Risks & Opportunities

Managing risk effectively

The aim of our risk management system is to enable the company to identify risks and opportunities in a proactive and dynamic way and manage or mitigate them to an acceptable level wherever possible.

To anticipate economic and geopolitical uncertainty, increased focus on climate change and energy transition, the rapidly changing technological landscape etc., a robust risk management process supported by strong governance is crucial to support the Group achieving its financial and extra-financial strategic objectives.

Each of the Group’s activities is exposed to a variety of risks that are financial or non-financial in nature but have the potential to impact the financial performance of the Group. Financial risks include changes in metal prices, in foreign currency exchange rates, in certain market-defined commercial conditions, and in interest rates as well as credit and liquidity risks. The Group’s overall risk management program seeks to mitigate risks and potential adverse effects on the financial performance of the Group, including through the use of hedging and insurance instruments. For more on Managing financial risks, see note F3.

Umicore’s annual Business Risk Assessment – endorsed by the Supervisory Board – fulfils this role while at the same time ensuring compliance with laws and regulations.

All identified risks and opportunities are assessed against three criteria, while at the same time determining their time horizon (short-medium-long), their likelihood of occurrence and the impact the materialization of a risk or opportunity could have.

Sustainability matters are also assessed on their impact on the Group as well as on people, society and the environment.

Process and framework

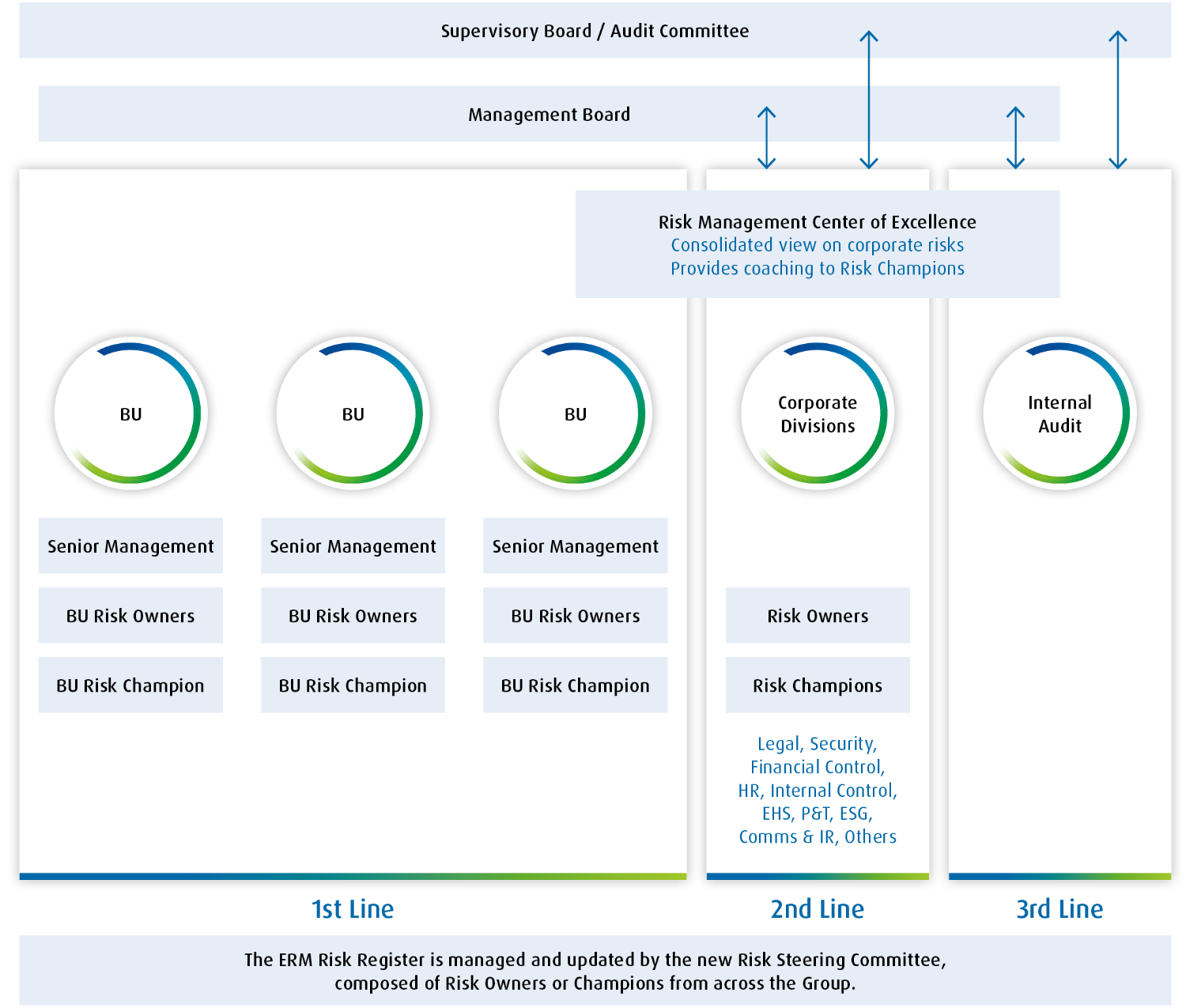

Umicore’s Enterprise Risk Management framework is based on the “Three lines of defense” model, where the primary source and responsibility for the identification of risks and opportunities lies within the individual business units.

As they operate in an environment carrying specific growth expectations and differing degrees of market and technological uncertainty potentially impacting strategic objectives, each business unit is responsible for the implementation of the necessary mitigating actions which are systematically reported corresponding to the respective strategic objectives and identified risks and opportunities.

The second line of defense is insured by specific corporate departments in close collaboration with the Enterprise Risk Management (ERM) function.

Under the auspices of the Management Board, these corporate departments are also tasked with identifying, managing and mitigating certain risks and opportunities while ensuring that adequate systems are in place to address them. These risks and opportunities cover Group-wide elements that extend beyond the purview of individual business units, (e.g. financial, strategic, social, reputational, climate and environmental-related risks and opportunities) in the short, medium or longer term.

Together, they aggregate the risks and opportunities and provide a consolidated view while the ERM function will also assure a regular follow-up of the mitigation actions.

Finally, the Internal Audit function, through its independent review, assures the effectiveness and efficiency of the Risk Management process, while at the same time aligning the internal audit plan with the ERM priorities.

This model is subject to continuous improvement and is designed to be dynamic and flexible in a way that enables Umicore to respond appropriately to the Risk & Opportunity Environment.

An example of such improvement is the creation of a Steerco as shown in the below figure which will be implemented in the course of 2023.

Umicore is also enhancing its ERM organization to facilitate the implementation of a Governance, Risk and Compliance tool (GRC), supporting the visibility of the different risks and opportunities.

Governance and oversight

The audit committee of the Supervisory Board reviews all financial and non-financial risks and opportunities at Group-level, defines the Risk Appetite and Risk Tolerance, while the Management Board, as the “Executive Risk Owner” and "Subject Matter Expert" will be making and supporting risk-priority decisions following the regular review of the top risks potentially affecting the Group’s financial and extra-financial strategic objectives.

