Operations

Millions of Euros

Operations: optimizing excellence

Umicore is a circular materials technology Group, with more than 11,000 employees, creating sustainable products and services for a broad range of customers located in 99 countries.

To cater to this international customer base, Umicore has established local presence in Asia-Pacific, Europe, North and South America and South Africa. With headquarters in Brussels, Belgium, we work from 44 different production sites, 15 R&D sites and 34 other sites such as sales and marketing offices. Many of these sites accommodate a combination of business units, corporate departments or other activities.

Our local presence reflects Umicore’s strong belief in customer proximity. As a reliable partner, we listen to our customers and focus on supporting them in their own ambition to become sustainable and circular companies. With our local presence, we offer our customers proximity to the best possible technologies, tailor-made products and services. Our upstream value chain integration in the local markets provides us with the opportunity to further reduce greenhouse gas emissions in the upstream value chain, while optimizing excellence and continuity of operations.

While Umicore’s 11 business units serve a multitude of customers across different sectors and industries, the global automotive industry would be a key end market for Umicore. Umicore offers a unique value proposition to automotive customers who are impacted by the global clean mobility transformation. We are a reliable transformation partner that provides clean mobility solutions for all existing types of automotive platform drivetrains (e.g. emission control catalysts to clean the exhaust gases from gasoline and diesel internal combustion engines in light-duty and heavy-duty vehicles; rechargeable battery materials required to power plug-in hybrid and full-electric vehicles; and catalysts for fuel cell-powered vehicles). By offering the full spectrum of automotive drivetrain technologies across the globe, Umicore is uniquely positioned to support its automotive customers in their complete journey from internal combustion engine towards electrification, ultimately, becoming a trustworthy partner for the whole mobility transformation.

As a global company, Umicore is supplied from an established and diverse supplier base in 87 countries. Our decentralized approach facilitates local activities, as business units and sites have operational flexibility and can respond quickly to the dynamics in local markets, both in the upstream supply chain and in the downstream needs expressed by customers. At the same time our customers, suppliers and partners can rely on strong support from the center. This allows us to build long-term relationships with our stakeholders.

Operations driven by megatrends and an ambition to rise

Based on the solid foundations of the Horizon 2020 strategy and Let’s Go for Zero sustainability ambitions, in 2022 Umicore launched the 2030 RISE Strategy, its new strategic plan designed to accelerate value creative growth. The 2030 RISE Strategy builds on Umicore’s proven ability to embrace megatrends, and Umicore is more determined than ever to leverage its unique position and mutually reinforcing portfolio of activities to benefit from the global transformation of mobility, respond to the growing need for advanced materials, and contribute to the pursuit of a global circular economy.

Mobility transformation

- Mobility transformation: The mobility transformation is accelerating and the shift to carbon-free mobility is expected to grow exponentially by 2030. Through its complementary portfolio and presence in all drivetrain technologies, Umicore is uniquely positioned to capture this growth opportunity and guide our automotive customers through their transformation journey, from start to finish.

- Growing need for advanced metal materials: Advanced materials are key enablers for faster, more scalable, more efficient, and more sustainable solutions that tackle the challenges of society today and tomorrow. Umicore develops the next generation of sustainable advanced materials ensuring that they are used again and again through its recycling technologies.

- Circularity for critical metals: Against a background of a rapidly growing conviction that the future economy will be even more of a circular economy, also considering the increasing electrification of mobility, Umicore enables full circularity for critical metals. Circularity is also integrated in our everyday business both within the transformation of mobility and the growing need for advanced materials.

The 2030 RISE Strategy comprises four implementation pillars to ensure a strict focus on strategic execution and scaling-up. Each pillar plays a vital role in our strategic success going forward:

