE” strategy, which is designed to accelerate value creative growth. We have delivered a strong business performance in a context of significant macroeconomic headwinds and have already demonstrated very tangible progress against key strategic and financial objectives. I am tremendously proud of the Umicore team that has made this performance possible and I remain very confident that we are best positioned to capture the significant growth opportunities provided by the accelerating mobility transformation.”Mathias Miedreich, CEO of Umicore

The year 2022 also marks the introduction of Umicore’s 2030 RISE Strategy, designed to deliver significant, value creative growth. The Rechargeable Battery Materials Business Unit made significant progress by closing multiple long-term value creative customer contracts and supplier partnerships, as well as by achieving major milestones in executing its value chain presence in Europe and North America. The Catalysis and Recycling Business Groups again demonstrated their resilience, operational excellence and ability to generate strong free cash flows in a very challenging market context. These achievements reconfirm the ability of Umicore to balance growth, returns and cash flows over the time-frame of its 2030 RISE Strategy and are proof points of its execution. The Group also diversified and extended its funding base at attractive conditions with newly issued sustainability linked debt instruments for a total amount of € 1,091 million. In addition, the Science Based Target initiative (SBTi) has validated Umicore’s intermediate greenhouse gas reduction targets for 2030, an important milestone in its Let’s Go for Zero ambitions to achieve Net-Zero greenhouse gases by 2035, an integral part of the 2030 RISE growth strategy.

Adapted revenue definition for Energy & Surface Technologies to enhance comparability

As lithium and manganese are increasingly valuable and volatile components in rechargeable battery materials, it was decided to no longer treat them as consumables but as hedged metals in order to make the accounting approach consistent with the revenue4 performance indicator used in Umicore’s other business units. This will allow neutralizing distortions in revenues resulting from the volatility in the value of the purchased metals and enhance comparability of the underlying performance of the Rechargeable Battery Material business unit. Henceforth the pass-through value of the purchased lithium and manganese will therefore be excluded from the revenue calculation, as is currently already the case for cobalt and nickel. The Energy & Surface Technologies 2021 and 2022 revenues have been restated accordingly.

| Annex | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Total turnover | 13,717 | 17,485 | 20,710 | 24,054 | 25,436 | |

| Total revenues (excluding metal)1 | 3,271 | 3,361 | 3,239 | 3,791 | 4,155 | |

| Adjusted EBITDA | F9 | 720 | 753 | 804 | 1,251 | 1,151 |

| Adjusted EBIT | F9 | 514 | 509 | 536 | 971 | 865 |

| of which associates | F9 | 5 | 11 | 8 | 21 | 16 |

| EBIT adjustments | F9 | (14) | (30) | (237) | (75) | (32) |

| Total EBIT | F9 | 500 | 479 | 299 | 896 | 832 |

| Adjusted EBIT margin (in %)1 | 15.5 | 14.8 | 16.3 | 25.1 | 20 | |

| Return on Capital Employed (ROCE) (in %) | F31 | 15.4 | 12.6 | 12.1 | 22.2 | 19.2 |

| Effective adjusted tax rate (in %) | F9 | 24.4 | 24.7 | 24.2 | 23.1 | 20 |

| Adjusted net profit, Group share | F9 | 326 | 312 | 322 | 667 | 593 |

| Net profit, Group share | F9 | 317 | 288 | 131 | 619 | 570 |

| R&D expenditure | F9 | 196 | 211 | 223 | 245 | 316 |

| Capital expenditure | F34 | 478 | 553 | 403 | 389 | 470 |

| Net Cash flow before financing | F34 | (604) | (271) | 99 | 787 | 153 |

| Total assets, end of period | 6,053 | 7,023 | 8,341 | 9,045 | 9,942 | |

| Group shareholders' equity, end of period | 2,609 | 2,593 | 2,557 | 3,113 | 3,516 | |

| Consolidated net financial debt, end of period | F24 | 861 | 1,443 | 1,414 | 960 | 1,104 |

| Gearing ratio, end of period | F24 | 24.4 | 35.2 | 35.0 | 23.3 | 23.60 |

| Net debt / LTM adjusted EBITDA | 1.19x | 1.92x | 1.76x | 0.77x | 0,96x | |

| Capital employed, end of period | F31 | 3,802 | 4,442 | 4,457 | 4,377 | 4,716 |

| Capital employed, average | F31 | 3,344 | 4,048 | 4,451 | 4,384 | 4,511 |

Catalysis

Millions of Euros

Millions of Euros

Millions of Euros

Millions of Euros

Millions of Euros

%

Overview 2022 performance

The Catalysis business group set another all-time record performance in 2022, with both revenues and earnings exceeding the previous record result achieved in 2021.

Revenues reached € 1,776 million and adjusted EBITDA amounted to € 419 million, representing respective increases of 5% and 4% compared to the previous year.

This exceptional performance was primarily led by Automotive Catalysts which significantly outperformed, both in volumes and revenues, a subdued global car market. This was driven by a favorable platform and customer mix in light-duty gasoline applications as well as by further market share gains in gasoline catalyst technologies in China.

The Business Group also benefited from higher revenues in Precious Metals Chemistry while revenues in Fuel Cells & Stationary Catalysts remained in line with the previous year, impacted by COVID-19 lockdowns in China in the first half of the year. The higher revenues, combined with a favorable product mix, operational optimizations in Automotive Catalysts and a pass-through of cost inflation into pricing, resulted in margins well above historical levels. Adjusted EBIT amounted to € 342 million, representing an increase of 5% year on year.

2022 Business Review

The year 2022 proved to be another difficult year for the automotive industry, which was affected by severe supply constraints. Continued global logistic disruptions and shortages of semi-conductors, together with a resurgence of the COVID-19 pandemic in China in the first half of 2022, forced car manufacturers to reduce production despite strong global demand. As a result, global light-duty production for the full year 2022 remained broadly in line with the level of 2021 (+1.5%). This is however still well below the pre-pandemic level of 2019. Lower year on year car production in China and Europe was offset by strong growth in other regions, in particular in the second half of the year.

Despite this challenging backdrop, Automotive Catalysts delivered another set of record results, growing both revenues and earnings year on year. The business unit outperformed the global light-duty vehicle market both in volumes and revenues (+11% year on year) driven by a favorable platform and customer mix in China, North and South America, and India as well as further market share gains in gasoline catalyst applications in the Chinese market. This more than offset a decrease in revenues from the heavy-duty diesel segment, caused by a steep year on year decline in Chinese heavy-duty diesel production. Earnings were further supported by the product mix - with a higher portion of light-duty vehicles - and a favorable PGM price environment, and increased year on year despite cost inflation headwinds.

The light-duty vehicle segment represented 86% of Automotive Catalysts’ revenues in 2022, of which 79% corresponds to gasoline technologies.

The Chinese ICE market, which represented 29% of Umicore’s global light-duty catalyst volumes, declined 4.9% compared to the previous year. After a first half affected by a resurgence of the COVID-19 pandemic in major Chinese provinces, which resulted in temporary production suspensions in car manufacturer plants in March and April, car production rebounded strongly in the second half of 2022. Umicore substantially outperformed the Chinese market, both in volumes and revenues (+13.3%), benefitting from its strong customer mix and further market share gains with local car manufacturers.

The European ICE market, which represented 25% of Umicore’s global light-duty catalyst volumes, decreased with 4.4% year on year, reflecting supply disruptions related to semiconductors and wiring harnesses, in particular in the first half of the year. Umicore’s volumes and revenues (-4.7%) developed in line with the market.

The North and South American ICE markets, which represent 27% of Umicore’s global light-duty catalyst volumes, increased compared to the previous year (+8%) reflecting robust consumer demand. Umicore substantially outperformed the car market in this region, both in terms of volumes and revenues (+30%), driven by a favorable customer and platform mix.

Umicore’s revenues (+14.3%) and volumes were well above the Asia Pacific ICE market, which grew +3.7% year on year. This was primarily driven by a favorable customer and platform mix in India, which allowed Umicore to outpace a steeply growing Indian market.