Insurance

One of the techniques used to respond to risks is the use of insurance as a risk transfer mechanism. Umicore currently has insurance programs in place to protect itself against a number of risks including Property Damage & Business Interruption, Public & Products Liability, Employer’s Liability, Workers Compensation, Transport, Directors’ and Officers’ Liability and Credit Insurance.

Since 2021, Umicore is also using its fully owned reinsurance captive in Luxembourg to retain part of the (insured) risks before transfer to the (direct) insurance market.

The type of insurance and the respective insured limits purchased from the direct insurance market are regularly reviewed to be aligned with our assessment of the relevant risks and the group’s risk appetite.

Our internal control system

Internal control is a key aspect of Risk Management. Different Internal control mechanisms exist throughout Umicore to provide management with reasonable assurance of our ability to achieve our objectives. They cover:

- Effectiveness and efficiency of operations

- Reliability of financial processes and reporting

- Compliance with laws and regulations

- Mitigation of errors and fraud risks

Umicore adopted the COSO1 framework for its Internal Control System and has adapted its various constituents within its organization and processes. “The Umicore Way” and the “Code of Conduct” are the cornerstones of the internal control environment; together with the concept of management by objectives and through the setting of clear roles and responsibilities, they establish the operating framework for the company.

Specific internal control mechanisms have been developed by business units at their level of operations, while shared operational functions and corporate services provide guidance and set controls for cross-organizational activities. These give rise to specific policies, procedures and charters covering areas such as corporate security, environment, health and safety, human resources, information systems, legal, trade compliance, research and development and supply chain management.

Umicore operates a system of Minimum Internal Control Requirements (MICR) specifically to address the mitigation of financial risks and to enhance the reliability of financial reporting. Umicore’s MICR framework requires all Group entities to comply with a uniform set of internal controls in 12 processes.

Within the internal control framework, specific attention is paid to the segregation of duties and the definition of clear roles and responsibilities. MICR compliance is monitored by means of self-assessments to be signed off by senior management. The outcome is reported to the management board and the audit committee.

Out of the 12 control cycles, 3 cycles (Fixed Assets, Human Resources and Travel and Entertainment) were assessed in the course of 2022 by the 101 control entities currently in scope. Risk assessments and actions taken by local management to mitigate potential internal control weaknesses identified through prior assessments are monitored continuously. The Internal Audit department reviews the compliance assessments during its missions.

Opportunities & risks overview

1 Regulatory and legal context

Risk description

The globally changing regulatory environment brings both threats and opportunities for Umicore. This applies not only in the countries and regions where Umicore operates, but also in those where its products are sold and used.

Umicore’s business operations are subject to a variety of increasingly stringent environment, health & safety related laws, regulations and standards. In the short term, these present operational challenges for our businesses, resulting in continuous improvements and investments (hence in higher costs) and potentially in an uneven competitive environment. One of the areas in which this short-term impact is visible, is the renewal or “ex officio” amendment of operational (environmental) permits for Umicore’s production sites. In the course of 2021, the Flemish government imposed new and more stringent environmental requirements for Umicore’s recycling plant in Hoboken. These new and challenging requirements include, amongst others, annually declining limits for levels of lead in the blood of young children under the age of 12 living in the vicinity of the Hoboken plant. Despite Umicore’s continuing efforts to reduce the harmful effects of emissions and the further declining levels of lead during 2022 it cannot be excluded that certain of these new targets in the Hoboken permit will not be met in the future. As Umicore’s recycling activities are concentrated on this one unique site in Hoboken, not reaching an environmental target might have a significant impact on Umicore’s earnings and cash flows.

Similarly, environmental legislation can impact the way end-of-life batteries must be handled, transported and stored, which in turn can drive business decisions.

However, in the mid- to longer term, Umicore can benefit from these trends, especially those regarding the reduction of vehicle emissions, electrification and the circular economy.

This evolving EHS regulatory framework will ultimately also be beneficial to the environment and society as new and better technologies will have to be developed and implemented, for the emissions of both production facilities and vehicles as well as to cope with resource scarcity.

Changes in product content regulation in general and more specifically REACH regulation (or its equivalent in regions outside the EU) can in turn drive business options and/or technology choices.

Data protection and intellectual property rights have a significant impact on technology-driven businesses including Umicore. Failure to adequately manage data, knowledge and intellectual property (IP) rights may, in the short- and medium-term, have a negative impact on Umicore’s business and freedom to operate. Despite robust mitigation measures in place, it cannot be excluded that Umicore becomes the victim of a data breach and will be fined or have to compensate victims as a result of such a breach. Umicore could be forced to take legal action against perpetrators to safeguard its intellectual property rights. Likewise, Umicore is also exposed to the risk of having to defend itself against alleged breaches of third-party IP rights, despite efforts to manage its IP portfolio actively.

Geopolitical conditions, trade legislations and restrictions continue to be a factor in Umicore’s trans-border activities in short, medium and long term. In more and more regions, review or approval procedures are implemented for cross-border technology transfers, acquisitions and exports. Compliance with such measures may adversely affect the speed of innovation and/or the flexibility to collaborate with third parties or even within the same group. They may, however, also create opportunities for Umicore (whether in protecting its technology or creating barriers to market entry by foreign competitors).

Today, Umicore is the only cathode player to produce industrial cathode materials on two continents and has the intention to set up local production in North America, as such completing the global rollout of regional supply chains for automotive and cell customers on three continents.

The growing trend towards electrification (as recently confirmed by the decision of the European Parliament to ban the sale of new fossil fuel cars from 2035) and more stringent emission control should be seen as an opportunity to Umicore’s business as described in investing at Umicore. However, governments in other parts of the world might decide to postpone the implementation of such new legislation. In the short term, such delays could have a negative impact on certain parts of Umicore’s business. In the medium term, this will rather be an opportunity for further and increased market development, positively impacting sales and revenues.

The new Inflation Reduction Act of 2022 (IRA) in the USA, requiring that a certain percentage of critical minerals in the battery must have been recycled in North America or been extracted or processed in a country that has a free-trade agreement with the United States and that the battery must have also been manufactured or assembled in North America is rather an opportunity for Umicore.

As we have the intention to set up a manufacturing facility for cathode active battery materials (CAM) and their precursor materials (pCAM) in Ontario, Canada, these products will be “IRA approved”.

Potential product or contractual liabilities remain risk factors to be monitored at all times.

National and international tax regulation is increasing and becoming more complex which increases the Group’s tax compliance related risks (particularly in the field of transfer pricing and indirect taxes such as VAT). The uncertainty associated with announced or potential tax reforms is equally increasing (both on a national level such as for example in Brazil or on an international level such as for example the OECD initiatives). These risks might impact the Group’s earnings despite Umicore continuing to manage them proactively (e.g. through the recognition of uncertain tax position provisions).

Risk profile

The increased complexity of the global regulatory environment remains very complex and legislation continues to become more stringent, but overall we can consider that the risk profile remains stable compared to 2021. At the same time, new opportunities will equally arise out of such more stringent legislation.