- The “R” stands for reliable transformation partner

- The “I” is for innovation and technology

- The “S” is for sustainability champion

- The “E” in rise denotes excellence in execution

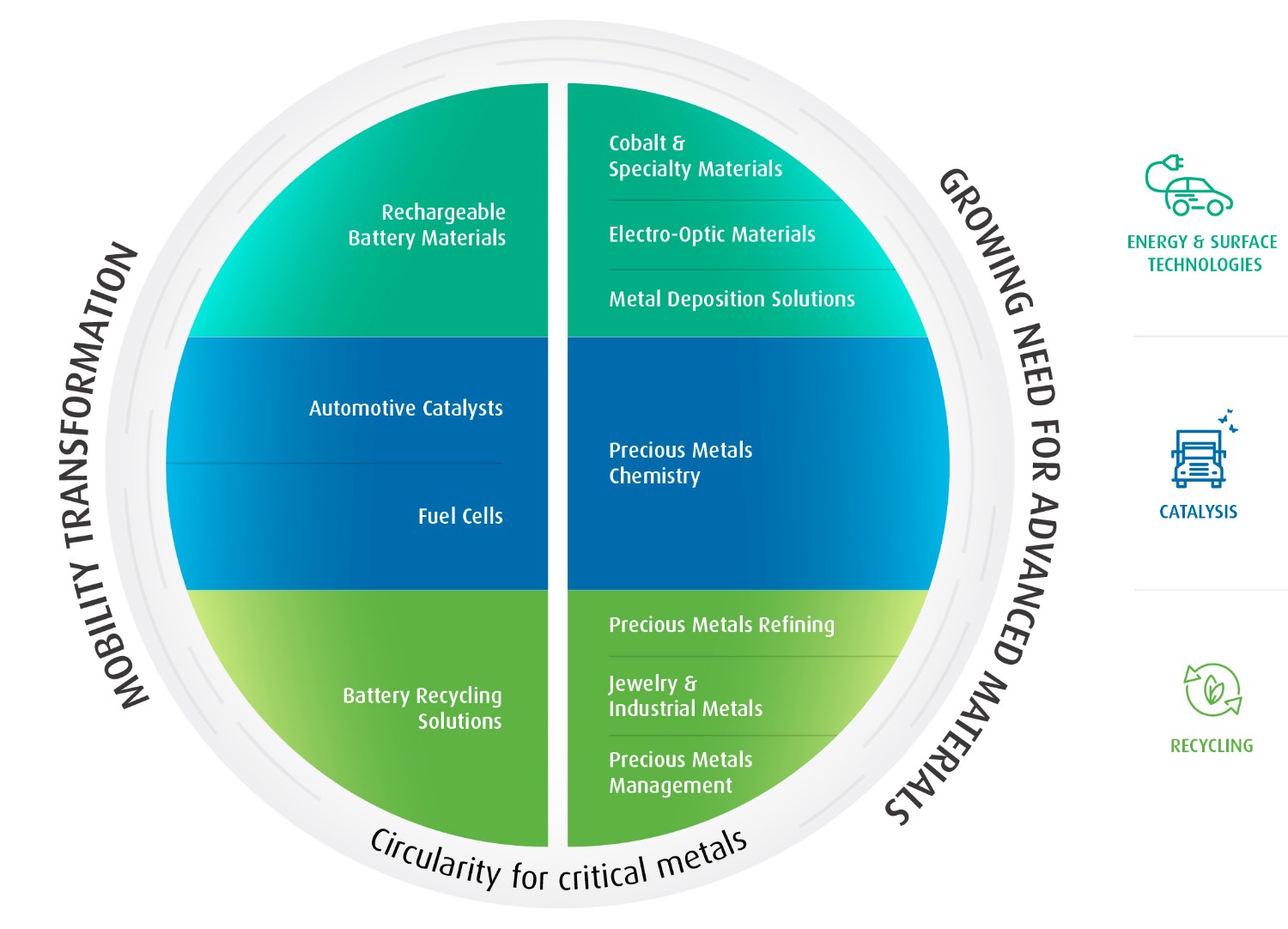

Umicore’s operations are organized into three business groups (Catalysis, Energy & Surface Technologies and Recycling) and 11 Business Units.

Catalysis

Umicore’s Catalysis Business Group comprises the Automotive Catalysts, Fuel Cells & Stationary Catalysts and Precious Metals Chemistry Business Units. Their activities focus on the development and production of catalyst formulations and systems used to abate harmful emissions from combustion engines, for use in fuel cells, and chemical and life science applications. These catalysts mainly use Platinum Group Metal (PGM) chemistries, in which Umicore has over 50 years of experience.