The heavy-duty diesel segment represented 14% of the business unit’s revenues in 2022.

The Chinese heavy-duty diesel market, accounting for 49% of Umicore’s global heavy-duty diesel volumes, contracted substantially in 2022 (-33%) reflecting continued supply chain disruptions which were further exacerbated by COVID-19 related production suspensions in the second quarter and compared to a year 2021 that was boosted by strong demand for China V technologies ahead of the nationwide implementation of China VI. Umicore’s heavy-duty diesel volumes and revenues were down in this overall bearish market.

In Europe, Umicore’s volumes and revenues substantially outperformed the heavy-duty diesel market, which increased 4.8% compared to 2021, reflecting a favorable customer and platform mix.

Revenues for Precious Metals Chemistry increased compared to the previous year. Volumes of inorganic chemicals benefited from strong demand from the automotive industry. Revenues from homogenous catalysts were slightly below the record level of the previous year, with higher sales volumes of homogenous catalysts used in bulk applications offset by lower revenues from the life science applications segment. The performance of the business unit was also supported by a favorable PGM price environment.

Revenues for Fuel Cells & Stationary Catalysts remained in line with the previous year. Revenues from proton-exchange-membrane (PEM) fuel cell catalysts used in the transportation segment declined, affected by the COVID-19 related lockdowns in China in the first half of the year. Over the course of the year, Umicore entered into additional collaboration agreements with leading OEMs in China, thereby successfully extending its customer portfolio in the region.

Based on the growing number of customer contracts and ongoing qualifications, Umicore announced an expansion of its PEM-fuel cell catalyst mass-production capabilities with a greenfield plant in Changshu, China, which is set to start production mid-2025. This plant, which will be the world’s largest fuel cell catalyst plant by that time, will be scalable to align with the future growth of the business unit’s customer portfolio.

The lower revenues from the fuel cell activity were offset by higher revenues from stationary catalysts which benefited, after a more difficult year 2021 impacted by COVID-19 related project postponements, from a recovery in demand from the chemical, refining and manufacturing end-markets. Earnings for the business unit decreased, reflecting cost inflation as well as costs related to the construction of the plant in Changshu.

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| Total turnover | 3,311 | 4,539 | 5,917 | 8,155 | 7,738 |

| Total revenues (excluding metal) | 1,360 | 1,460 | 1,364 | 1,687 | 1,776 |

| Adjusted EBITDA | 237 | 264 | 234 | 402 | 419 |

| Adjusted EBIT | 168 | 185 | 154 | 326 | 342 |

| of which associates | 0 | 0 | 0 | 0 | 0 |

| Total EBIT | 162 | 185 | 96 | 308 | 331 |

| Adjusted EBIT margin (in %) | 12.4 | 12.7 | 11.3 | 19.3 | 19.2 |

| R&D expenditure | 135 | 147 | 139 | 142 | 139 |

| Capital expenditure | 79 | 104 | 64 | 70 | 67 |

| Capital employed, end of period | 1,265 | 1,537 | 1,727 | 1,551 | 1,564 |

| Capital employed, average | 1,200 | 1,358 | 1,596 | 1,743 | 1,522 |

| Return on Capital Employed (ROCE) (in %) | 14 | 13.6 | 9.6 | 18.7 | 22.5 |

| Workforce, end of period (fully consolidated) | 3,070 | 3,190 | 3,073 | 3,007 | 3,080 |

| Workforce, end of period (associates) | - | - | - | - |

Energy & Surface Technologies

Millions of Euros

Millions of Euros

Millions of Euros

Millions of Euros

Millions of Euros

%

Adapted revenue definition for Energy & Surface Technologies to enhance comparability

As lithium and manganese are increasingly valuable and volatile components in rechargeable battery materials, it was decided to no longer treat them as consumables but as hedged metals in order to make the accounting approach consistent with the revenue performance indicator used in Umicore’s other business units. This will allow to neutralize distortions in revenues resulting from the volatility in the value of the purchased metals and enhance comparability of the underlying performance of the Rechargeable Battery Material business unit. Henceforth the pass-through value of the purchased lithium and manganese will therefore be excluded from the revenue calculation, as is currently already the case for cobalt and nickel. The Energy & Surface Technologies 2021 and 2022 revenues have been restated accordingly.

Overview 2022 performance

In 2022, revenues1 in Energy & Surface Technologies amounted to € 1,278 million and adjusted EBITDA to € 290 million, up respectively 28% and 11% compared with the previous year, driven by higher revenues and earnings in Rechargeable Battery Materials and Cobalt & Specialty Materials.

The Cobalt & Specialty Materials Business Unit benefitted from exceptionally strong demand and a supportive price environment in the cobalt and nickel chemicals and related distribution activities in the first half of the year, before an expected normalization of demand patterns in the second half. As anticipated and previously announced, sales volumes of cathode active materials in Rechargeable Battery Materials remained subdued. Revenues of the Business Unit, however, were well up compared to the previous year, reflecting a favorable transactional exposure to the lithium price in 2022.

As mentioned, this sensitivity of revenues and earnings to the price of lithium will decrease throughout 2023 and be minimized from 2024 through forward contracts and hedging mechanisms. Adjusted EBIT of the business group amounted to € 166 million, up 20% year on year, including the increase in D&A following the production start of the plant in Nysa as of mid-2022.

2022 Business Review

Revenues in Rechargeable Battery Materials were well above the levels of the previous year, including a favorable transactional lithium price impact resulting from the time lapse between the conversion of purchased raw materials into cathode materials and the sale of these materials to customers.

Despite a challenging context for the automotive industry, global sales of electric vehicles increased +56% compared to the previous year, driven by a strong demand in China and Europe. An important milestone was reached in 2022, with sales of full electric vehicles for the first time accounting for 10% of all new vehicles sales worldwide, demonstrating the rapid ascent of this new drivetrain technology and the speed of transformation that the automotive industry is going through.