Risks and opportunities related to trade and tariffs (including export regulations regarding both goods and technologies) require close monitoring and follow-up.

The risk profile for matters related to intellectual property rights and data protection is increasing as a result of the stricter regulations and the IP landscape which has become more litigious than previously. Despite our active management of patents and other IP rights, Umicore cannot exclude that any of our patents will be violated (and we may not always be able to successfully take action to stop or obtain compensation for any such violations) nor that there will not be any litigation against the company for an alleged infringement of a third-party IP right.

Risk mitigation

Umicore provides continuous training on regulatory requirements to ensure compliance with applicable legislation.

Umicore is continuously and systematically monitoring the regulatory landscape on health, safety, environment and climate change, and adapting its frameworks and reporting accordingly.

To ensure ongoing compliance with EHS legislation on our industrial sites, Umicore has a well-established EHS compliance audit program and constantly monitors changes in legal requirements where it operates. For more information, see Environment.

Several initiatives have been taken and continue to be taken to reduce the possible impact of harmful emissions from Umicore’s production, such as the creation of a “green zone” on and next to the Hoboken production facility, as described in Environment.

At Umicore, we are committed to the responsible and sustainable management of our products throughout their lifecycle. We recognize the importance of product stewardship in protecting human health and the environment. We work collaboratively with our stakeholders to ensure the responsible management of our products. For Umicore, a specialty materials company, this also includes managing the potential risks associated with the chemicals used and implementing measures to reduce those risks. Umicore ensures regulatory compliance of the products worldwide and therefore closely monitors all changes in regulations, interpretations and guidance documents that might affect its European REACH implementation strategy. In 2022, we have submitted 13 additional substances for registration under REACH due to new business developments. As part of regular maintenance, we have updated 17 REACH dossiers for reasons including changing the tonnage band, replying to ECHA requests and including new information. Additionally, a 1st Full Registration dossier for UK-REACH has been completed to support new UK import activities.

Umicore successfully achieved the first Korea REACH (K-REACH) registration deadline at the end of 2021. With a few new registrations ongoing in 2022, Umicore is already preparing for the next wave before December 2024.

See more on Umicore’s approach to Product Stewardship here.

To mitigate the potential impact of (product) liability claims, Umicore has implemented mechanisms such as contract management and risk transfer using insurance policies, in addition to rigorous quality controls.

Umicore’s dedicated Intellectual Property Team within the global legal department, has rigorous processes that monitor the required freedom to operate to commercialize our products.

More and more governments have implemented new or enhanced legislation on data protection, such as GDPR in Europe, LGPD in Brazil, POPI in South Africa or PIPL in China. Umicore has implemented the necessary governance structures in compliance with these legislations and is closely monitoring any changes or new regulations on this topic.

To safeguard its data and innovative ideas, Umicore is providing training to its employees worldwide on how they can contribute to and ensure the protection of trade secrets. To that end, the “I Stay Alert” campaign, which was launched in 2021, was continued throughout 2022 as described in information security and data protection.

The Umicore Trade Compliance Team closely follows and responds to global trade conditions, not in the least the newly imposed sanctions following the recent geopolitical events in 2022.

Umicore continues to play an active role in informing legislators of various emission control technologies for both diesel and gasoline powered vehicles, to help legislators make informed decisions about future emission and testing norms. To manage policy risks, Umicore participates in public consultations and is a member of multiple industry associations, including those related to sourcing, climate and business. As described in Engaging For Impact, Umicore is supportive of challenging targets in areas such as battery regulation, as they represent opportunities for us. As a founding member of the Global Battery Alliance (GBA), Umicore is one of the staunchest drivers and co-developers of the Battery Passport. Transparency on a battery’s lifecycle enables consumers, companies and regulators to make well-informed choices, propelling decarbonized electric driving.

Umicore is further enforcing its international tax team and has increased its use of third-party advisory services to monitor and manage tax-related risks.

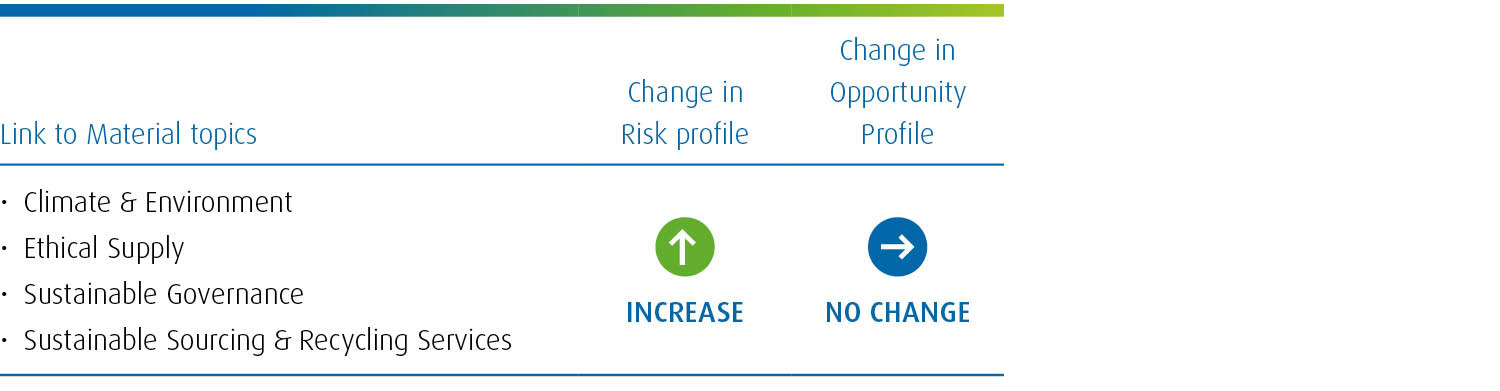

2 Sustainable and ethical supply

Risk description

In the short term, potential disruption in supply chains due to factors including changes in trade regulation, geopolitical events and subsequent delays at borders and ports, container transportation shortage and high energy prices remain a real risk. A further source of stress in the supply relates to stricter application of regulations on transboundary movements of waste and/or bans by carriers, ports or countries to accept waste or dangerous goods. Regarding the supply of metals, securing adequate volumes of raw materials is essential in the ongoing viability of our product and service offering and in achieving our growth objectives. Responsible sourcing is a key priority and competitive edge for Umicore: when sourcing materials or through indirect procurement, we check suppliers and conduct due diligence based on a risk assessment to ensure that no harm is inflicted on people (e.g., human rights violations), the environment or society. More details about what we expect from our suppliers can be found in Society. Insufficient availability of raw materials such as palladium, rhodium, lithium or battery nickel units, combined with a lack of alternatives, can impact metal prices as described in the metal price chapter.