The Automotive Catalysts Business Unit is one of the world's leading producers of catalysts used in automotive emission systems for light-duty and heavy-duty vehicles. Its PGM-based emission catalysts are used in gasoline and diesel internal combustion engines, including the engines of mild and full hybrid vehicles. The business unit develops and manufactures three-way catalysts (TWC) and particulate filters (cGPF) for gasoline engines as well as diesel oxidation catalysts (DOC), particulate filters (DPF), NOx (Nitrogen oxides) and SCR (selective catalytic reduction) systems for diesel engines. In particular, it has a very strong market position in the gasoline light-duty segment, reflecting industry-leading gasoline catalyst technology. In addition, the business unit produces catalysts for heavy duty diesel (HDD) vehicles such as buses and trucks and for motorcycle or small engine applications. Umicore Automotive Catalysts’ worldwide operations deliver emission catalysts to global and local automobile manufacturers in Asia-Pacific, Europe and North and South America.

Despite the rapidly increasing penetration of full-electric vehicles in the light-duty segment, the Automotive Catalysts Business Unit anticipates a substantial increase in the value of its addressable market. This is based on the projected light duty gasoline and diesel vehicles and heavy-duty diesel production growth rates towards 2030 and on upcoming emission legislation in Europe and China. Based on its strong technology portfolio, Umicore’s Automotive Catalysts activity is well positioned to capture this market value peak and to maximize business value through a continued focus on process efficiency and operational agility. Between 2022 and 2030, the business unit has the potential to generate a free cashflow of approximately € 3 billion with approximately 20% adjusted EBITDA margins maintained over the period.

Through the Fuel Cells & Stationary Catalysts Business Unit, Umicore supports future growth in both Proton Exchange Membrane (PEM) fuel cells and stationary catalysis, targeting a broad range of industries including the automotive industry, manufacturing, hydrogen production and power and propulsion. It aims to support its customers in developing clean engines and reaching zero emission mobility and power supply. The business unit benefits from Umicore’s established global presence in both business areas with headquarters in Shanghai.

Fuel cell drivetrain technology for heavy-duty vehicles, is gaining momentum as an environmentally friendly alternative to internal combustion engines. Demand from the hydrogen-based mobility segment is set to grow exponentially towards 2040. As a leading fuel cell catalyst provider, with currently 40% global market share in the mobility segment, Umicore is ideally positioned to capture the growth in hydrogen-based mobility. Umicore’s fuel cell activity, which has applied R&D centers in Europe and Asia as well as an industrial-scale PEM-catalyst production footprint in Germany and Korea, will expand its PEM-catalyst mass-production capabilities with a greenfield plant in China in order to cater for the rapidly growing demand of its customers. This plant, which is set to start production in 2025, will be by that time the world’s largest fuel cell catalyst plant.

Umicore Precious Metals Chemistry develops and manufactures metal-based catalysts, active pharmaceutical ingredients (APIs) and chemical vapor deposition (CVD) precursors. Its expertise includes the conversion of metals into inorganic and organometallic chemicals, APIs and homogeneous catalysts as well as the handling and manufacturing of highly toxic or sensitive materials. Its key end markets are automotive, chemicals, electronics and pharmaceuticals.

Energy & Surface Technologies

Umicore’s Energy & Surface Technologies (E&ST) Business Group contains the Cobalt & Specialty Materials, Rechargeable Battery Materials, Metal Deposition Solutions and Electro-Optic Materials Business Units. This business group comprises Umicore’s innovative battery materials that power rechargeable lithium-ion batteries and enable the world’s transition to electromobility. The Cobalt & Specialty Materials Business Unit has a long-standing track record in the sourcing, production and distribution of cobalt and nickel products. The business group also supplies products for precious and non-precious metal-based electroplating and PVD coating in the Metal Deposition Solutions Business Unit and germanium-based material solutions for the space, optics and electronics sectors in the Electro-Optic Materials Business Unit.

Umicore Rechargeable Battery Materials is a leading supplier of active cathode materials for lithium-ion batteries which is the main battery technology powering full electric and (plug-in) hybrid vehicles. The Rechargeable Battery Materials Business Unit has more than 25 years’ experience in cathode active materials (first for portable electronic applications, then for electric vehicle (EV) applications). It has an impressive product and process technology leadership track record and demonstrated industrial capabilities in manufacturing cathode active materials and the related precursor materials at mass scale at the highest quality and environmental standards.