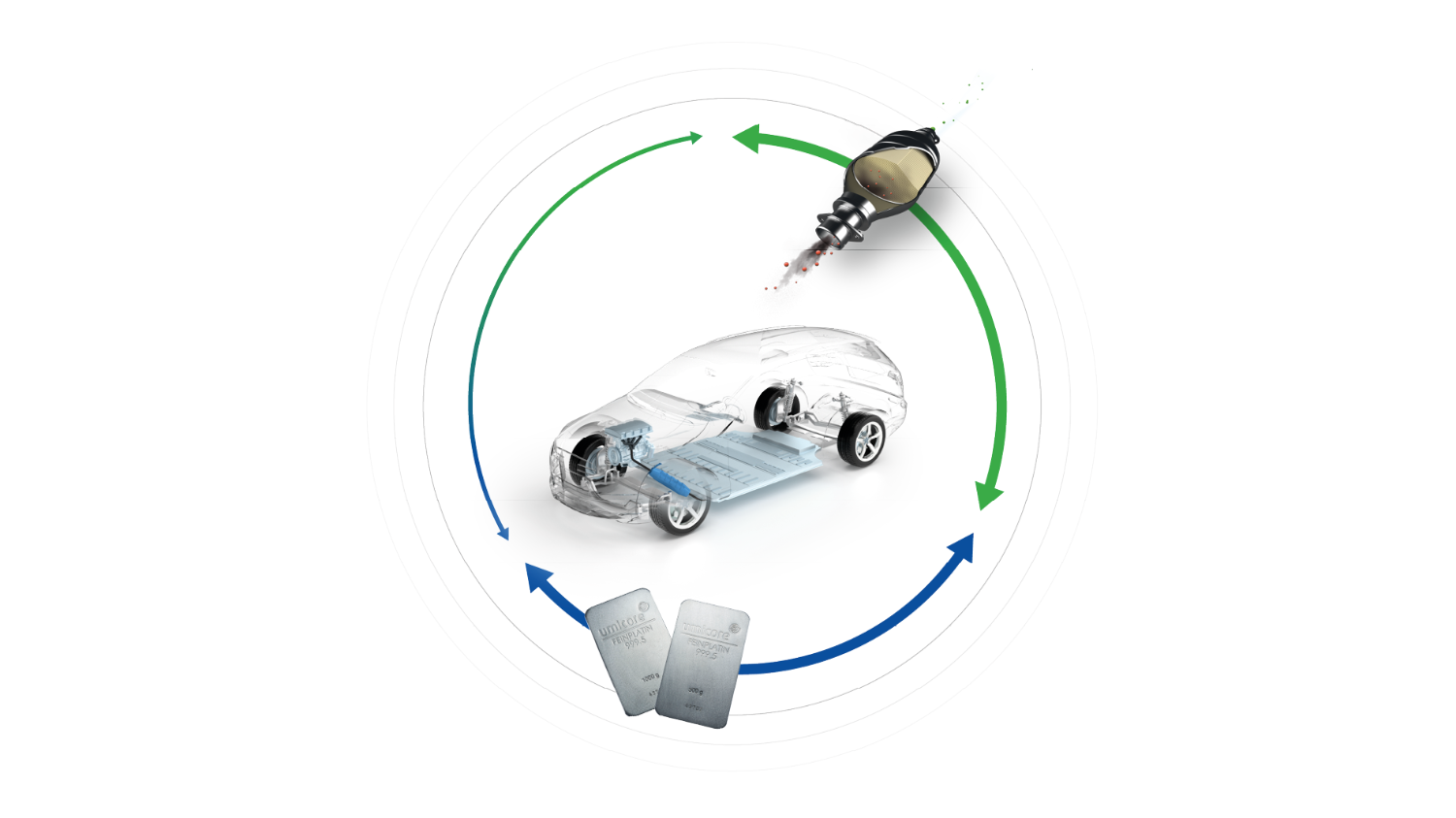

Sales of electric vehicles in Europe were well up (+15%) year on year with demand for battery materials growing +22%. Sales volumes of Umicore’s NMC (nickel, manganese, cobalt) cathode materials grew in line with the market demand for battery materials, confirming Umicore’s strong position in the region. In September, Umicore officially inaugurated its greenfield production plant for cathode active materials in Nysa, Poland. This plant, which is fully powered by renewable electricity, is Europe's very first gigafactory for cathode active materials and makes Umicore the only company in Europe with a complete circular and sustainable battery materials value chain. As previously announced, it will be further expanded with additional production lines set to come on stream in 2023. Upon finalization of this expansion, the plant will have a total production capacity of 20 GWh.

Sales of electric vehicles in China nearly doubled (+83%) compared to 2021. The increase in demand for NMC cathode materials was, however, less pronounced (+65% year on year) as the majority of the growth in China was driven by sales of shorter-range, LFP-based, vehicles. As anticipated and previously announced, Umicore’s volume evolution did not match the NMC demand growth in China due to an unfavorable customer mix for certain mid-nickel platforms.

Electric vehicles sales in North America grew substantially in 2022 (+52%), albeit it from a smaller base, reflecting strong customer demand as well as a growing number of electric vehicle models introduced by car OEMs in the region. It is expected that the Inflation Reduction Act (IRA), which provides for significant investments in clean energy and transportation technologies, will further boost local demand for electric vehicles through consumer and commercial tax credits and will strongly incentivize the creation of a domestic EV supply chain. In July, before the electrification impetus provided by the IRA, Umicore announced its plans to construct a manufacturing facility for cathode materials and related precursor materials in Ontario, Canada based on growing customer traction and ongoing qualifications in North America. The cathode materials produced in this facility are intended to be covered by the IRA2 and allow eligibility for the respective tax credits mechanisms in the US. Pending the closing of customer contracts, Umicore is targeting to start construction of the plant in 2023 and operations at the end of 2025 with the potential to reach, by the end of the decade, an annual production capacity capable of powering approximately one million EVs. In the meantime, Umicore is serving its North American customers out of its cathode materials production plant in Korea. Umicore’s sales volumes of cathode materials in the region increased substantially compared to last year, reflecting the strong momentum in the North American EV sales.

Over the year, Umicore made strong progress in the execution of its 2030 RISE Strategy in Rechargeable Battery Materials and reached key milestones in the build out of long-term, value creative strategic customer and supplier partnerships. As battery-ecosystems are being established in key regions, car manufacturers become increasingly direct involved in the selection of the performance-critical cathode materials and their precursors. In this context, Umicore is pioneering long-term customer partnerships and simultaneously diversifying its customer and platform exposure.

- In Europe, Umicore signed a joint venture agreement for precursor and cathode material production with PowerCo, the battery company of Volkswagen.3 From 2025 onwards, this joint venture will supply PowerCo's European battery cell factories with key materials. The partners aim to produce by the end of the decade cathode materials and their precursors for 160 GWh cell capacity per year, which compares to an annual production capacity capable of powering about 2.2 million full electric vehicles.

Umicore also signed a long-term strategic supply agreement for EV cathode materials with Automotive Cells Company (ACC), set to start with an annual offtake commitment of 13 GWh in early 2024 with the ambition to grow yearly supplied volumes to at least 46 GWh by 2030.4 - In North America, Umicore and PowerCo announced an intention to explore a strategic long-term supply agreement to serve PowerCo’s future battery Gigafactory in the region5. This planned, non-exclusive agreement, would make PowerCo an important customer for Umicore’s planned battery materials production plant in Ontario, Canada.

- Umicore also recently signed an agreement with Terrafame Ltd. for the long-term supply of low carbon, sustainable high-grade nickel sulphate. This agreement will cover a substantial part of the future nickel requirements of Umicore’s cathode materials manufacturing plant in Poland and reconfirms Umicore’s strong commitment to establish a sustainable battery materials value chain in Europe.

Through its continued R&D efforts Umicore remains at the forefront of Li-ion battery technologies thereby ensuring the best array of today’s and next generation’s design-to-cost and design-to-performance technologies to its customers. In the framework of its broad technology and innovation roadmap, Umicore agreed with Idemitsu Kosan Co., Ltd to jointly develop high-performance catholyte materials for solid-state batteries, combining both players’ expertise in cathode active materials and solid electrolytes, and aiming to provide the technological breakthrough to extend the driving range and thereby propel e-mobility6. After the close of the year, Umicore announced7 that it is starting the industrialization of its manganese-rich HLM (high lithium, manganese) cathode active materials technology and targets commercial production and use in electric vehicles in 2026. By adding HLM to its portfolio, Umicore introduces a distinctly competitive battery technology to other design-to-cost technologies. This complements Umicore’s broad range of NMC battery materials for high performance, long-range EVs. HLM is gaining traction with car and battery cell manufacturers as a differentiating lower cost, high energy-density and sustainable battery technology.

Umicore also continues to build further on its pioneering approach in terms of responsibly sourced materials. As founding member of the Global Battery Alliance, Umicore is co-developing the Battery Passport8 with the aim of setting up a global vision of a sustainable, responsible and circular battery materials value chain, based on standardized, comparable and auditable data. The proof of concept was launched at the World Economic Forum’s Annual Meeting in Davos in January 2023.

The Business Unit Rechargeable Battery Materials is at the core of Umicore’s 2030 RISE Strategy. As a next step in the execution of its strategy, Umicore intends to group the Rechargeable Battery Materials activities within one legal entity. This set-up will provide the best foundation for the business unit to scale within Umicore and maximize its financing options, while delivering on its ambitious 2030 RISE objectives.

Revenues for Cobalt & Specialty Materials increased substantially year on year. The cobalt and nickel chemicals and related distribution activities generated an exceptionally strong performance in the first half of the year driven by high activity levels in key end-markets and inventory build-up of customers in a context of high demand and increasing cobalt and nickel prices. As anticipated, performance normalized in the second half reflecting an expected slowdown in demand in a competitive market environment and a cobalt price that fell back substantially from the peak level reached in May. Revenues from the tool materials activity increased, benefiting from strong demand for hard metal and diamond tools, in particular in the first half of the year. Revenues from carboxylates were also higher, reflecting high demand from the coating and painting industries.