In the medium term, price volatility and limited availability of supply remain a concern, in particular for battery materials for which demand is expected to soar or for certain platinum group metals, the use of which is currently closely linked to internal combustion engine technology. The uncertain grade mix for battery materials may lead to inadequate supplies. There are risks that development of new supply may not precisely match demand increases, whereby the gap in supply and demand during the rapid future growth could lead to temporary supply shortages or excesses, which will reflect in metal prices. Other materials such as germanium face long-term supply challenges due to changing market conditions, where there is a trend for suppliers to move downstream. Regarding sustainability and the impact of Umicore’s activities on society, it is crucial we deliver performance against our ESG ambitions, with a supply chain that is fully certified against environment, social and governance criteria and decarbonization targets for Scopes 1, 2 and 3. Next to the grade, price volatility and limited availability, the GHG impact of the raw materials we purchase comes as an additional dimension to be taken into account when locking in supply and spans over the short, medium and the long term.

In the long term, regarding supply, Umicore requires certain metals or metal-containing raw materials to manufacture its products and feed its recycling activities. Some of these raw materials are comparatively scarce and require very specific sourcing strategies. Obtaining adequate supplies of these materials is important for the ongoing success and growth of our business.

Risk profile

Regarding battery materials in particular, demand is expected to increase massively in the coming years and decades, as is competition for the ethical and low carbon, sustainable sourcing of the required materials. Regarding certain precious metals and platinum group metals (PGM) in particular, physical supply is currently tight and short-term sensitive to any supply or demand disruption while on a longer-term sensitive to the pace of electrification and alternative drive train technologies such as fuel cells.

The impact of COVID-19 and measures taken to contain contagion are expected to continue having an impact on the availability of raw materials and in general on the supply chain, but that risk is expected to decrease and stabilize through 2023. Conversely, geopolitical risks are increasing.

Existing and upcoming laws at national and EU level on due diligence and sustainable product policy have increased awareness about the topics of responsible sourcing and sustainable value chains, in particular for designated conflict minerals (tin, tantalum, tungsten and gold) and more recently also for battery materials (cobalt, nickel, lithium, manganese). Requirements for robust due diligence management systems, compliance and reporting will only increase in the coming years for the entire supply chain, both for the impact on human rights, as well as for environmental, social and governance (ESG) criteria. Increased standards are also an opportunity for Umicore because of our long-standing experience in due diligence and responsible sourcing and because they will create a more level playing field for the industry.

Risk mitigation

Umicore has implemented policies and measures covering: human rights, the right for workers to organize, collective bargaining, equal opportunities and non-discrimination, banning of child labor, banning of forced labor, consistent with International Labour Organisation (ILO) standards, as supported through a Global Framework Agreement (GFA) on Sustainable Development with IndustriALL Global Union. The GFA captures Umicore’s engagement to both our employees and our suppliers.

Umicore’s policies and charters such as theCode of Conduct, Human Rights Policy and the Umicore Global Sustainable Sourcing Policy (UGSSP) illustrate our long-standing and growing experience in ensuring we only buy from suppliers who can guarantee sustainable and ethical sourcing.

In addition to these general policies, Umicore also has specific risk-based policies in force, designed to safeguard the environment and to protect Human Rights in our supply chain: “Responsible global supply chain of minerals from conflict-affected and high-risk areas” and “Sustainable Procurement Framework for Cobalt”, which follow the principles of the OECD "Due Diligence Guidance for Responsible Supply Chains from Conflict-Affected and High-Risk Areas".

Both policies include a robust due diligence system, which includes background screening of suppliers, a risk assessment based on country, material and supplier risk and risk mitigation actions, in combination with onsite visits and third-party audits for critical suppliers. Under the due diligence system of the Cobalt Framework, the identification of "red flags" or "orange flags" triggers engagement with the supplier on the related issue and an internal decision-making process involving senior management in appropriate follow-up. Umicore was the first company globally to get annual third-party assurance on its responsible sourcing framework for Cobalt through the annual compliance report (publicly available).

The Cobalt Framework has been extensively reviewed in 2022, broadening among others the scope of supplier requirements to a wider set of environmental, social and governance (ESG) criteria. The review also strengthened the risk assessment and risk mitigation approach. Similar frameworks have also been developed for the sustainable procurement of nickel and lithium and will become applicable for suppliers throughout 2023. The new frameworks will formalize the due diligence already conducted on nickel and lithium suppliers since 2021.

Regarding the sustainable sourcing, Umicore defined in 2022 a Scope 3 reduction target focusing on purchased goods and services. Battery materials and precious metals are the main contributors to the impact of this Scope 3 category. We have identified ways to achieve our target by 2030 and have started reaching out to suppliers to understand their GHG emission profile and reduction opportunities. We aim to work in the future with suppliers who have ambitious GHG reduction targets to be able to provide our customers with both responsible and sustainable products.

Furthermore, Umicore continues to ensure that its production operations are certified as conflict-free and receives site and metal-specific responsible sourcing certifications from the LBMA, RJC and RMI. For more information, see Society.

Regarding managing risks of critical materials and supply disruption, mitigation actions can vary depending on the materials and the position of the business unit in the market. Beyond responsible sourcing, we ensure that materials can be supplied from several reliable suppliers, we closely monitor developments in other regions and investigate other projects to diversify sourcing and we seek out secondary raw material sources and negotiate long-term contracts.

3 Metal price

Risk description

Umicore’s main risk in the short term is related to the volatility of metal prices. Earnings are exposed to risks relating to the prices of the metals which are processed or recycled. These risks relate mainly to the impact that metal prices have on the surplus metals recovered from materials supplied for recycling, and concern platinum, palladium, rhodium, gold, silver and a wide range of base and specialty metals.

Umicore also faces transactional price risks on metals. The majority of its metal-based transactions use global metal market references. If the underlying metal price were constant, the price Umicore pays for the metal contained in the raw materials purchased would be transferred to the customer as part of the price charged for the product. However, because of the lapse of time between the conversion of purchased raw materials into products and the sale of products, the volatility in the reference metal price creates differences between the price paid for the contained metal and the price received. Accordingly, there is a transactional exposure to any fluctuation in price between the time raw materials are purchased (when the metal is “priced in”) and the time the products are sold (when the metal is “priced out”). As lithium and manganese have become increasingly valuable and volatile components in rechargeable battery materials, Umicore decided to no longer treat them as a consumable but to hedge the transactional exposure going forward, in line with other battery metals like nickel and cobalt. For more information on the structural risk and on the transactional and inventory risk related to the metal prices, see note F3 of Statements.

Materials produced by Umicore contain precious or scarce metals which are partly sourced from in-house recycling operations and, for the balance, procured from primary metal producers. Umicore’s ability to procure the required quantity of such metals is key in determining our ability to produce the materials which have been ordered by our customers. Although Umicore has been fading out its sourcing business with Russia in the course of 2022, the current geopolitical tensions between Russia with its leading position as a major global producer of e.g. palladium, and Ukraine could fuel metal price volatility in general and as such impact the global supply of certain metals.

The availability of metals such as nickel, lithium and cobalt - as described in Ethical and Sustainable Supply above - is the main long-term risk.

Due to the liquidity of the metal markets for precious metals, platinum group metals (PGM) and battery metals, Umicore’s impact on the metal price is limited.