Based on its longstanding upstream know-how in cobalt and nickel refining and recycling, and as a front runner in the sustainable raw material sourcing, the Rechargeable Battery Materials Business Unit established a unique position in the battery value chain.

In terms of supply capacities, Umicore has been expanding significantly its cathode materials production capacity since 2016 to cater for rapidly growing customer demand, particularly from the EV segment. Today, Umicore supplies its customers from its Gigafactories in China and Korea. In 2022, we also started production in our greenfield plant in Nysa, Poland, which is the first Gigafactory for cathode materials in Europe.

Umicore is currently the only cathode player to produce industrial cathode materials on two continents. In addition, it is the first to supply cathode materials to global customers with identical quality and performance from different plants across different regions. Based on ongoing customer qualifications, Umicore plans to set up local production in North America. This expansion would complete Umicore’s global rollout of regional supply chains for automotive and battery cell customers on three continents.

Umicore’s unique locally integrated value chain proposition, both upstream and downstream, provides solid benefits in securing ethical and low-carbon footprint raw materials and is a strong competitive differentiator. It is further complemented by the closed loop recycling of battery materials provided by the Battery Recycling Solutions Business Unit in the Recycling Business Group.

During 2022, Umicore reached key milestones in Europe in the build-out of long-term strategic customer partnerships, further building on its first movers’ advantage. In April, Umicore and Automotive Cells Company signed a long-term strategic supply agreement for EV cathode materials. Set to start in early 2024, the agreement foresees an annual offtake commitment of 13 gigawatt hours (GWh) in with the ambition to grow yearly supplied volumes to at least 46 GWh by 2030.

In September, Umicore announced a joint venture with PowerCo, the battery company of Volkswagen, for precursor and cathode material production. From 2025 onwards, the joint venture will supply PowerCo's European battery cell factories. By the end of the decade, the partners aim to produce cathode materials and their precursors for 160 GWh cell capacity per year, which compares to an annual production capacity capable of powering about 2.2 million full electric vehicles.

Focusing on its expansion to North America, Umicore and PowerCo announced in December that they aim to extend their collaboration in battery materials and are exploring a strategic long-term supply agreement to serve PowerCo’s future battery Gigafactory for electric vehicles in North America. Based on the closing of this agreement and pending other customers contracts, Umicore expects to start construction of its Ontario Gigafactory in 2023 and operations at the end of 2025 with the potential to reach, by the end of the decade, an annual production capacity capable of powering approximately one million electric vehicles.

At the same time, Umicore will be strengthening its position in Asia through a more diversified customer and platform exposure.

At the start of 2023, Umicore also signed an agreement with Terrafame Ltd for the long-term supply of low carbon, sustainable high-grade nickel sulphate. This agreement will cover a substantial part of the future nickel requirements of Umicore’s cathode materials manufacturing plant in Poland and reconfirms Umicore’s strong commitment to establish a sustainable battery materials value chain in Europe.

The pace of electrification continues to accelerate rapidly, underpinned by a strong regulatory push (e.g. the zero emissions from new cars and vans in Europe by 2035, the Inflation Reduction Act in the US, and most recently the Green Deal Industrial Plan in Europe) as well as ambitious commitments from major car manufacturers. As a result, demand for cathode materials used in electric vehicles is set to grow massively between 2022-2030. With its’ industry leading product and process technology and unique locally integrated value chain proposition, the Rechargeable Battery Materials Business Unit is in an excellent position to capture profitable growth and deliver sustainable value. The business unit is set to deliver by focusing on reinforcing and further growing its R&D, refining and precursor and cathode materials manufacturing footprint in key regions, close to customers. This growth strategy and related investments are predicated on the establishment of long-term value creative partnerships with battery and car OEM customers of which key achievements for 2022 are presented above.

Based on its roadmap, the Rechargeable Battery Materials Business Unit has the ambition to reach adjusted EBITDA margins of approximately 20% in 2030. Umicore is expecting to earn more than its cost of capital shortly after 2026 with growing returns thereafter.