Revenues for Metal Deposition Solutions were stable compared to the previous year. Higher revenues for decorative applications and platinized compounds used in electrocatalytic materials offset the impact of lower demand for precious metal-based electrolytes used in portable devices and printed circuit boards used in the electronics industry. Revenues of thin film products remained in line with previous year, with a slowdown in demand from the micro-electronics industry compensated by higher order levels for optic applications.

Revenues for Electro-Optic Materials remained stable year on year. Revenues from infra-red solutions increased, driven by strong demand for optical lenses used in infra-red vision applications. This was offset by lower revenues from germanium solutions, reflecting a less favorable product mix and slightly lower volumes in high purity chemicals used in optical fibers and lower demand for germanium substrates.

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| Total turnover | 3,650 | 2,938 | 2,811 | 3,534 | 4,974 |

| Total revenues (excluding metal)1 | 1,289 | 1,225 | 1,045 | 1,001 | 1,278 |

| Adjusted EBITDA | 323 | 271 | 186 | 262 | 290 |

| Adjusted EBIT | 257 | 183 | 75 | 139 | 166 |

| of which associates | 0.9 | 5 | 5 | 8 | 5 |

| Total EBIT | 251 | 154 | (36) | 141 | 169 |

| Adjusted EBIT margin (in %)1 | 19.8 | 14.5 | 6.7 | 13.1 | 12.6 |

| R&D expenditure | 39 | 46 | 58 | 64 | 107 |

| Capital expenditure | 316 | 348 | 252 | 219 | 296 |

| Capital employed, end of period | 1,769 | 2,324 | 2,133 | 2,275 | 2,751 |

| Capital employed, average | 1,469 | 2,014 | 2,209 | 2,198 | 2,498 |

| Return on Capital Employed (ROCE) (in %) | 17.5 | 9.1 | 3.4 | 6.3 | 6.7 |

| Workforce, end of period (fully consolidated) | 3,447 | 3,997 | 3,761 | 3,836 | 3,991 |

| Workforce, end of period (associates) | 782 | 751 | 727 | 792 | 821 |

Recycling

Millions of Euros

Millions of Euros

Millions of Euros

Millions of Euros

Millions of Euros

Overview 2022 performance

The Recycling Business Group delivered another excellent performance in 2022 with revenues reaching € 1,107 million, in line with the record level achieved in 2021.

The Precious Metals Refining Business Unit benefited from solid volumes and an overall supportive metal price environment, despite diverging pricing trends per metal. A slightly lower contribution from the trading activity in Precious Metals Management was offset by higher revenues in the Jewelry & Industrial Metals Business Unit, which benefited from high demand from the investment, jewelry and high purity glass end-markets. Adjusted EBITDA amounted to € 532 million and adjusted EBIT to € 463 million. Although well above historical levels, earnings were below the record level achieved in 2021 reflecting substantial cost inflation headwinds.

2022 Business Review

Revenues for Precious Metals Refining were close to the record level achieved in the previous year. Earnings, however, were impacted by significant cost inflation driven primarily by higher energy prices. As previously indicated, the long-term fixed contracts allowed only a limited pass-through of inflation to pricing.

The year 2022 was marked by volatile precious and PGM prices. Prices of rhodium and palladium peaked in the first half before declining substantially, while platinum, silver and gold prices significantly fluctuated throughout the entire year. Against this volatile background and taking into account the existing strategic metal hedges concluded in previous years, a lower average received price for rhodium was offset by higher average received prices for most other precious as well as non-precious metals.

Operational performance of the Hoboken plant was robust and processed volumes remained broadly in line with the levels of the previous year. The regular maintenance shutdown of the smelter in the last quarter was completed successfully and operations restarted as planned. The global logistic disruptions, which affected the input mix in the first half of the year, eased during the summer months. In the second half of the year, the business unit was able to catch-up and process the delayed supplies of complex PGM-rich materials from the first six months of the year. Availability of spent automotive catalysts, however, remained constraint throughout the year due to lower volumes of end-of-life vehicles and collectors holding on longer to scrap material in current volatile PGM price environment.

Precious Metals Refining continues to invest and take measures to reduce the impact of its operations on the environment. In 2022, the business unit built windshields around storage areas where raw materials are loaded and unloaded and created a green buffer zone on the site’s premises in order to further minimize dust spreading. The results of the most recent monitoring of lead in blood values, carried out in November 20221[1], showed the lowest average level ever achieved, well below legal norms. This is a testimony of the success of Umicore’s long-standing and continued efforts to minimize its impact on the environment and the plant’s surroundings. Additional measures will take place in 2023 with the construction of a closed green zone outside the plant to increase the distance between the plant and the residential area. Altogether these measures should allow for a long-term sustainable co-existence of the site and its neighbors.

Revenues for Jewelry & Industrial Metals increased compared to the previous year reflecting a strong performance in most product lines. Revenues from platinum engineered materials used in high purity glass applications were well up, reflecting industry-leading product performance that resulted in higher order levels from existing customers as well as a successful extension of the customer base. Order levels of silver coins increased driven by safe-haven consumer buying, while sales volumes of jewellery products continued to benefit from strong demand from the luxury end-market. This more than offset subdued demand for platinum based performance catalysts used in the industrial and agricultural industries. The contribution from the refining and recycling activities remained overall in line with the previous year.

The earnings contribution from Precious Metals Management was slightly below the level of the previous year reflecting primarily a less favorable PGM price environment, in particular for rhodium. Revenues from the physical delivery of metals remained broadly in line with the previous year, with strong industrial demand for silver offset by lower order levels for gold and silver bars from the institutional investment industry.