Risk profile

Prices for precious metals were volatile throughout 2022, with rhodium and palladium reaching peaks in the first half of the year on the back of geopolitical tensions, whereas in the second half of the year prices for rhodium dropped. Overall, precious metal prices were down from the historic highs of 2021.

The price of nickel was volatile over the year and was impacted by a temporary short squeeze on the London Metal Exchange. Cobalt price increased in the first half, before dropping significantly in the second half. Lithium price increased significantly in the first half of the year to reach historic highs. The increase of battery metal prices is primarily driven by the growing demand for EV batteries.

As described in the sustainable and ethical supply risk, metal scarcity is increasing because of supply / demand tightness and other factors such as geopolitical tensions or trade regulations.

Risk mitigation

For some metals quoted on futures markets, Umicore hedges a proportion of its forward metal exposure to cover part of the future price risks.

Over the course of 2022, Umicore entered additional forward contracts securing a substantial portion of its structural price exposure for certain precious metals in 2023, 2024 and 2025, thereby increasing earnings predictability. For 2023, based on the respective currently expected exposures, the following lock-ins have been secured: more than a third for silver and gold, somewhat less than half for palladium and close to a quarter for platinum and rhodium. For 2024, the expected lock-in ratios are: close to half for gold and palladium, more than a third for silver and close to a quarter for platinum and rhodium. For 2025, close to a quarter was locked-in for the expected gold and silver exposures.

The Group’s policy is to hedge the transactional risk to the maximum possible extent, primarily through forward contracts. For a selection of metals, either no derivatives markets exist, or the existing market does not offer the required liquidity to enter forward contracts. This is increasingly the case for metals gaining in importance, such as cobalt and lithium. To mitigate the price risk on its transactions in these metals, Umicore maximizes the use of back-to-back hedging, matching the price reference of purchases and sales.

Umicore is continuously increasing production of precious and scarce metals from its recycling capabilities, thereby securing a significant proportion of its metals' needs. In addition, the group maintains close commercial relationships with leading primary metals producers from which it procures metals through annual or evergreen contracts.

4 Market

Risk description

The main industries served by Umicore are automotive (clean mobility materials such as automotive catalysts and fuel cell catalyst, rechargeable battery materials, recycling), consumer electronics (rechargeable battery materials, recycling, coating and electroplating solutions), and non-ferrous metal mining and refining industries (recycling activities). Umicore is sensitive to any major growth or global reduction in activity levels or market disruptions in these industries.

The changes in the automotive industry create the main risks for Umicore today.

In the short term, Umicore has a limited visibility on future automotive (ICE and EV) demand. Geopolitical tensions create market uncertainty in the short and medium term. Persistent supply chain disruptions impact the supply and demand market dynamics. The pace of electrification also impacts demand of our products. Electrification will reduce the demand for automotive catalysts and boost the demand for rechargeable battery materials. Increased demand for rechargeable battery materials requires more production lines and sites, entailing challenges in hiring and training people, acquiring the right qualifications against the right timelines and available CapEx. The lack of visibility on demand for rechargeable battery materials is a risk in both the short and medium term.

The rapidly accelerating shift to electrification has an influence on Umicore’s catalysis and recycling activities. Since emission control catalysts are produced with platinum group metals (PGMs), a declining demand for emission control catalysts due to the reduced production of ICE vehicles has an impact on PGM prices. The availability of recyclable end of life catalysts is also decreasing over the medium to long term. Due to the increasing electrification, price volatility of metals needed to produce battery materials is increasing. It is therefore needed to put in place the necessary hedging mechanism (see above). A consistent supply of metals for rechargeable battery materials (as described in "ethical and sustainable supply") is imperative to ensure efficient production of rechargeable battery materials.

In the long term, the transition to electrification changes the competitive environment. The market for cathode active materials is still an emerging market with different dynamics per continent (for example in terms of over and under supply). Through its current customer and product portfolio, Umicore is exposed to design-to-performance (NMC, mid and high nickel) cathode active materials technology, and has recently announced the industrialization of the design-to-cost HLM (high lithium, manganese) cathode active materials technology. As the pace of electrification is increasing rapidly technological disruptions could have a negative impact on Umicore, in case a battery technology, to which Umicore is not exposed, would be preferred by the industry over another. The market for rechargeable battery materials is becoming more crowded as new players enter. At the same time, more and more original equipment manufacturers (OEMs) are starting to produce rechargeable battery materials – in addition to being Umicore’s customer, they become Umicore’s competitor.

This has an impact on Umicore, but with its positioning, Umicore is also influencing the changing market structure for rechargeable battery materials for the automotive industry. Umicore is uniquely positioned to give the market a closed-loop solution for cathode materials, as we are both producing cathode materials and recycling batteries. Furthermore, Umicore’s recycling services are positively impacting society by enabling a shift towards an industrial future with low impact.

Risk profile

As confirmed in the scenario analysis of our climate related risks and opportunities, the electrification of mobility is increasing Umicore’s risk profile for the catalysis business and at the same time is increasing Umicore’s opportunity profile for the rechargeable battery materials and recycling business.

Risk mitigation

Notwithstanding the limited visibility on automotive demand, and even in fast electrification scenarios, the Catalysis Business Group is expected to continue to benefit from its strong market position in gasoline catalyst applications in Europe and China. Umicore works continuously to maintain its excellent cost position with continued work on operational efficiencies, a globally optimized production footprint and a low break-even point, which resulted in market share gains in 2022. We have the right product and technology portfolio with strong demand from our customers, also for the next waves of emission legislation such as EURO 7, which will give us the opportunity to differentiate through our next generation catalyst technologies. In 2022, Umicore already acquired several EURO 7 platforms. These strengths will feed the value creation potential over the next decade of Umicore’s Automotive Catalysts activities allowing it to generate strong free cash flows to support the growth businesses in Umicore’s portfolio.

In the Energy & Surface Technologies (E&ST) Business Group, and more specifically in the Rechargeable Battery Materials Business Unit, Umicore is actively diversifying its customer and platform exposure. The business unit reached important milestones in 2022 in the build-out of long-term strategic customer partnerships and securing future market share. These milestones are described in the operations section of this Report. Increased intimacy with car OEMs and qualifications for the right platforms are ever more important, which is why we are solidifying our relationships with customers. Umicore’s agility in its operations and supply chain equip us to adapt quickly to changes in demand.

In terms of competitive environment, the Rechargeable Battery Materials Business Unit has more than 25 years’ experience in cathode active materials (first for portable electronic applications, then for electric vehicle (EV) applications). It has an impressive innovation roadmap, combined with a proven product and process technology leadership track record and demonstrated industrial capabilities in manufacturing cathode active materials and the related precursor materials at mass scale at the highest quality and environmental standards. In addition, it is currently the only cathode player to produce industrial cathode materials in Europe and Asia and plans to set up local production in North America.

In terms of demand and supply dynamics for cathode active materials (CAM), it is expected that there will be a structural undersupply of CAM capacity in Europe and North America until 20301. In this context, Umicore’s fully integrated supply chain and existing and planned CAM manufacturing footprint in Europe and North America will play an important role supporting regional demand of battery and car OEMs.