The Business Unit Cobalt & Specialty Materials is a worldwide leader in the recycling and refining of nickel and the transformation and marketing of cobalt and nickel specialty chemicals. Its broad expertise covers a multitude of applications in both chemical and powder metallurgy. The unit covers all steps of the value chain, from sourcing to distribution, with production units and sales offices on all continents.

Umicore’s Metal Deposition Solutions Business Unit is one of the world's leading suppliers of products for precious metal-based coating of surfaces in the nano and micrometer range. The unit masters the two highest-quality coating processes: electroplating and PVD coating which offer customers tailor-made coating processes for their specific needs. Its coating solutions are used by manufacturers in the electronics, semi-conductor, automotive, optics and jewelry industries.

The Electro-Optic Materials Business Unit supplies germanium-based material solutions to customers around the world. Its main markets are thermal imaging and opto-electronic applications, for which it supplies germanium wafers, infrared lenses and optics, and germanium-based chemicals.

Recycling

In its Recycling Business Group, Umicore gives new life to used metals. The Recycling business recovers a large number of precious and other metals from a wide range of waste streams and industrial residues. Its operations also extend to the production and recycling of jewelry materials. This business group also offers products for various applications including chemical, electric, electronic, automotive and special glass applications. It consists of four business units: Precious Metals Refining, Battery Recycling Solutions, Precious Metals Management and Jewelry & Industrial Metals, with at the center its flagship Precious Metals Refining plant in Hoboken, Belgium, unique in its kind. The recycling business group builds on a strong 25-year track record integrating circularity at the core of its existence, many years before circularity became a household word.

Umicore Precious Metals Refining operates as one of the world's largest precious metals recyclers and is the market leader in low-carbon recycling of complex waste streams containing precious and other non-ferrous metals, serving a broad range of customers worldwide. As other business units (such as Automotive Catalyst, Rechargeable Battery Materials and Fuel Cells & Stationary Catalysts) use these metals, Precious Metals Refining truly closes the metals loop in our operations and is therefore at the heart of our closed-loop business model, providing a true competitive edge. It is a key enabler of the low carbon economy as recycling reduces the carbon footprint of metals in the value chain by about 50%. Recent innovations allowed Umicore to maximize input of highly complex PGM materials, such as spent automotive and industrial catalysts. Umicore’s unique technology touches the full value chain, going from industrial by-products to end-of-life materials. Precious Metals Refining recovers 17 metals out of more than 200 types of complex waste streams which makes us intrinsically flexible and gives us the opportunity to focus on raw materials that bring us the most value.

“Recycling reduces carbon footprint of metals in the value chain by about 50%.”

Growing metal scarcity and increasing complexity of the materials offered for recycling are key drivers for the business. Increasing regulatory requirements and more stringent legislation, such as obligations regarding proportions of recycled materials in the product and environmental restrictions, present a real opportunity for Umicore as it can leverage on its leadership in complex and low-carbon recycling. All of this translates in an increasing structural demand for sustainable and complex recycling solutions regardless of the metal price evolution. In addition, the Battery Recycling Solutions Business Unit (see hereafter) greatly benefits from the world-class expertise of the Precious Metals Refining Business Unit.

Through its leadership in sustainable and complex recycling, the Precious Metals Refining Business Unit is seen to continue to create sustainable value with EBITDA margins above 35%, to generate a 20% return on capital employed by 2030 and to continue to generate substantial cash flows, considering the assumption of normalized Platinum Group Metals prices.

The Battery Recycling Solutions Business Unit is an essential part of our contribution to the sustainable electrification of the automotive industry as it enables us to close the loop in battery manufacturing. With accumulated industrial-scale experience in lithium-ion EV battery recycling and over 15 running commercial partnerships with leading car manufacturers and cell makers, Umicore is a true pioneer in this activity. Based on growing customer engagements, the business unit announced plans for a significant scale-up of its battery recycling activities in Europe with a 150,000-ton battery recycling plant. This plant, which will be the largest battery recycling plant in the world, will deploy Umicore’s latest proprietary pyro-hydro recycling technology, resulting in industry leading recovery rates for cobalt, copper, nickel and lithium while having a minimal impact on the environment. Upon commissioning of the plant, Umicore is expected to be the first company in Europe covering the full cathode materials value chain at large scale, thereby strongly contributing to the European Union’s objective to establish a sustainable and circular electric vehicles battery ecosystem in Europe.