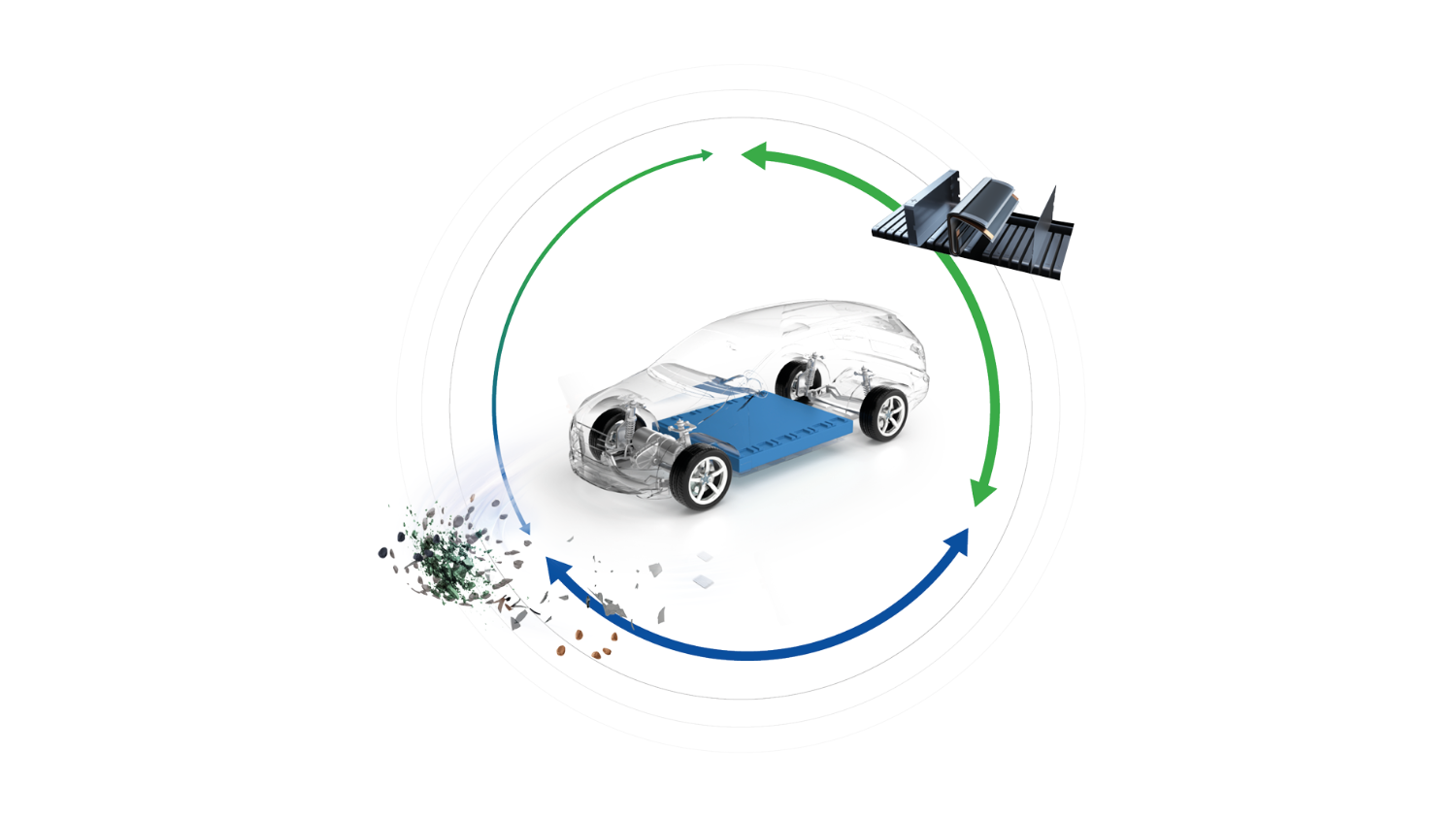

Driven by accelerating vehicle electrification, volumes of battery production scrap and “end-of-life” batteries are set to increase exponentially towards 2030. Sustainable and environmentally sound recycling solutions for the processing of these batteries will be critical, as evidenced by the stringent regulatory battery recycling requirements that are being introduced in key regions. At the same time, the rapidly increasing penetration of electric vehicles will result in a sharp increase in demand for key metals used in batteries such as nickel, lithium and cobalt, and a challenge will be to meet this growing demand in a sustainable and circular way.

Umicore’s recently created Battery Recycling Solutions business unit will be a key enabler for the sustainable electrification of the automotive industry providing regional access to critical metals and allowing closed-loop, environmentally friendly, low carbon battery manufacturing. Based on growing customer engagements and more than 15 running commercial partnerships, Umicore announced a significant scale-up of its battery recycling activities in Europe with a 150,000 ton battery recycling plant. This plant, which will be the biggest battery recycling plant in the world, will deploy Umicore’s latest proprietary technology which allows to recover nickel, lithium, cobalt and copper into their purest battery-grade form in an eco-efficient way.

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| Total turnover | 7,625 | 11,320 | 13,904 | 15,609 | 15,338 |

| Total revenues (excluding metal) | 626 | 681 | 836 | 1,108 | 1,107 |

| Adjusted EBITDA | 195 | 250 | 425 | 640 | 532 |

| Adjusted EBIT | 135 | 188 | 362 | 573 | 463 |

| Total EBIT | 126 | 190 | 311 | 529 | 463 |

| Adjusted EBIT margin (in %) | 21.5 | 27.6 | 43.3 | 51.7 | 41.8 |

| R&D expenditure | 15 | 8 | 10 | 13 | 24 |

| Capital expenditure | 68 | 82 | 72 | 83 | 81 |

| Capital employed, end of period | 546 | 405 | 447 | 461 | 347 |

| Capital employed, average | 483 | 479 | 502 | 345 | 415 |

| Return on Capital Employed (ROCE) (in %) | 27.9 | 39.3 | 72 | 165.9 | 111.6 |

| Workforce, end of period (fully consolidated) | 2,832 | 2,849 | 2,769 | 2,867 | 2,996 |

Corporate review

As anticipated, corporate costs increased over 2022 compared to 2021. This is explained by important R&D expenditures linked to Umicore’s technology and innovation roadmap. In particular, Umicore invested in the development of new state-of-the-art battery technologies such as high-performance catholyte materials for solid-state batteries and manganese-rich HLM cathode active materials in the design-to-cost segment. Corporate costs also included investments related to digitalization efforts. It is to be expected that corporate costs will further increase over 2023 in the framework of Umicore’s future expansion and growth in line with its 2030 RISE strategy.

Element Six Abrasives’ contribution to Umicore’s adjusted EBITDA was stable compared to the previous year reflecting a robust business performance, the impact of operational excellence programs and cost discipline efforts, and a favorable exchange rate effect. Revenues from the oil & gas drilling activity were well up, driven by a further recovery of the drilling industry, which reached pre-COVID-19 production levels again in the second half of 2022. Revenues of carbide-based materials increased compared to an already strong performance in 2021, driven by operational efficiencies and end-market demand growth. Revenues in the precision tooling activity were somewhat below the level of the previous year, reflecting a more challenging context in the automotive end-market, in particular in the first half of the year

Research & development

In 2022, R&D expenditures in fully consolidated companies amounted to € 316 million, up 29% compared to € 245 million in 2021. This significant step-up reflects primarily increased spending in Rechargeable Battery Materials related to next generation design-to-performance and design-to-cost product and process technologies as well as ongoing customer qualifications. Umicore also increased R&D expenditures in battery recycling and advanced technology development related to decarbonization and emission reduction programs to meet its ambitious sustainability programs. In addition, efforts in corporate mid- to long-term technology development and open innovation collaboration programs were also higher. Over the course of the year, Umicore filed 72 new patent applications.

The R&D spend represented 7.6% of Umicore’s 2022 revenues and capitalized development costs accounted for € 21 million of the total amount.

Corporate & Financial review

Financial result and taxation

Adjusted net financial charges totaled € 125 million, compared to € 100 million in the same period last year, reflecting higher net interest charges, in particular on short term loans, and somewhat higher foreign exchange related costs.

The adjusted tax charge for the period amounted to € 145 million, down compared to € 196 million last year as a result of a year on year decrease in taxable profit in combination with a lower adjusted effective group tax rate (20.0% versus 23.1% in the same period last year). Taking into account the tax effects on adjustments, the net tax charge for the Group amounted to € 138 million. The total tax paid in cash over the period amounted to € 216 million and was also well up from € 175 million last year.

Cashflows and financial debt

Cashflow generated from operations including changes in net working capital amounted to a level of € 835 million, compared to the record level of € 1,405 million last year. As expected, working capital requirements in Energy & Surface Technologies were well up, mainly on the back of increased battery material metal prices. After deducting € 491 million of capital expenditures and capitalized development expenses, the resulting free cash flow from operations was € 344 million, compared to € 989 million in the same period last year.

At 31 December 2022 adjusted EBITDA amounted to € 1,151 million, down 8% compared to last year’s record of € 1,251 million. This corresponds to a robust adjusted EBITDA margin of 27.3% for the Group, after the all-time record of 32.5% in the same period last year. While margins in Energy & Surface Technologies and Recycling decreased respectively due to ramp-up costs and energy inflation, the Catalysis business group maintained margins in line with previous year.

Net working capital for the Group increased by € 342 million compared to the end of 2021. While higher battery metal prices increased working capital in Energy & Surface Technologies, working capital needs remained stable in Catalysis and decreased in Recycling thanks to a temporary positive impact. At current metal prices, working capital at the end of 2023 is expected to increase from the levels of end of 2022, including the reversal of some temporary cash inflows in Recycling and anticipating volume growth in Energy & Surface Technologies.

Capital expenditure totaled € 470 million at the end of 2022, compared with € 389 million the previous year. Energy & Surface Technologies accounted for more than 60% of the Group’s capital expenditure, driven by investments in the expansion of the Rechargeable Battery Materials business unit European’s footprint. In the Catalysis and Recycling business segments capital expenditure slightly decreased. In Catalysis, the Automotive Catalysts business unit continued to focus on investments in production footprint optimization and targeted capacity expansions. In Recycling, the increase in capital expenditure was related to environmental and safety investments in the Precious Metals Refining business unit. Capitalized development expenses amounted to € 21 million, down versus 2021. The further expansion of the Rechargeable Battery Materials business unit’s footprint in Europe, combined with the expected investments in North America, should result in higher Group capital expenditure in 2023 versus previous year.