The market risk is intimately associated with the metal price risk. As described in the metal price section above, we hedge a proportion of our forward metal exposure to cover part of the future price risks and maximize the use of back-to-back hedging, matching the price reference of purchases and sales.

The complementarity of our activities has proven to be a true competitive edge. In E&ST and Catalysis we serve the automotive market by enabling electrification on a mass scale and by offering cutting-edge technologies for clean combustion engines. Through our Recycling (including the Battery Recycling Solutions) activities, we close our own and our customers’ materials loop and offer a unique sustainable and circular approach that will be ever more important in a world of raw materials scarcity.

Umicore will further strengthen its market position with our ambition and plan to capture growth from the next wave of sustainability-driven markets, such as fuel-cell catalysts and battery recycling.

For more information, see Financial, Operations and RISE strategy.

5 Technology and substitution

Risk description

Umicore is a materials technology group with a strong focus on the development of innovative materials and processes. The choice and development of these technologies for existing and new markets represents the single biggest opportunity and risk for Umicore.

The European Commission (EC) recently announced its intention to reduce emissions from heavier vehicles by 65 percent from January 2035 and by 90 percent from January 2040 relative to 2019 levels. Although Umicore’s business related to HDD (Heavy Duty Diesel) is mainly situated in China, this announcement by the EC may affect Umicore’s business in this segment. The substitution of internal combustion engines by electrical vehicles and fuel cell cars presents an opportunity for Umicore in the short and medium term. Apart from the opportunity for Umicore’s battery materials, Umicore can leverage its catalysis expertise in hydrogen applications. Umicore’s risk/opportunity depends on how well the development of our technologies will correspond to such new demands.

Achieving the best cost-performance balance for materials is a priority for Umicore and its customers. There is always a risk that customers will seek alternative materials for their products, should those of Umicore not provide this optimum balance. The risk is especially present in businesses producing materials containing expensive metals (especially those with historically volatile pricing characteristics).

In achieving an optimal cost-benefit balance, the cost efficiency of our production processes plays a key role. Hence, there is a risk that we could fall behind the competition in our operational excellence and digitalization.

It is crucial for Umicore to consistently develop winning technologies, such as in battery recycling and for cathode materials. For example, lithium iron phosphate (LFP) battery chemistry is a mainstream technology in China. This chemistry is not produced by Umicore, and the risk is that LFP would become widely adopted elsewhere. A switch to solid state batteries – as a substitution for lithium-ion batteries - is an opportunity in the long term as this battery technology calls for more sophisticated materials solutions that may require Umicore’s expertise. Umicore’s activities have a lasting positive impact on society. Umicore upskills its workforce by offering learning and development opportunities in areas such as digitalization and technology as described in Innovation. We are continuously improving our technologies to minimize the environmental impact from our activities. Umicore’s R&D in automotive catalysts, batteries and fuel cells contribute to clean mobility and our recycling developments make industry more sustainable.

Risk profile

Given the pace of the market evolution, Umicore’s opportunity profile is increasing, but at the same time, the risk profile is also increasing.

Risk mitigation

Timely introduction of key technologies is essential. As described in the market risk, Umicore closely monitors the market and makes sure a close relationship with its customers is maintained to focus on the right technology trends at the right time. We prioritize key development projects and allocate the necessary resources. We are continuously working on the efficiency and digitalization of our R&D. We have installed a rigorous governance system for our R&D activities with a key focus on essential milestones and risks to be covered.

As described in the regulatory and legal context risk, the environmental permit for the smelter on our Hoboken site is a risk for our license to operate. To mitigate this risk, Umicore has leveraged robotic process automation (RPA) to automate the ‘wind barometer’ process which steers which activities on the site can be conducted according to the weather forecast. We are also evaluating whether we can engineer the slags on our Hoboken site towards a cement replacement product.

To support our opportunity in hydrogen technology, Umicore has set up a dedicated ‘Fuel Cells’ business unit and in our New Business Incubator there is a portfolio of projects around hydrogen.

As a pioneer in battery recycling, we have continued to develop our technologies in battery recycling, focusing on the most relevant battery chemistries. This has been done with a keen focus on the sustainability but also on the recovery of all essential metals with the highest yields, including Cu, Ni, Co and also Li. By making sure we look to develop our processes in an integrated way, pre-processing and refining, we secure also the lowest environmental impact. For cathode materials, we investigate a range of chemistries and prepare them to be ready for the market. We design products both for performance and for cost-driven segments. In line with the trend to lower cobalt and nickel contents in the cost-driven segment and to mitigate the risk posed by LFP, we are developing our high lithium manganese (HLM) solution.

Umicore patents disruptive technologies. In 2022, Umicore registered 72 new patent families.

For more information, see Innovation.

6 Information security & data protection

Risk description

Umicore’s production plants and services are highly dependent on the availability of IT services. Cybersecurity includes our hardware, software and information protection. Due to cyber incidents, Umicore’s servers or network could be blocked, and data breaches could jeopardize the confidentiality of our data. Unavailability of services, disruption of the supply chains or interruption of our production facilities due to cyber-attacks could have a major impact on our customers and our financial results. Any compromise on the confidentiality of intellectual property would negatively impact our competitive advantage. Unauthorized modification of financial data would jeopardize accurate reporting to shareholders. Whether in the short, medium or long term, any cyber incident or data breach would have an immediate impact.

Beyond Umicore’s own operations, we would be impacted if any of our main suppliers experiences a cyber incident. Cyber incidents can be local or global and if Umicore is attacked, this could have consequences for our customers and as an example the automotive industry could be impacted.

Risk profile

Cyber-attacks may be very focused and advanced. The expanding threat landscape and expanding digital footprint is leading to an increase in cyber-attacks. The risk profile is increasing because there are more cyber-attacks, and they are becoming more sophisticated as the attacks happen in multiple layers.

In addition, due to the increased use of a digital work environment (on site and at home), the role of IT services in delivering seamless access to all corporate resources as well as ensuring information security is more important than ever.

In 2022, there was no change in opportunity profile.

Risk mitigation

Umicore protects its data for confidentiality, availability and integrity.

Umicore has put in place in-service training sessions for our employees about phishing and all employees are part of a mobile device management platform to protect Umicore’s applications and data. Umicore launched the "I stay alert campaign" on eight topics, including general topics such as confidential information and clean desk for all employees as well as topics such as trade secrets, social engineering and HR security for a specific target group of employees. The materials for these awareness campaigns remains available and additional training is being developed.

Umicore regularly continues to assess and improve its information security, and the state of cyber resilience of its IT landscape, against evolving threats. A security operation center analyzes the logs of the systems and warns us of any suspicious movement. We have ourselves tested by ethical hackers and scan all our hardware and software to exclude technical vulnerability.

Since April 2022, Umicore obtained ISO 27001 (information security) certification, after independent external audit by the British Standards Institute (BSI).

Third party expert security assessments are conducted, and both the corporate cyber security team and the corporate security department are being expanded. Umicore consistently increases its investments in security-related IT systems and applications such as backup processes, virus and access protection, authentication and encryption tools. Security-related IT controls are being extended and are tested as part of Umicore’s external audit process.