New and more stringent regulatory requirements will support our battery recycling activities further. Metal scarcity, the circular economy component and the focus on limiting the carbon footprint will continue to drive the use of recycled metals in batteries and on a broader scale.

Umicore Precious Metals Management is a global leader in the supply and handling of all precious metals. The business unit ensures physical delivery to most countries worldwide, by using the output of Umicore’s precious metals refineries as well as its close network with reliable industrial partners and banks. The business unit acts as a link between the recycling activities and producers in need of precious metals (internal as well as external). Umicore guarantees supply continuity through sustainable sourcing of raw materials.

The Jewelry & Industrial Metals Business Unit supplies precious metal-based products to jewelers and precious metals processors. It provides semi-finished products and alloys for industrial applications, as well as equipment for high-quality glass applications and optimized performance catalysts for ammonium oxidation processes. It also offers precious metals recycling services. The business unit, headquartered in Germany, has operations in Austria, Brazil, Canada, China, Germany, Thailand and the US.

Capital expenditure

Capital expenditure totaled € 470 million at the end of 2022, compared with € 389 million the previous year.

Energy & Surface Technologies accounted for more than 60% of the Group’s capital expenditure, driven by investments in the expansion of the Rechargeable Battery Materials business unit European’s footprint.

In the Catalysis and Recycling business segments capital expenditure slightly decreased. In Catalysis, the Automotive Catalysts business unit continued to focus on investments in production footprint optimization and targeted capacity expansions. In Recycling, the increase in capital expenditure was related to environmental and safety investments in the Precious Metals Refining business unit. Capitalized development expenses amounted to € 21 million, down versus 2021.

The further expansion of the Rechargeable Battery Materials business unit’s footprint in Europe, combined with the expected investments in North America, should result in higher Group capital expenditure in 2023 versus previous year.

The Research & Development spend represented 7.6% of Umicore’s 2022 revenues and capitalized development costs accounted for € 21 million of the total amount.

Associate & joint venture companies

Umicore has investments in various business activities over which it does not exercise full management control. Associate companies are those in which Umicore has significant influence over financial and operating policies, but no control. Typically, this is evidenced by ownership of between 20-50% of the voting rights, while joint ventures usually entail a 50:50 split in ownership and control. Joining forces is a way to speed up technological developments, gain access to specific markets, or share investments.

When management control is not exercised by Umicore, we are able to guide and control the management and monitor business developments through representation on the board of directors. Although we cannot impose our own policies and procedures on any associate or on any joint venture when we do not possess majority voting rights, our expectations that the operations be run in accordance with the principles of the Umicore Way are clearly communicated.

Umicore is rigorous in safeguarding any intellectual property that is shared with associate or joint venture partners. For a full list of associate and joint venture companies, see note F17.

Umicore and PowerCo announce joint venture

In September 2022, Umicore and PowerCo, the battery company of Volkswagen Group, announced the founding of a joint venture for precursor and cathode material production in Europe. Production at the JV is scheduled to start in 2025 to supply PowerCo’s Salzgitter factory and reach an annual capacity of 40 GWh in 2026. Both partners target to grow the joint venture‘s annual production capacity to 160 GWh by the end of the decade, which compares to an annual production capacity capable of powering about 2.2 million full electric vehicles. Under the terms of the agreement, both partners will jointly control the joint venture and will share costs, investments, revenues and profits.

The joint venture will give both partners a significant first-mover advantage in the fast-growing e-mobility market in Europe. Together they plan to invest about € 3 billion into new materials production capacities.

The partnership will provide Umicore with secured access, through firm take or pay commitments, to an important part of the European demand for EV cathode materials at guaranteed value creative returns.

The joint venture is designed to meet both partners’ profitability and return criteria and will unlock, for each side, significant synergies and economies of scale. Umicore’s IP and know-how will be made available through a license agreement to the joint venture to ensure its leading technology position.

In addition to the joint venture, Umicore and PowerCo will collaborate on the sustainable and responsible sourcing of raw materials, an area in which Umicore is an industry leader. Finally, Umicore will provide refining services to PowerCo and both partners aim to include, at a later stage, elements of refining and battery recycling based on Umicore’s technology and know-how into the scope of the joint venture.