Dividend payments over the period amounted to € 192 million, while the net cash outflow related to the exercise of stock options and the purchase of treasury shares (to cover stock option plans and share grants) amounted to € 43 million.

The increase in working capital requirements and capital expenditures drove a moderate increase of net financial debt from € 960 million at the end of 2021 to € 1,104 million at 31 December 2022. The leverage ratio amounted to 0.96x LTM adjusted EBITDA. The group’s equity amounted to € 3,566 million at 31 December 2022, corresponding to a net gearing ratio1 of 23.6%.The sustainability linked US Private Placement Notes, issued in November2 2022, has been drawn in January 2023.

Adjustments

Adjustments had a negative impact of - € 32 million on EBIT of which - € 20 million was already accounted for in the first half. These adjustments were mainly related to the increase of some environmental provisions linked to legacy remediation initiatives and include € 12 million of restructuring charges in the stationary catalyst business in Denmark.

Including positive adjustments to financial and tax items of respectively € 3 million and € 7 million, the total adjustments to net group earnings over the period corresponded to negative impact of - € 23 million.

Hedging

Umicore entered into forward contracts to cover part of its expected structural price exposure to certain precious metals for 2023, 2024 and 2025. For 2023, based on the respective currently expected exposures, the following lock-ins have been secured: more than a third for silver and gold, somewhat less than half for palladium and close to a quarter for platinum and rhodium. For 2024, the expected lock-in ratios are: close to half for gold and palladium, more than a third for silver and close to a quarter for platinum and rhodium. For 2025, close to a quarter was locked-in for the expected gold and silver exposures.

Next to strategic metal hedges, the Group typically manages a portion of its forward energy price risks by entering into energy hedges. Currently, Umicore has hedges in place that cover a majority portion of its expected European electricity, natural gas and fuel needs for 2023. These hedges particularly cover future energy needs in Belgium, Finland and Poland and are expected to reduce Umicore’s exposure to energy market price fluctuations in particular for its Belgian operations in 2023. For 2024 and 2025, close to a third of the electricity needs and two thirds of the natural gas needs for the European activities are hedged.