A Proof of Concept was performed with the objective to determine the maturity of Operational Technology and to upgrade the resilience of industrial control systems against malicious actions.

7 Talent attraction and retention

Risk description

The attraction and retention of skilled people are important factors in enabling Umicore to fulfil its strategic ambitions and to build further expertise, knowledge and capabilities in the business. This represents Umicore’s most important risk, because being unable to do so would compromise our ability to deliver on our 2030 RISE ambitions in the short, medium and long term.

Umicore’s main short-term risk remains linked to keeping our employees healthy and safe. We continued to keep on-site COVID-19 infections to a minimum and no production site had to be closed in 2022 as a result of the pandemic.

We will also look to recruit new employees due to the expansion of the group, especially in the RBM and BRS Business Units, and anticipate a number retirements at some production sites in the coming years.

In the medium term, Umicore is faced with the challenge of ensuring a safe working environment in an industrial operation combined with a deep need to foster and operationalize a new safety culture. Employee safety impacts the employees, their families and our operations. Employee wellbeing is key to both employee retention and recruitment.

Talent management, -attraction and -retention pose a medium to long term risk, especially in terms of expected strategic growth as part of our 2030 RISE ambitions, this might be accompanied by new skills to be developed or acquired. Umicore aspires to have an agile workforce, so we can adapt and quickly respond to change – key elements towards maintaining a competitive advantage.

Diversity of thought at Umicore is a reality we live in our organization: our employees are active across the globe, in our different Business Units and support organizations, representing multiple generations and different genders. We firmly believe that this diversity of thought, where different perspectives are valued, leveraged and where knowledge is shared across the organization and generations, will continue to enrich our employees in triggering bold, new and creative ideas, leading to even more innovative teams.

Risk profile

The short-term risk linked to the coronavirus pandemic has decreased.

In the longer term, the war for talent is still a reality. As Umicore is growing, the recruitment of additional colleagues will generate more opportunities to boost diversity in the company’s workforce.

Risk mitigation

Employer branding campaigns, pro-active sourcing and reinforced recruitment teams are some of the initiatives we take to mitigate our main risk of talent attraction and retention. We have reinforced talent management processes and will continue to do so in the coming years, both globally and regionally, to improve employee engagement, through e.g. providing sufficient internal mobility opportunities for our employees. Employee wellbeing is a strategic priority and multiple initiatives have been launched, such as burn-out prevention and vitality.

The pandemic has changed the work environment globally and at Umicore, we have decided to introduce a new teleworking policy which was further rolled out during the first quarter of 2022.

Following the Umicore’s Group EHS Guidance Note, units and sites identify occupationally linked health and safety hazards and risks. Workplace injuries and occupationally related health symptoms are thoroughly investigated, reported and discussed at the site’s safety committee. This information contributes to the set-up, maintenance and, where needed, improvement of a health and safety management system with the aim of preventing all workplace-related injuries and health symptoms.

A process safety management system is deployed on all sites following strict process risk analysis and risk reduction methods. Regular internal health and safety audits evaluate the efficiency of its implementation.

We are improving the safety culture within the company, by deploying a “Coaching for Safety” program. Active leadership engagement is in place to stimulate engagement on all levels and measures endorsed by the shop floor are implemented. Safety programs focus on Control of High Risk activities, behavioral aspects, administrative measures and include in-service training. Health programs aim at reducing exposure and also focus on improving physical and mental wellbeing at the workplace.

In the chapter Employees, many initiatives and programs illustrate how Umicore is mitigating the risks linked to talent management and how we are developing our diversity of thought.

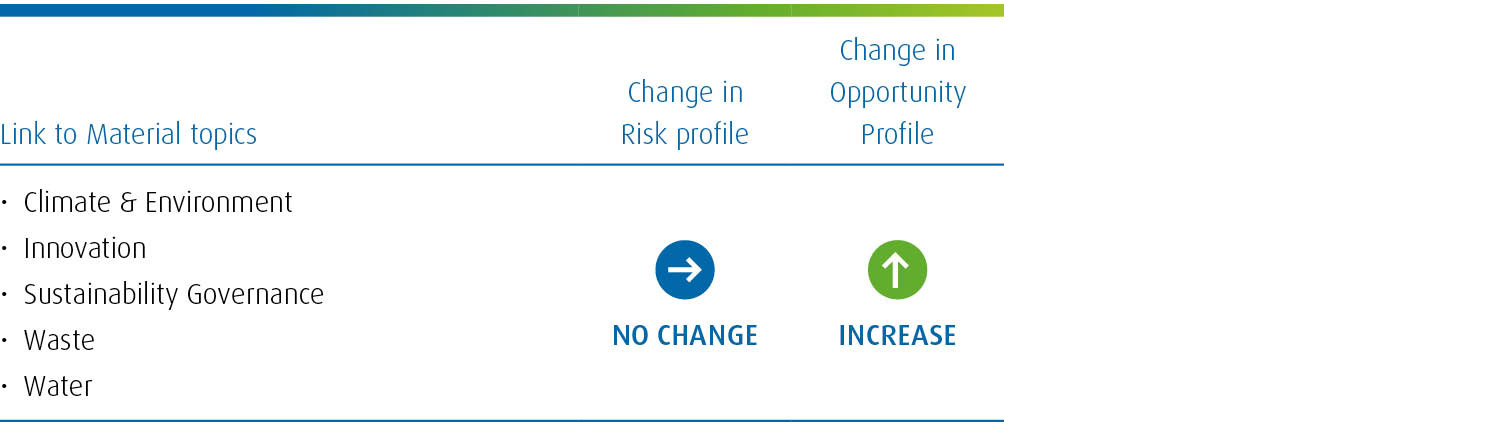

8 Climate and environment

Risk description

In the short term, many of the climate and environmental risks are either regulatory or linked to the impact of our operations on the environment. Increasingly stringent regulations on energy use and emissions can induce higher operational costs and our license to operate is predicated on managing the impact of our operations in the communities where we operate. Any incident in a plant can affect emissions in air or water and increase noise, impacting the immediate surroundings – which is in fact a risk on any time horizon. There is also an environmental risk linked to the shipment of materials. Many of the materials Umicore processes, such as scrap and residues, are classified as dangerous goods and maritime and air transport are increasingly reluctant to ship this hazardous material. The scarcity of transport could impact Umicore’s operational efficiency and there is also an impact on society, as a leakage of hazardous materials during transport could have negative consequences for the environment and for people’s health.

In the medium term, Umicore experiences the market risk of increasing requirements for carbon footprint of products and processes. Increasing requirements for environmental impacts such as biodiversity and land use could pose a risk and the rising cost of water is a risk in the medium and long term, as well as access to renewable energy, which is both a risk and an opportunity.

The consequences of climate change are the main long-term risk for Umicore.

Umicore has conducted climate-related risk analysis. Scenarios were chosen for relevance to Umicore and to represent the entire spectrum of possible future worlds, from Paris-aligned, through business as usual, to strongly increased physical risks. Short term is defined as until 2025, medium term until 2030 and long term after 2030.