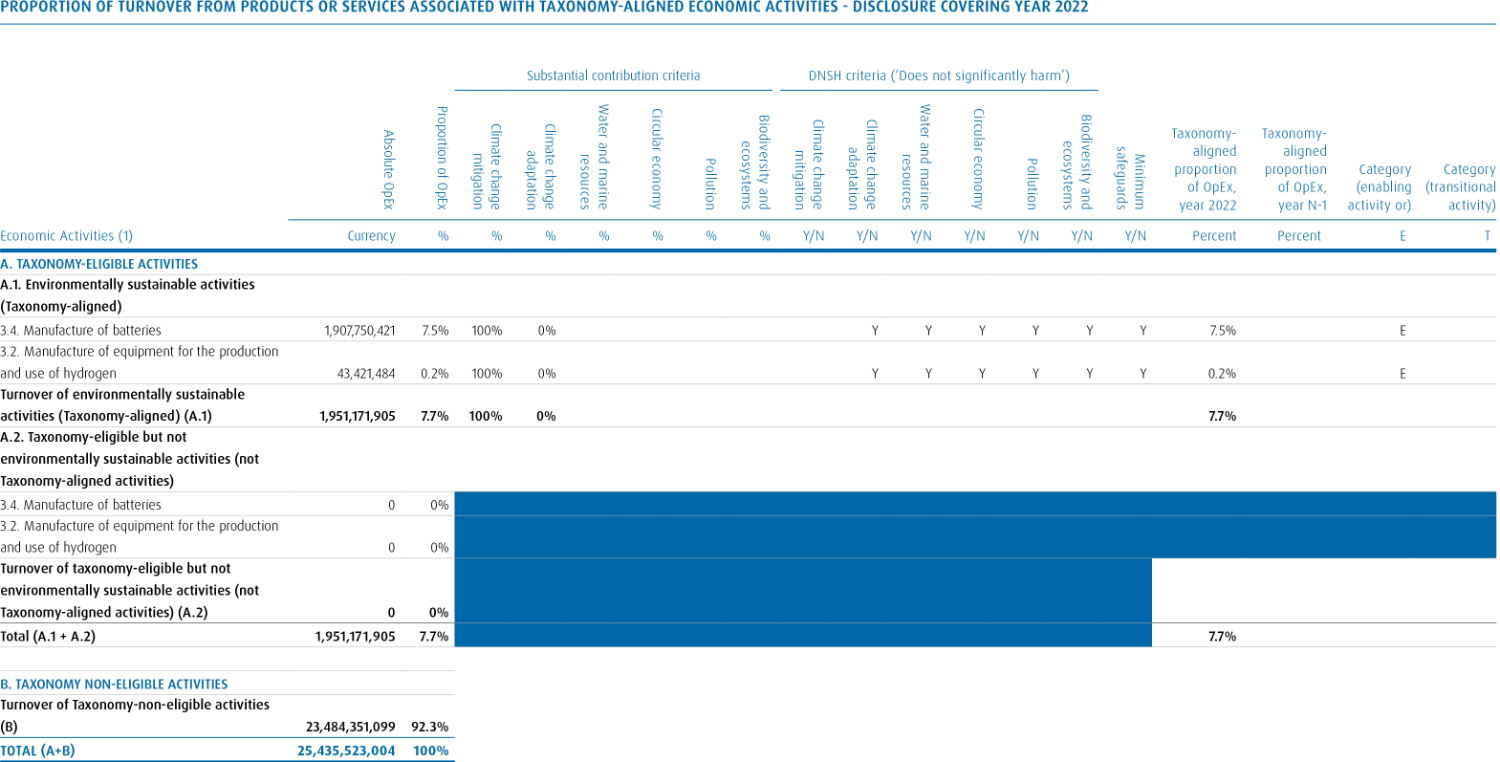

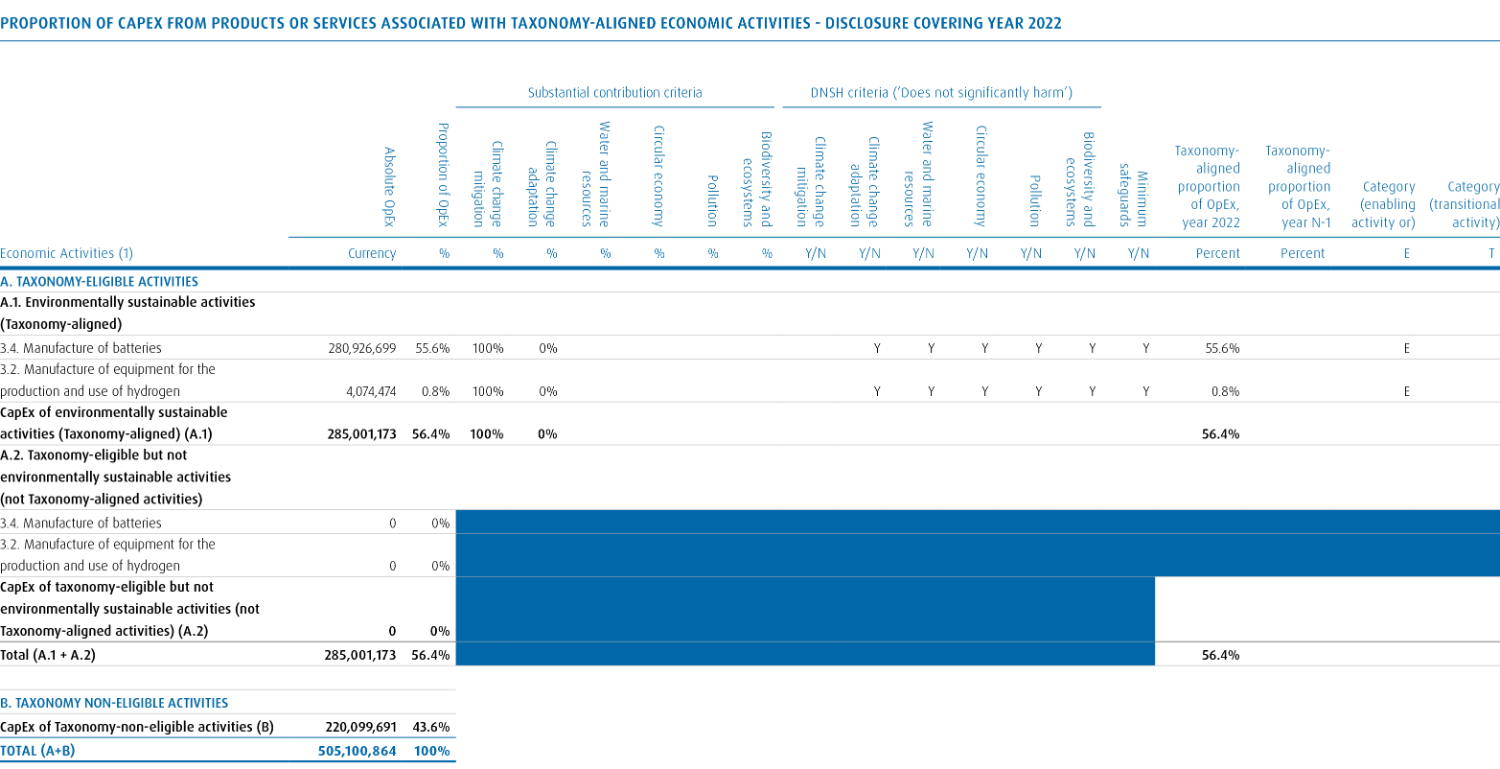

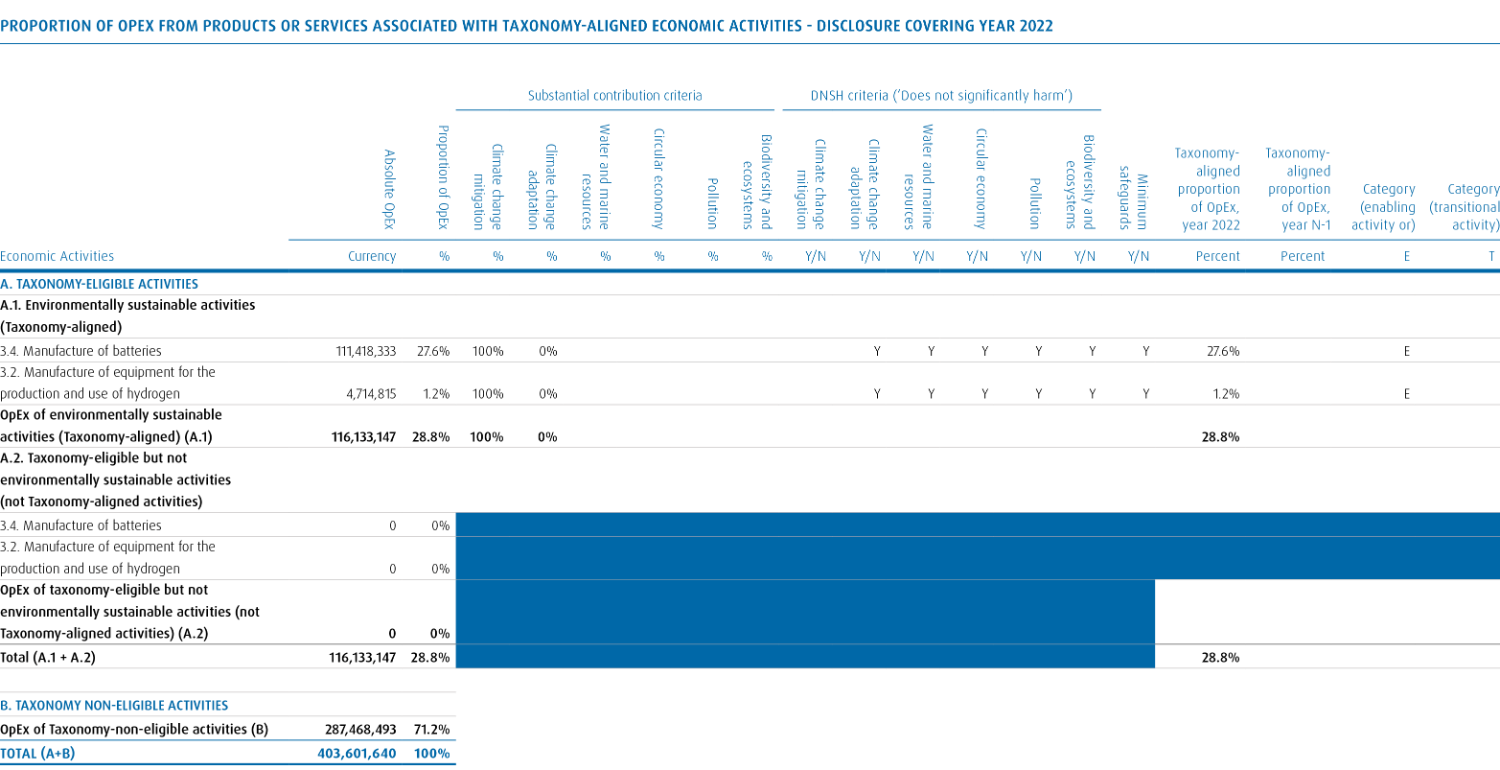

EU taxonomy

The European Union created an action plan to finance sustainable growth, aimed at redirecting capital flows to sustainable economic activities. This is part of the efforts to reach the objectives of the European Green Deal and make Europe climate-neutral by 2050. In 2021, the European Union introduced the EU Taxonomy, which is a classification system establishing a list of economic activities qualifying as sustainable. Umicore has assessed the compliance of its products and services with Taxonomy Regulation (EU) 2020/852 and the subsequently published Delegated Acts. In our Integrated Annual Report 2021, we reported on the Taxonomy-eligibility assessment of our economic activities for two of the six environmental objectives: Climate Change Mitigation and Climate Change Adaptation. For the reporting on 2022, Umicore’s eligible activities have been assessed against the alignment criteria as set forward by the EU Taxonomy Regulation. The results of our Taxonomy-alignment assessment are presented in the sections below. The remaining four environmental objectives are yet to be published by the EU in 2023. Umicore will report on its eligibility and alignment with the four additional environmental objectives when required. This year’s Taxonomy reporting therefore reflects only a piece of Umicore’s eligibility and potential alignment with all the six environmental objectives and focuses only on Climate Change Mitigation and Climate Change Adaptation.

Assessment results

Based on the eligible economic activities that are defined by the Taxonomy Regulation as substantially contributing to climate change adaptation and mitigation, we reviewed which Umicore economic activities qualify as eligible economic activities in contributing to the EU Taxonomy objectives of Climate Change mitigation and Climate Change adaptation. In this assessment, we took into account Umicore’s turnover generating economic activities that we sell as products and services to the market, and have excluded internal industrial activities that are not turnover generating. Umicore’s two eligible activities “Manufacturing of rechargeable batteries” and “Manufacturing of equipment for the production and use of hydrogen” have been identified as significantly contributing to the EU Taxonomy objective of Climate Change Mitigation and not Climate Change Adaptation.

| Turnover1 | CAPEX2 | OPEX3 | |

| EU Taxonomy "Climate Change Mitigation" aligned activities (in million EUR)4 | 1,951 | 285 | 116 |

| EU Taxonomy "Climate Change Mitigation" aligned activities (in %)4 | 7.7% | 56.4% | 28.8% |

| Total Umicore activities (in million EUR)4 | 25,436 | 505 | 404 |

Manufacturing of rechargeable batteries

Umicore has activities that match the EU Taxonomy eligible business activity: “Manufacturing of rechargeable batteries, battery packs and accumulators for transport, stationary and off-grid energy storage and other industrial applications. This includes the manufacturing of respective components (battery active materials, battery cells, casings and electronic components) and recycling of end-of life batteries.1 Umicore supplies battery active materials for lithium-ion rechargeable batteries used in electric vehicles, energy storage systems and portable electronics. This is an enabling activity as it can contribute to substantially reducing greenhouse gas (GHG) emissions in transport, stationary and off-grid energy storage.