Umicore has conducted a climate-related transition risks scenario analysis of a 1.8°C scenario (RCP2.6, Paris-aligned) and a 3.0°C scenario (RCP4.5), based on the IEA ETP and WEO 2020 reports, for our own operations with a timeframe of 10 and 30 years. Umicore’s climate-related transition risks and opportunities could be market, reputation, policy & legal and technology related. Building on the qualitative scenario analysis from 2021, in 2022, we focused on quantifying the financial impact of climate transition-related opportunities and risks; specifically in terms of EBITDA impacts, to test the resilience of our business and integrate the findings into our 2030 RISE Strategy. This deepened analysis confirmed the findings of the qualitative analysis: In a 1.8°C scenario, Umicore has a transition risk in the automotive catalysts business as demand for catalysts might be impacted given the foreseen declining demand for cars with internal combustion engines. Most other Umicore product lines, e.g. rechargeable battery materials, fuel cells and recycling services, show transition opportunities in both the 1.8°C and 3.0°C scenarios, the degree of which is linked to the pace of the shift towards electric mobility. The impact of these scenarios is described in investing in Umicore.

For the climate-related physical risk analysis, we chose the 3.0°C scenario (RCP4.5) and the worst-case climate change scenario (RCP8.5) until 2050 in which we identified both chronic and acute physical risks. For both climate-related physical risk scenarios, climate change causes extreme natural events, chronic deviations in temperatures and precipitation patterns, and rising sea levels. This could impact our sites or supply chain: for example, Flanders, which is an area where Umicore has several production sites, has been declared an area in risk of drought. Umicore’s main physical risks are related to flooding and water availability.

Risk profile

The climate and environmental risks from a regulatory or operational point of view remained the same.

The opportunity profile has increased, because lower carbon footprint products in the clean air, e-mobility and recycling sectors are in high demand from customers. The ongoing transition to a lower carbon economy continues to present Umicore with opportunities to expand and develop processes in ways that can mitigate or address climate change and environmental risks.

Risk mitigation

Umicore plays a key role in the transition to a low-carbon future as our materials tackle global trends for clean air and e-mobility, and our closed loop business model tackles resource stewardship.

Our facility in Hoboken is the world’s largest and most complex precious metals recycling operation, processing over 200 types of raw material and recovering over 20 different metals. We ensure that a high volume of the metals we process come from secondary sources – production scraps, residues and end-of-life materials. We can also recycle customers’ residues and production scrap to help them maximize their material efficiency and then transform the recovered materials into new products. In total we recover 28 metals from our closed loop activities, and we continue to adapt our processes to recycle new and more complex end-of-life products. As described in the regulatory and legal context and in Environment, we are mitigating the risk concerning the environmental permit in Hoboken. Umicore’s recycling activity is the best mitigation to both climate change and environmental degradation, because recycling metals emits less greenhouse gases and is more resource efficient than mining metals.

To mitigate the impact of our operations, Umicore keeps to the most stringent environmental standards for air and water and works every year to improve our energy efficiency and environmental footprint despite our growth and increased production. Umicore takes measures, such as windshields and green buffer zones to further minimize the impact of operations and manages its historical environmental legacy, ensuring adequate financial provisions are in place, which are reviewed twice a year. For more information, see Environment.

Umicore maps its sites in water stress areas and keeps track of water types and consumption to mitigate our risk with respect to water availability and rising costs of water. Only the Olen and Hoboken, Belgium sites have been identified as material in terms of both water impact and risks. In 2022, a Group-wide water stewardship program was defined. The program includes an ongoing education and awareness campaign, review of data granularity for improved disclosure, the development of contextual targets based on granular process-by-process water use data at material sites, and development of internal water risk guidance.

Efforts around water risks mitigation were also linked to Umicore’s review of the Group’s impact on biodiversity. In 2022, we set out to understand Umicore’s global biodiversity exposure and impact risk. This first assessment at Group-level showed that only some sites are embedded in an environment with high biodiversity value and revealed several local initiatives to preserve or improve biodiversity around site operations. More information can be found here. Moving forward, a centralized, Group-level environmental impact program will be implemented to include biodiversity risk and impact management and to improve Group-level disclosure on those topics.

To address the environmental impact of our products, Umicore is committed to the responsible and sustainable management of our products throughout their lifecycle. We recognize the importance of product stewardship in protecting human health and the environment. We work collaboratively with our stakeholders to ensure the responsible management of our products (see Legal & Regulatory risks for more on REACH and online for more on Umicore Product Stewardship. To address the carbon footprint of products and processes, Umicore performs life cycle assessments on selected products and services on a rolling and ongoing basis to sharpen insight on environmental performance, through the right choice of the chemistry, energy mix, and raw materials, including recycled materials.

Group-wide, Umicore has defined a climate action plan with 3 pillars: avoiding emissions, replacing sources that cause emissions and finally capturing emissions that we can’t design out. Climate related risk mitigation measures corresponding to this action plan include:

- Avoiding emissions by improving energy and heat efficiency, such as the heat and power cogeneration in Olen, Belgium, which increases energy efficiency. In addition, our R&D is at the heart of our successful pilot in capturing nitrous oxide. This is the case for our nitric acid plant in Hoboken where we capture nitrous oxide emissions and transform them into nitric acid for reuse in our precious metals refinery.

- Avoiding emissions by ensuring carbon neutral growth, with our new plant in Nysa as an example: 100% powered by renewables as of the start of production.

- Replacing emissions by generating renewable electricity across several sites; reducing the need for purchased electricity, piloting circular energy storage projects and securing long-term green power purchase agreements (PPAs). We actively pursue and sign green PPAs for our largest sites around the world, as part of our commitment to meet 100% renewables in Europe and 60% globally by 2025. For more, see Environment

- Designing out emissions through research and development around carbon-neutral fuels (biofuels) and electric furnaces as part of our R&D scope 1 decarbonization roadmap.

Umicore supports the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD) and while full alignment with all recommendations will take more than one reporting cycle, we intensified our analysis in the past year. In 2019, we started with an analysis of physical risks and in 2021, we conducted a qualitative transition risk scenario analysis. The results of the TCFD recommended qualitative scenario analysis were discussed with the management board in 2021. In 2022, we quantified the financial impacts from climate change, discussed outcomes with the management board, and integrated our findings into the 2030 RISE strategic planning process.

Umicore’s businesses, strategy and financial planning reflect many climate-related risks and opportunities. Our global footprint and diverse site locations reduce our exposure to physical risks. New sites have been chosen considering proximity to customers, access to skilled workforce, excellent logistics, infrastructure and green energy. The focus of our products and services, our investments in R&D and operational excellence, our policies for collaboration with our suppliers and our 2030 RISE objectives are a few examples of these strategic choices. They are embedded in our ongoing financial planning and decision making through their integration in business planning and the development of the ESG dashboard. Further analysis will be repeated or refined on a recurring basis to identify risks based on current scientific findings.