The manufacturing of battery materials for the portable electronics market has not been considered as an eligible activity as there is no direct link with a substantial reduction in GHG emissions. Only the cathode materials used for electric vehicles and energy storage systems have been considered in the assessment. This includes also specific R&D activities related to anode materials for electric vehicles and energy storage systems.

Umicore also recycles, refines, transforms and sells cobalt and nickel specialty chemicals for a wide range of applications. Our assessment of eligible economic activities includes, however, only the cobalt and nickel products sales flowing into the battery value chain for electric vehicles. We excluded any internal sales of cobalt and nickel among Umicore business units. Umicore’s activity contributes to the Climate Change Mitigation objective because batteries for electric vehicles and energy storage systems are an alternative to internal combustion engine vehicles and energy generation technologies emitting GHGs.

Manufacturing of equipment for the production and use of hydrogen

Umicore has activities that are eligible for the EU Taxonomy eligible business activity: ”Manufacture of equipment for the production and use of hydrogen”2 . Umicore produces proton exchange membrane fuel cell catalysts for hydrogen power generation in vehicles. Fuel cell-powered vehicles combine the best of both worlds: long driving ranges and short refueling times combined with zero use-phase emissions. These advantages make the fuel cell-powered automotive particularly attractive in long-distance or energy-intensive haulage applications. Umicore’s activity is an enabling activity for the production and use of hydrogen as it can contribute to substantially reducing GHG emissions in transport. For this purpose, we only took the fuel cells business line into account and disaggregated this from the stationary catalysts business line.

Taxonomy-Eligibility Assessment Process

For the EU Taxonomy eligibility and alignment assessment, we engaged the external expertise of PwC. They assisted Umicore in the analysis of the EU Taxonomy definitions and criteria. In collaboration with the business units, we identified which Umicore activities are eligible for the EU Taxonomy’s Climate Change Mitigation and Climate Change Adaptation objectives. A key focus of the assessment was to avoid double counting, which we mitigated in two ways. On the one hand, we excluded all intercompany transactions from the exercise, and we only took the turnover-generating economic activity for a specific business unit or business line into account. On the other hand, some Umicore activities could be eligible for several environmental objectives of the EU Taxonomy. We anticipate that our economic activities in Catalysis and Recycling will be most relevant for the four additional environmental objectives to be published by the EU in 2023. The main purpose of our Catalysis activities is to reduce toxic pollution in the air rather than to reduce GHG emissions. As we assume that the contribution of our Catalysis activities will be most relevant to the EU Taxonomy objective of Prevention of Pollution, we have to date chosen not to put it forward for the Climate Change Mitigation objective. Umicore’s Recycling business supports the transition of the use of primary resources towards recycling, which is less carbon intensive. As we assume that the contribution of our Recycling business will be most relevant to the objective of Transition to a Circular Economy, we have to date chosen not to put it forward for the Climate Change Mitigation objective.

Taxonomy-Alignment Assessment Process

For the alignment assessment of Umicore’s eligible economic activities, we engaged the external expertise of PwC. They assisted Umicore in identifying and analyzing the alignment criteria as set out in the Delegated Acts of the EU Taxonomy Regulation. The process included three alignment assessment steps:

Technical Screening Criteria

For Umicore’s identified Taxonomy-eligible economic activities, the Technical Screening Criteria were closely analyzed. Both the ‘Manufacturing of rechargeable batteries’ and ‘Manufacturing of equipment for the production and use of hydrogen’ have been assessed as meeting the technical screening criteria that are set out by the EU Taxonomy. Both economic activities are enabling other industries to support in mitigation (reduce or avoid) GHG emissions through the electrification of transportation and application of energy storage systems.

Do No Significant Harm (DNSH)

For the assessment of whether Umicore’s eligible economic activities meet the Do No Significant Harm criteria, we have evaluated all relevant business operations against the specific criteria set out for the EU Taxonomy requirements. Our eligible activity for climate change mitigation has therefore been assessed not to harm the EU objectives related to the other five environmental objectives of: climate change adaptation; protection of water and marine resources; transition to a circular economy; prevention/reduction of pollution; and protection of biodiversity and ecosystems. Umicore has therefore performed an assessment of its economic activities against the specific requirements, including among others, the existence of required climate and vulnerability assessment of the operations, environmental degradation risk assessments, the implementation of circular business practices, avoidance of hazardous substances and environmental impact assessments. Based on the assessment performed, Umicore concluded that its eligible business activities meet the Do No Significant Harm criteria.

Compliance with Minimum Safeguards

As the last step in the EU Taxonomy alignment assessment, Umicore has assessed its eligible economic activities against the Minimum Safeguards. The Minimum Safeguards requires a Taxonomy activity to be carried out in alignment with: the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights (including the Declaration on Fundamental Principles and Rights at Work of the International Labour Organisation; the eight fundamental conventions of the ILO; and the International Bill of Human Rights). Umicore has performed an assessment of its relevant processes, procedures, policies, internal controls related to the Minimum Safeguards and evaluated the relevant outcome of the compliance management practices. In conducting the assessment, we have built on the guidance from the Final Report on Minimum Safeguards from the EU Platform on Sustainable Finance. Through this assessment, we evaluated that the management processes and outcome of these processes are aligned with the Minimum Safeguard requirements.

Based on the three alignment assessment steps outlined above, Umicore has concluded that the identified Taxonomy-eligible economic activities are also Taxonomy-aligned.

Accounting policy

The IFRS imposes the reporting of turnover in the segment information (note F7 of the Financial Statements). Turnover is defined as the sum of all outgoing sales invoices and contains the metal sales. When metal prices rise, turnover increases but this rise is not the result of increased business activity, nor will it automatically lead to improved profitability. The IFRS turnover published by Umicore has been analyzed and the Group concluded that the definition is in line with the Turnover KPI requested for EU Taxonomy purposes. To avoid double counting, only external turnover has been considered for the EU Taxonomy exercise.

For the KPI related to capital expenditures (CAPEX), the EU Taxonomy required inclusion of all the additions to tangible and intangible assets during the financial year considered, before depreciation, amortizations or impairments. It also covers the tangible and intangible assets resulting from business combinations and the leases that lead to the recognition of a right-of-use asset as per IFRS 16.

The capitalized expenditure definition at Umicore (see Glossary) is more restrictive than the EU Taxonomy definition as it concerns capitalized investments in tangible and intangible assets, excluding capitalized R&D costs. Capitalized R&D costs, new capitalized leases and the business combinations therefore represent differences between the CAPEX KPI presented in the Umicore Financial Statements and the CAPEX KPI as defined by the EU Taxonomy. Those additions are, however, available in the Financial Statements under notes F8, F14 and F16.

To avoid double counting, only external capital expenditure has been considered for the EU Taxonomy exercise.

For the KPI related to operating expenditures (OPEX), the EU Taxonomy required inclusion of a limited number of items compared with the number of items included in the total operating expenditures disclosed by Umicore in its Financial Statements (note F9 of the Financial Statements). The EU Taxonomy only includes direct non-capitalized costs related to R&D, building renovation measures, short-term leases, maintenance and repair and any other direct expenditures relating to day-to-day servicing of assets of property, plant and equipment by the undertaking or third party to whom activities are outsourced that are necessary to ensure the continued and effective functioning of such assets.

To avoid double counting, only the costs initiated in the originating eligible activity have been considered.

The assessment of Umicore’s eligible activities excludes Umicore’s joint ventures and associated companies.

Finally, note that the allocation to the numerator for the three required EU Taxonomy KPIs is based on Umicore’s internal financial reporting that identifies these KPIs per business line or per specific market. The respective business unit controllers have agreed upon the eligibility of their activities and reported the data centrally.